What is the Impact of ESG on Your Business?

The Impact Of ESG: The core is to look in detail at the risks related to ESG issues. But there is more than just risk coverage. There are great opportunities for long-term value creation, too. Long-term value creation depends on how companies can adapt to climate change, minimize carbon emissions, deal with the scarcity of natural resources and how they can handle social topics and governance matters.

ESG is no longer a topic linked exclusively to investments and funds. More and more companies use ESG factors as an overall operating concept.

What ist the impact of ESG on Reputation, Risk, Opportunities, and Culture?

There is more than one answer to that. Over the last years, consumer attention on companies impact on social, governance and environmental matters has significantly increased. There is also a transition from shareholder to stakeholder focus happening. Stakeholders relevant to companies include customers, employees, suppliers, communities as well as regulating bodies. Stakeholders opinion on how a company is doing business gains more and more weight and influence.

REPUTATION

RISK

OPPORTUNITIES

CULTURE

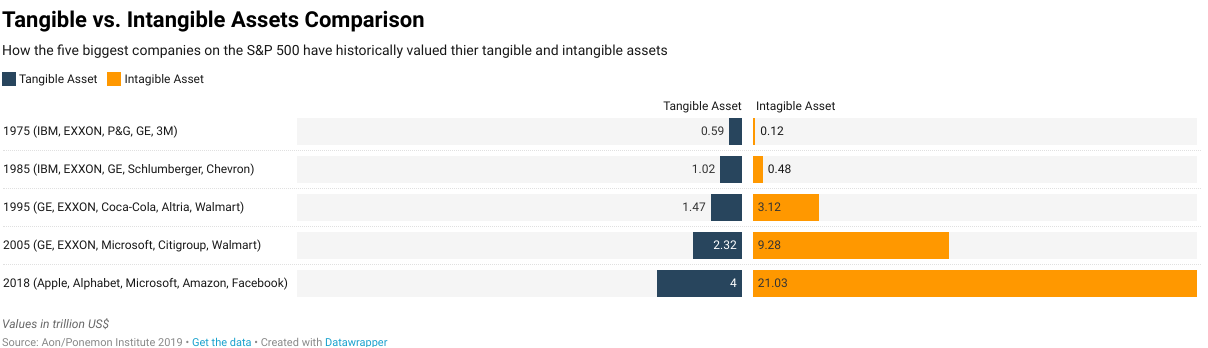

How did the five biggest companies on the S&P 500 historically valued their tangible and intangible assets? In 1975 the then five biggest companies (IBM, EXXON, P&G, GE, 3M) accounted tangible assets of US$ .59 trillion while intangible assets have been valued at US$ .12 trillion.

Fast forward to 2018 the numbers have drastically changed. While tangible assets of the then five biggest companies on the S&P 500 (Apple, Alphabet, Amazon, Facebook) have risen to US$ 4 trillion, the intangible assets have risen to more than US$ 21 trillion – more than 175 times 1975 values. Intangibles are now a key-aspect taken into consideration by investors. The increased importance of intangible assets over tangible assets also contribute to the risk landscape of a company.

How does it drive business?

ESG is here to stay. It is more than just a trend that will pass by. According to research and studies, ESG can drive business in various aspects. Investments in ESG projects have substantially grown. At the same time, stakeholder awareness has grown steadily. Companies that take ESG considerations into account can perform better by creating sustainable growth and value while avoiding risks with the added benefit of higher credit ratings.

Green products have a better acceptance in the B2C and B2B sphere. Policies on energy usage, waste avoidance and reduced water intake can lead to cost reductions. A strategic approach to sustainability can lead to better interaction with regulating bodies and pave the way to subsidies.

Internal communications can foster employee motivation and attract talent through social credibility. ESG also about money. Incorporating an ESG approach can lead to better capital allocation and credit ratings.

