EU Regulation for ESG Ratings Providers – June 2023

As the “Rate the Raters 2023” report put it, ESG Ratings are at a crossroads. The report highlighted a paradox – “Thanks to the growing emphasis on ESG performance, ratings are more widely used than ever. At the same time, investors and companies show only moderate confidence in the accuracy and utility of ESG ratings. These trends cannot comfortably coexist, suggesting that significant changes will be needed in order to maintain the future credibility of the rating ecosystem.” (Read the report here). In one of our most widely read articles, “ESG Ratings – A Primer” (read here), we highlighted the divergence in the ESG ratings offered by different providers and how the lack of transparency surrounding the rating methodology poses a significant challenge for the users of the ESG ratings.

What is the EU proposal?

Recognising the need for addressing the challenges with ESG ratings, the EU has published a proposal for regulating ESG rating activities. The regulation states that the current ESG ratings have two problems:

- There needs to be more transparency regarding the characteristics, methodologies, and data sources of ESG ratings.

- There is a lack of clarity on how ESG rating providers operate. As a result, ESG ratings do not adequately inform users, investors, and rated entities about ESG-related risks, impacts, and opportunities.

The objective of the proposed regulation is to improve the reliability, comparability and transparency of ESG ratings. However, it does not “intend to harmonise the methodologies for the calculation of ESG ratings but to increase their transparency. ESG rating providers will remain in full control of the methodologies they use and will continue to be independent in their choice to ensure that a variety of approaches are available in the ESG ratings market.”

Highlights of the proposal

Some of the key points of the proposal are given below.

- ESG rating agencies require authorisation (or a licence to operate) by the European Securities and Markets Authority (ESMA)

- ESMA will be required to maintain a register on its website with all authorised ESG rating providers and provides for requirements on the accessibility of information on the European Singly Access Point (ESAP).

- In order to protect investors and ensure a fair market, rules need to be set for ESG rating providers from outside the Union who want to operate in the Union. These rules include three options: equivalence, endorsement, and recognition, all based on the idea that the regulations in the provider’s home country should be as good as those in the Union. This will affect some of the major non-EU ESG rating providers like MSCI, S&P, Moody’s, Fitch, and others.

- Other provisions are

- To ensure the quality and reliability of ESG ratings – ESG rating providers must employ robust, objective, and continuously validated rating methodologies. Regular and ongoing reviews of these methodologies should be conducted, at a minimum, on an annual basis.

- To ensure higher-level transparency – ESG rating providers must publicly disclose information about the methodologies, models, and key rating assumptions they use. Additionally, their rating products should clearly indicate whether they consider both the financial risk to the rated entity and its impact on the environment and society or if they focus on only one of these dimensions.

- To ensure their independence – “ESG rating providers should avoid situations of conflict of interest and manage those conflicts adequately where they are unavoidable. ESG rating providers should disclose conflicts of interest in a timely manner.”

- To avoid potential conflicts of interest, ESG rating providers should not be allowed to offer a number of other services, including

- consulting services,

- credit ratings,

- benchmarks,

- investment activities,

- Audit, or banking, insurance and reinsurance activities.

- To support smaller firms – Supportive measures are required for smaller ESG rating providers to ensure their sustainability and market entry. These measures may include exemptions from certain organisational requirements granted by ESMA based on specific criteria.

