The Corporate Sustainability Reporting Directive and the “Brussels Effect” – How the CSRD will affect non-EU companies

The Corporate Sustainability Reporting Directive (CSRD) is estimated to apply to more than 50.000 companies across the European Union. Companies that fall under the CSRD must report on a wide range of sustainability information using the European Sustainability Reporting Standard (ESRS). However, the CSRD is also an example of the “Brussels Effect” since it will affect around 10.000 non-EU companies that do substantial business within the European Union. This blog post provides an overview of how the CSRD applies to non-EU companies, the thresholds and the timelines that apply.

The Big Picture

Before we delve into the details of CSRD and its impact on non-EU firms, it might be worthwhile to understand the evolution of the sustainability reporting landscape, which started shifting from a voluntary to a mandatory reporting paradigm, thanks to the increased importance and commitments to the UN Sustainable Development Goals (SDGs) and the Paris Climate Agreement since 2015.

Until 2017, corporate sustainability reporting was voluntary worldwide (except for countries like the UK, France, Denmark, and others with some form of mandatory sustainability reporting). Several reporting standards and frameworks, like GRI, SASB, CDSB, IIRC, and CDP, were used by corporations based on their convenience.

In 2017, the implementation of the Non-Financial Reporting Directive (NFRD) in Europe heralded a new era of mandatory sustainability reporting. While it was relatively light in terms of the scope of reporting, it was grand in scale as it covered about 10,000 firms in almost 30 countries in the EU, thereby making it one of the most extensive mandatory disclosure regimes in the world.

But still, the problem persisted that without clear rules on sustainability reporting, some companies followed the standards mentioned earlier word by word. In contrast, others reported only on a subset of sustainability aspects, leaving the task of interpreting the information to stakeholders like investors and others. So the lack of comparability of reported sustainability information and the lack of interoperability of the “alphabet-soup of reporting frameworks” were identified as the main points of criticism.

The NFRD paves the way for the CSRD

The NFRD was not perfect, but it paved the way for the CSRD [1], which is much more ambitious and detailed than the NFRD. Furthermore, as international efforts towards mandatory reporting started gaining momentum, standard setting for sustainability reporting started moving from voluntary bodies to regulators, who began consolidating several reporting standards and frameworks.

