ESG Confusion – Management, Investment, Rating & Regulation

ESG management, ESG investments, ESG ratings, ESG regulation and the infamous alphabet soup of ESG – what is ESG and how to overcome the ESG confusion?

What is ESG?

The answer to this question depends. ESG can be understood as a management approach by companies that helps them to create long-term value in a fast-paced environment. Businesses achieve this by implementing strategies that mitigate risks related to environmental, social and governance (ESG) factors. Simultaneously companies can focus on the opportunities that stem from ESG factors too. From an investor’s perspective, ESG is about risk management, research, and an ESG product. Then there are ESG ratings that provide insights into a company’s performance relative to ESG criteria. Finally, ESG regulation mandates companies to report on their ESG or sustainability performance. Examples are the SEC in the US and the CSRD in Europe. But regulation is not only for companies but also for the finance sector (think about the SFDR in Europe) or rating agencies.

Last but not least, there is the “infamous alphabet soup of ESG” where all the acronyms related to ESG come together: ESG, CDP, TCFD, GRI, SFDR, ESRS, CSRD, SEC, CVaR, CTVaR and PCVaR – to name a few. So again: The answer you get might depend on whom you ask about what aspect of ESG. We get asked this question often, so we decided to prepare this blog post to give an (initial) overview and make the concept of ESG a bit more accessible.

Seen from a Companies Perspective

From a company perspective, ESG can be understood as a management approach to create long-term sustainable value in a fast-changing business environment by implementing strategies that mitigate risks related to environmental, social and governance factors while simultaneously leveraging the opportunities that stem from ESG factors.