- Consistency with other EU policies

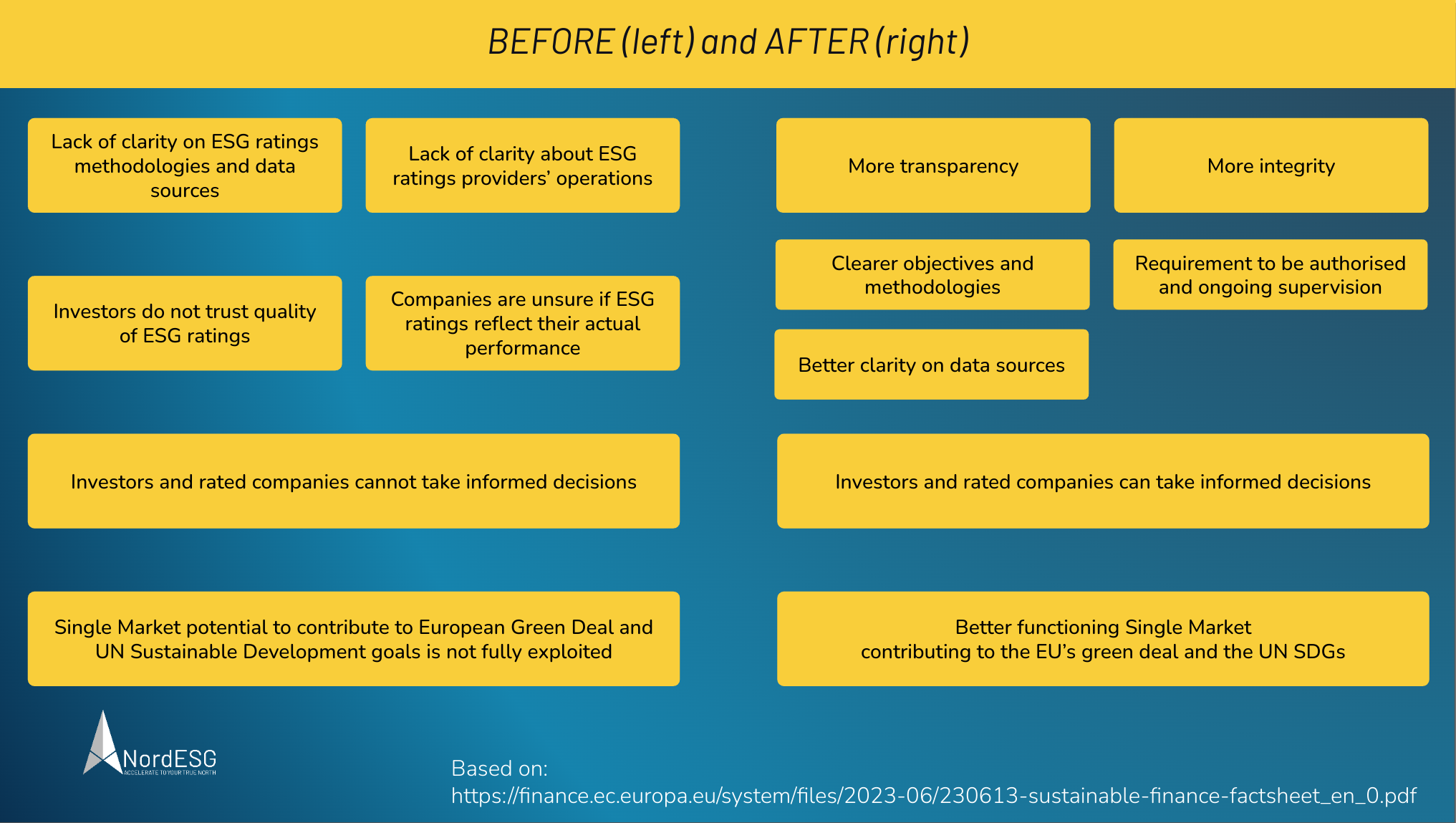

The ESG data are generated and published by corporates as part of compliance under the CSRD and EU Taxonomy, and the corporate data, along with ESG ratings, is then used by investors to comply with SFDR. This regulation considers ESG data utility under CSRD, EU Taxonomy and SFDR. Apart from these, this regulation will also interact with the European Green Bond Regulation and EU Climate Benchmark regulation(read more here). The “before” and “after” illustration provided by the EU is given below.

Got questions about sustainability?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you.

Key Takeaways

While the regulation is in the right direction, we do not see the regulations as transformative and current ESG ratings providers can easily adapt to them. There will definitely be additional costs and oversights for them, but not anything that is of existential crisis for them. More specifically,

- ESG rating providers do not have to change their current scoring/rating methodologies, but

- They now have to publish them in detail. If their methodologies are robust, objective and scientific, there should not be a cause of concern for them.

- Non-EU rating agencies(mostly US and UK based) like MSCI, S&P, FTSE Russel, etc. will be required to comply with these requirements and bring their rating process in line with the EU regulations even if they cater to some other jurisdiction, as they cannot have different processes for different geographies. This is another example of the “Brussels effect”, about which we wrote here.

- These regulations, however, will have a major impact on companies that also offer credit ratings, like S&P, Fitch and Moody’s cannot offer ESG ratings directly in the EU as per the regulations. They can, however, hive off the ESG rating division into a separate entity to avoid conflict of interest issues.

- There will be significant costs for ESG rating providers as they have to now pay fees to ESMA for getting authorisation to operate and for oversight.

Conclusion

While the EU is not the first to create a regulatory framework for ESG rating providers(India approved a rating framework in May 2023), it certainly has the weight to set the standards that can be the template for other jurisdictions to use. The regulations for ESG rating providers will provide much-needed transparency and oversight that will enable the users of the information to have more confidence in the ratings.

The draft regulation can be downloaded here.

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.