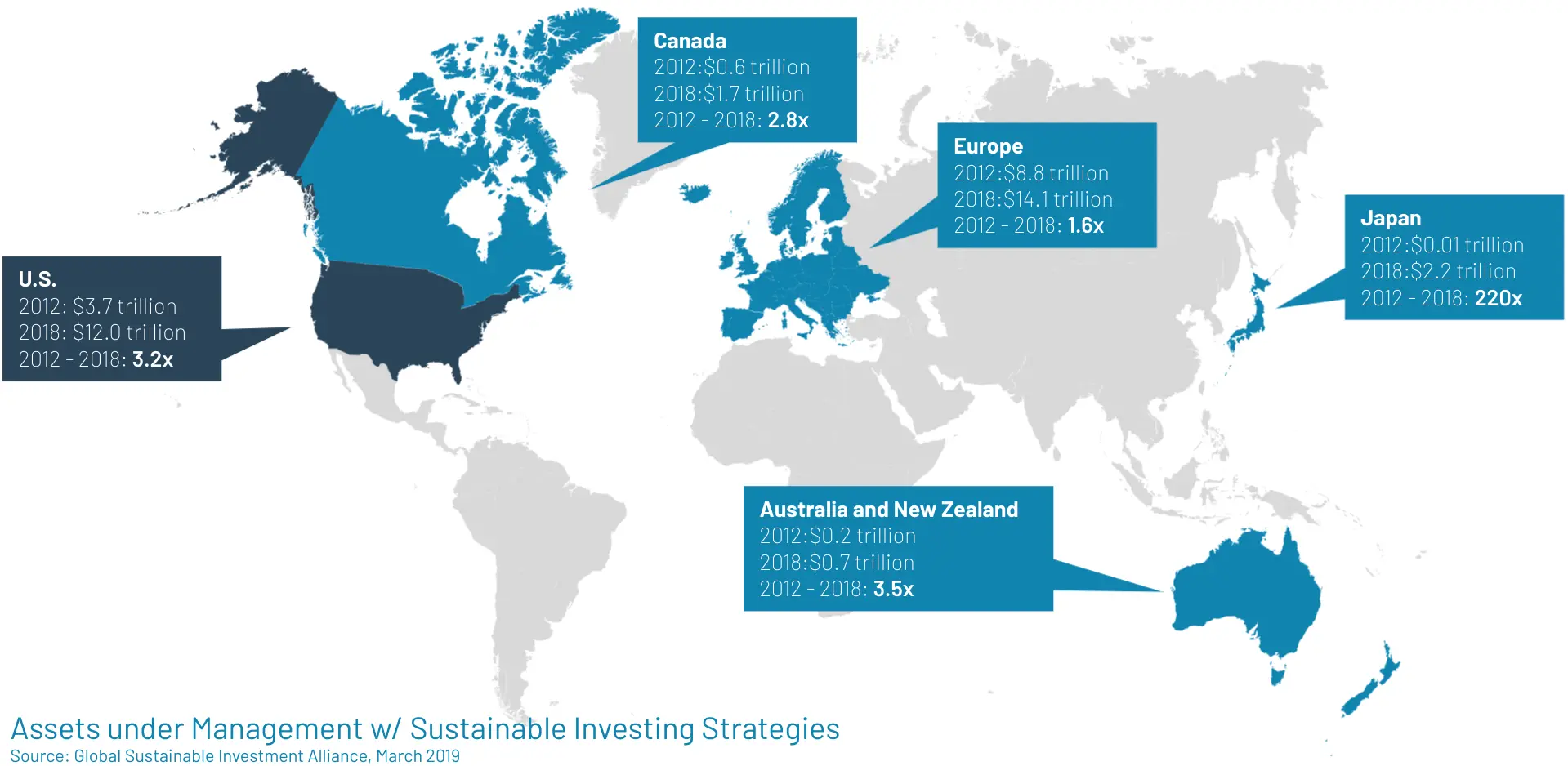

Finally, there are investments, project financing and company valuation, where ESG ratings have an impact. ESG-oriented investments are on the rise. Worldwide sustainable investments are already topping $30 trillion, increased by almost 70% compared to 2014 or more than ten times more than in 2004. Executives have realized that a strong ESG proposition is a cornerstone for long-term success and value-creation.

The Rise of ESG Investments

There has been a significant rise in Assets under Management with Sustainable Investing Strategies. For the United States of America the 2018 to 2021 comparison shows an increase by 3.2 times. The numbers for Australia and New Zealand are even higher at 3.5 times. Even Europe has seen a significant rise by 1.6 times. This is remarkable, since Europe started from US$ 8.8 trillion. In Japan AUM with sustainable investment strategies “exploded” by a factor of 220 times comparing 2012 to 2018 numbers.

How to Leverage the Impact of ESG?

ESG as a part of the operating system of your company comes with a lot of opportunities and can lead to business advantage. The business reality is changing. It is expected that more than 1/3 of all AUM will be ESG related investments making financing for companies with a weak or no ESG proposition challenging. Attracting new talents and employee retention are other factors to consider.