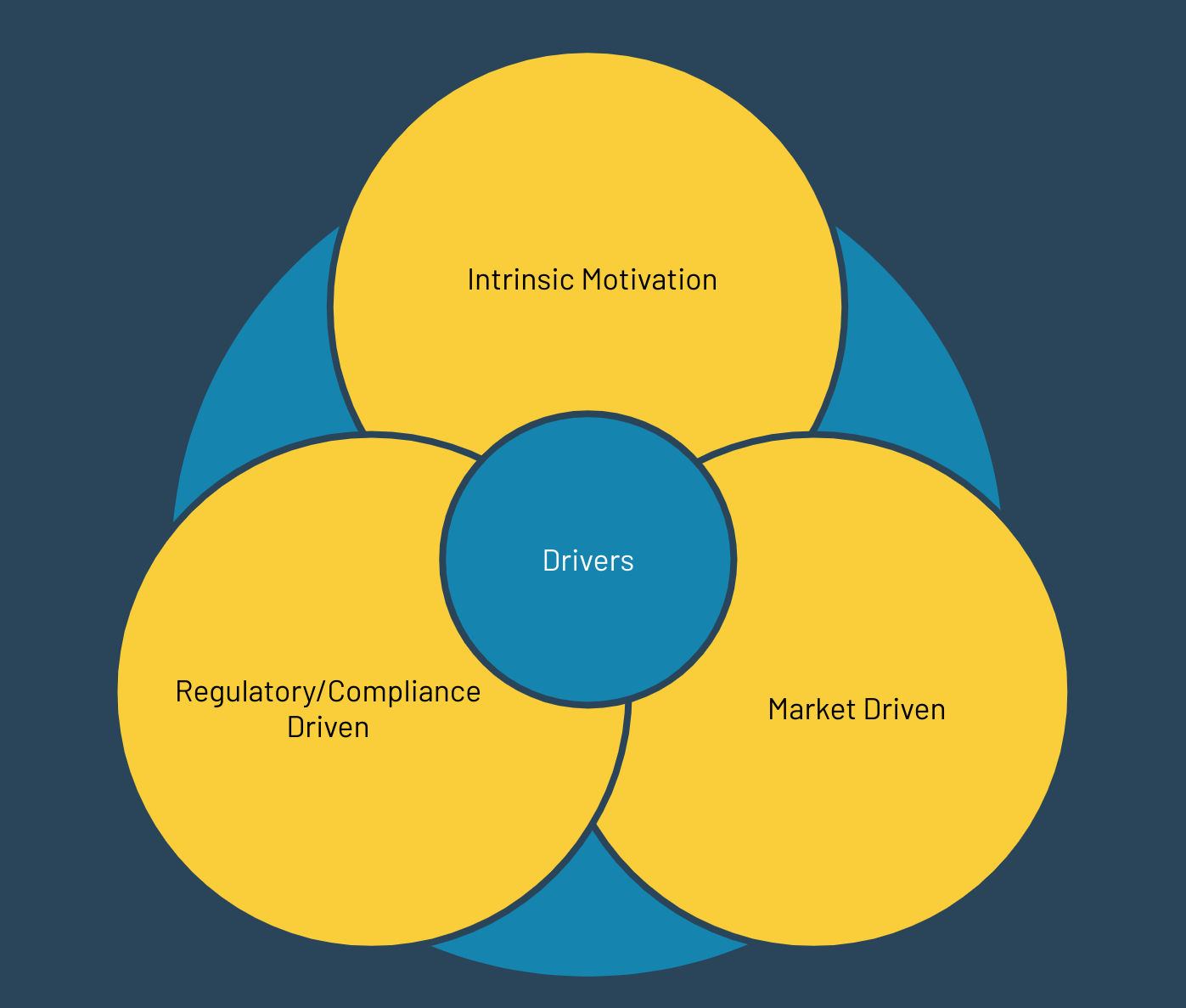

The motivation to integrate ESG may either originate from intrinsic motivations or can be market- or compliance-driven.

One of the most recent examples of intrinsic motivation is Patagonia, a US outdoor clothing retailer, where the earth is now the only shareholder. Market requirements drive the need to provide adequate answers to sustainability-related stakeholder questions. These stakeholders include investors, financing partners, customers, and other internal and external stakeholder groups. To give those answers, companies need to act by developing their ESG strategy, setting strategy-related goals, implementing initiatives to achieve them, and disclosing their sustainability performance through ESG reporting. In addition, driven by market requirements, companies with no regulatory obligation to report on their sustainability performance can be indirectly affected and must disclose ESG-related information. Finally, there are compliance or regulatory aspects that need consideration. The CSRD in Europe aims to stimulate further the integration of sustainability considerations in companies’ strategies and mandate companies to report their sustainability performance. But regulation on ESG is happening worldwide and is not limited to Europe.

Implementing ESG into a company’s operating system can create direct and indirect benefits: Boosting employee morale, attracting better talent-seeking for jobs in companies that share the same values, enhancing returns and decreasing costs. In some cases, even access to government funding is more accessible. Additional aspects are changing consumer and investor preferences and expectations. Here ESG can lead to benefits like increased consumer loyalty, higher revenue, and better equity and debt financing opportunities. So ESG is more than just a trend that will pass by; companies that take ESG considerations into account can perform better by creating sustainable growth and long-term value while avoiding risks.

Seen from an Investment Perspective

What is ESG investing? Again, it depends. One answer is in the process that leads to an ESG investment decision. That includes the research and screening of investment opportunities against benchmarks. Another answer is focused on the product level – sustainable investments, green funds or green financial products.

As established earlier, ESG is about risks and opportunities, and ESG is about data. Accordingly, fund managers prepare investment decisions using ESG-related information to expand their understanding of the material risks and opportunities of a company they plan to invest in beyond solely financial data to gain better insights.

Seen from a European perspective, that is where the interaction of CSRD, SFDR and EU Taxonomy comes into play. The figure above illustrates the interdependence of these three concepts that are the core of the European Green Deal. Company data is utilized by financial market participants and financial advisors together with EU Taxonomy information to determine how “green” a financial product is (Art. 8 or 9, SFDR).

However, the data universe relevant to decision-making is more extensive than company and taxonomy data. It will likely include third-party ESG ratings (more on that below) and considerations related to ESG factors ranging from the ability to acquire high talent to stakeholder demands associated with fighting climate change. The approach to the investment process is not standardized but highly individual. So again, when it comes to ESG, there is no “one-size-fits-all” approach, which is also true for preparing investment decisions.