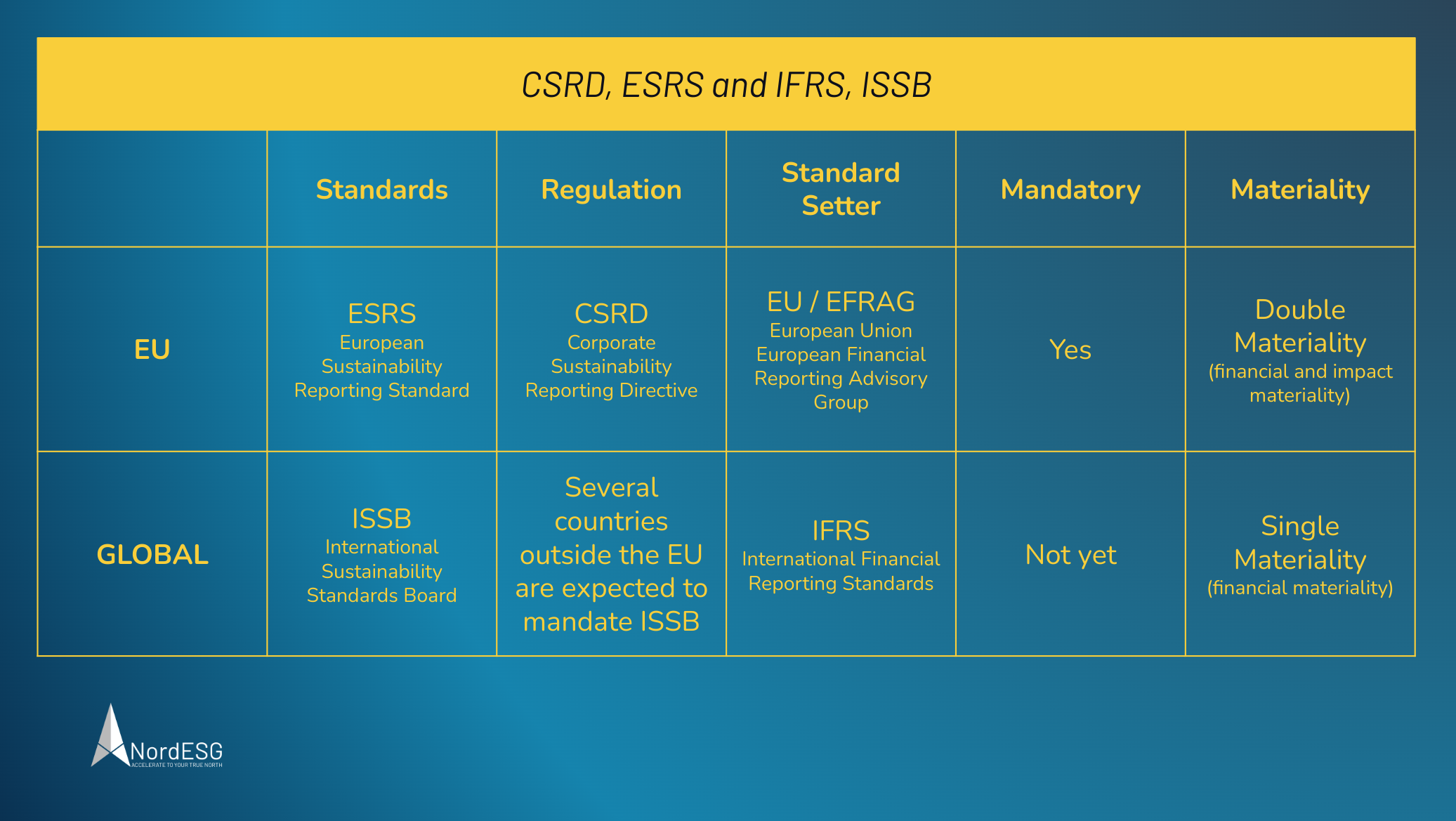

This consolidation may lead to a scenario where only two reporting frameworks – different by scope and philosophy on materiality – may be relevant for sustainability reporting. These two standards would be the European Sustainability Reporting Standard (ESRs) and the International Sustainability Standards Board (ISSB) developed by the IFRS. An overview of the two is given in the table below.

While the ESRS builds on GRI, IFRS builds mainly on SASB. Both also integrate TCFD reporting into their standards. Read more on the ESRS [2], its comparison with ISSB, and the interoperability of the standards [3] and about the concept of double materiality [4] in our blog posts [5].

Got questions about the CSRD?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you with aligning to the CSRD.

The CSRD, the “Brussels Effect”, and non-EU companies

The CSRD is an excellent example of the so-called “Brussels Effect” – a process by which laws and regulations of the European Union end up being externalised beyond its borders via market mechanisms. This unilateral regulatory globalisation makes EU regulation de facto standards corporations comply with [6, 7]. The proposed “Corporate Sustainability Due Diligence Directive” [8] may be another example of EU laws and regulations affecting non-EU companies.

Non-EU companies and the CSRD

The Corporate Sustainability Reporting Directive is a clear step up in sustainability reporting. With it comes the ESRS, an elaborate framework for sustainability performance reporting developed by the EFRAG. While the ESRS is still a (final) draft, we expect the final version to be available in the summer of 2023. The CSRD will apply to around 10.000 non-EU companies, recent data from Refinitiv featured in the Wall Street Journal [9] suggests, with the majority from the United States (31%), Canada (13%) and the United Kingdom (10%).

The criteria and timelines for non-EU companies

What criteria decide whether a non-EU company must report under the CSRD? The CSRD will apply to non-EU companies, including

- Companies that have listed securities (e.g. bonds or stocks) on a regulated market in the EU

- Companies with an annual EU revenue of > €150 million and an EU branch with net revenue of > €40 million

- Companies with an EU subsidiary that meets the criteria of being a large company (fulfilling at least two of the following three criteria)

- more than 250 EU-based employees

- balance sheet > €20 million

- local revenue of > €40 million

Still, non-EU companies have some time left to align with the CSRD:

- 2025: In 2025, those non-EU companies with EU listings and more than 500 employees in the EU will have to disclose their sustainability performance under the CSRD.

- 2026: The rules will apply to other large non-EU companies with EU listings.

- 2027: Reporting requirements will apply to small and midsize enterprises with EU listings.

- 2029: Non-EU companies not listed in the EU but meeting other criteria will have to report under the CSRD.

Implications for Non-EU companies doing business in the EU

The implications for non-EU companies that meet the criteria described above are multifold:

- Even if the majority of their operations are outside the EU, they still have to allocate resources to report under the CSRD.

- Companies already reporting using frameworks like GRI or TCFD may cross-reference existing information to the ESRS. However, those companies may experience that not all information is readily available or compatible with the ESRS.

- Companies that have never undertaken sustainability reporting may face additional challenges (and costs). They must implement systems across the entire reporting lifecycle, including data collection, analysis, and reporting. In addition, they need to establish a sustainability reporting governance structure to ensure data fidelity, data quality and data security that will enable them to meet the assurance requirements and to comply with the CSRD in letter and spirit.

How can non-EU companies prepare for the CSRD?

Non-EU companies that may fall under the CSRD should prepare early and use the remaining time to

- closely monitor the latest developments on the ESRS

- identify how they can map existing sustainability reporting to the ESRS or

- in case they have never undertaken sustainability reporting before, learn about the requirements that come with the CSRD and the ESRS

- discuss the demands for “limited assurance” with their assurance company

In any case, we are happy to help your company to align with the CSRD. To learn more about our services, you can book a free and non-binding discovery call with one of our sustainability experts using the links below.

Sources and further reading

[1] NordESG – CSRD Update November 2022

[2] NordESG – ESRS – 1000 datapoints dropped – relief for preparers

[3] NordESG – ESRS, GRI, TCFD & IFRS – Interoperability of reporting frameworks and disclosure requirements

[4] NordESG – The concept of “Double Materiality” in sustainability reporting

[5] NordESG – The future European Sustainability Reporting Standard (ESRS)

[6] Columbia Law School – The Brusseles Effect: How the European Union Rules the World

[7] Wikipedia – The Brusseles Effect

[8] NordESG – The Corporate Sustainability Due Diligence Directive – what is the CSDDD, who will be affected, what is the current stage, and what will happen next?

[9] Wall Street Journal – At Least 10,000 Foreign Companies to Be Hit by EU Sustainability Rules

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.