Stakeholders – that includes also customers and clients – are much more aware of ESG related topics leading to conscious buying decisions. Besides that, ESG reporting is becoming mandatory in more and more jurisdictions.

80%

175.25x

2.8x

37.7%

84%

67%

REGULATIONS

FINANCING

COMMUNICATIONS

Consulting Services That Help You Along Your ESG Journey

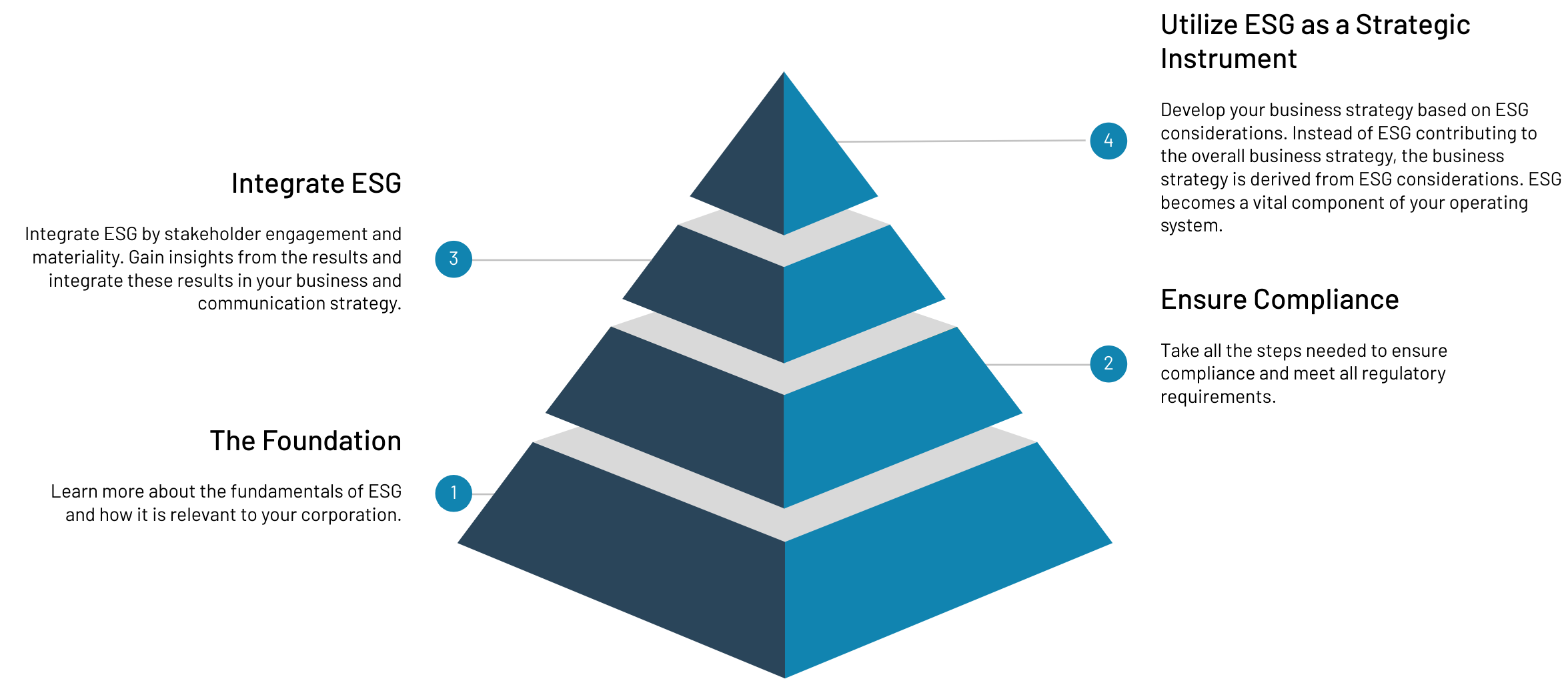

The concept of ESG can feel overwhelming at first. How do ESG frameworks and reporting relate to ESG scores and ratings? How can companies ensure compliance? And finally: How can corporations and institutions utilize ESG as a strategic instrument?

We’re here to help you to navigate your ESG landcape. We help you to discover opportunities, map the relevant factors of your ESG landscape and support your strategy implementation so you can set a course that accelerates you to your true north.

Learn more about our services by following the link below.