Sustainable financial products are popular, and ESG-aligned AUM is growing strong. To oversimplify the situation: ESG funds come in the same variety as “traditional” funds, but with the addition of ESG. So, how green are sustainable investments? It depends. Regulations like SEC’s “name rules” and the SFDR in Europe are in place. You can read more about regulatory aspects in the respective chapter below.

Got questions about ESG?

Book a free and nonbinding discovery call to discuss your questions with one of our ESG experts, and learn how we can help you navigating your ESG landscape.

Seen from a Rating Perspective

ESG Ratings are the bedrock of sustainable investing. Investors and other stakeholders use ESG Ratings to assess the corporate sustainability performance of the rated firms. ESG ratings can be traced back to early 1990 when KLD Research & Analytics Inc started providing environmental and social data for a limited number of companies. With a growing interest in socially responsible investments, the number of ESG rating providers has grown. Today more than 600 ESG ratings and rankings exist. Thanks to SustainAbility’s initiative “Rate the Raters”, ratings work in both ways.

What goes into an ESG rating also depends on the rating company that prepares the ratings. Typical ingredients are data points (typically > 1.000), answers to questionnaires, criteria scores, materiality maps, and corporate reporting, to name a few. Regarding ESG ratings, we observe less correlation among the results of different rating providers compared to credit ratings that highly correlate. That continues in the way the rating results are presented. For example, while S&P and Refinitiv give ESG scores, MSCI offers an industry-specific ESG rating on a scale from AAA to CCC. In contrast, Sustainalytics gives an entirely different rating in the form of an ESG risk rating. This approach makes it difficult to compare ratings: Sustainalytics provides a risk rating on a numeric scale, while MSCI provides a relative rating within an industry/sector. On the other hand, S&P gives an absolute numeric ESG score. So the pattern we have observed before seems to continue with ESG ratings: While there are hundreds of rating agencies, considerable divergence in ESG ratings, even among the top ESG rating agencies, can be observed. That is due to the data and methodological differences. However, there are efforts from regulators to improve data quality and transparency in ESG ratings. Read more about that in the next chapter.

Seen from a Regulatory Perspective

Each jurisdiction has its own take on ESG regulation. For example, in the US, the SEC has set rules on sustainability reporting. Another example is the European Union, where the trinity of CSRD, SFDR and EU Taxonomy intends to steer the transition into a sustainable future.

The CSRD sets the boundaries for how companies that fall under this regulation will have to disclose their sustainability performance using the ESRS framework. The SFDR is relevant for financial market participants and how they label and report their financial products. Finally, there is the EU Taxonomy. It is a classification system that enables one to determine what business activities are considered sustainable.

But there is more. Singapore has already set new rules and obligations, and Japan plans to do so. The European example illustrates how regulation affects interdependent systems and can be used to steer into a sustainable future.

You can find more insights on the regulatory perspective in the links below.

Still confused?

We know that we have just scratched the surface with this blog post. So, here is our guide for further reading:

Company perspective:

- In-house Management, Interim or Outsourcing?

- CSRD in Europe – Start or wait?

- How companies can get started with ESG

- EU Taxonomy – Eligible vs Aligned Economic Activities

Finance Perspective:

- SFDR, Double Materiality and Principal Adverse Impacts Indicators

- US SEC – Expansion of “Names Rules” to ESG Funds

- Financed Emissions 101: Measuring financial portfolio emissions

- Quantifying Climate Risk using CVaR, CTVaR and PCVaR

Regulatory Perspective:

- EU Taxonomy KPIs – Financial vs Non-Financial Undertakings

- US SEC – ESG Disclosures for Investment Advisers and Companies

- Singapore issues ESG Funds Disclosure and Reporting Guidelines

- EU Sustainable Finance Disclosure Regulation (SFDR)

How we can help

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, sustainability strategy development, and materiality assessments.

By doing so, we help businesses meet their disclosure compliance requirements but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities.

To avoid a decision-making dilemma at the end of this article, we offer a free, no-obligation discovery call in which we will be happy to discuss the individual courses of action with you.

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.