In-house ESG Management, Interim ESG Management or Outsourcing ESG management?

Companies seeking to integrate ESG typically achieve this by establishing an in-house ESG management. However, other options might make it even easier to start with sustainability and ESG. In this blog post, we take a closer look and compare “in-house ESG management” with “interim ESG management” and “outsourcing ESG management”.

Implementing ESG and sustainability

Implementing ESG criteria, i.e. economic, social, and governance policies, creates both direct and indirect benefits for the company. Immediate benefits include:

- Boosting employee morale (improvement in both efficiency and productivity)

- Attracting better talent

- Enhanced returns

- Decreased costs

- Easier access to government funding

Additionally, since changing consumer and investor preferences, implementing ESG criteria can lead to indirect benefits such as increased consumer loyalty, higher revenue, better equity and debt financing opportunities, and reduced market volatility.

Recently developments in regulatory requirements like the CSRD in Europe aim to further stimulate the integration of sustainability considerations into companies’ strategies and decision-making processes.

The market requirements drive the need to provide adequate answers to sustainability-related stakeholder questions. These stakeholders include investors, financing partners, customers, and other internal and external stakeholder groups.

Driven by market requirements means that even those companies with no regulatory obligation to report on their sustainability performance can be indirectly affected and must disclose ESG-related information.

So to provide adequate answers, companies need to act by (further) developing their ESG or sustainability strategy, setting goals, implementing projects and initiatives to achieve these goals, and disclosing their sustainability performance through ESG reporting. All of this requires know-how and (human) resources.

How companies can get started with ESG and sustainability

Companies can pick from various options that range from “in-house ESG management” to “interim ESG management” to bridge the time until the in-house ESG management is up and running. There is even the option to completely “outsource the ESG management”.

First, we will provide an overview of the various tasks an ESG management has to fulfil to understand the different options better. Then, based on that, we discuss the pros and cons of each approach.

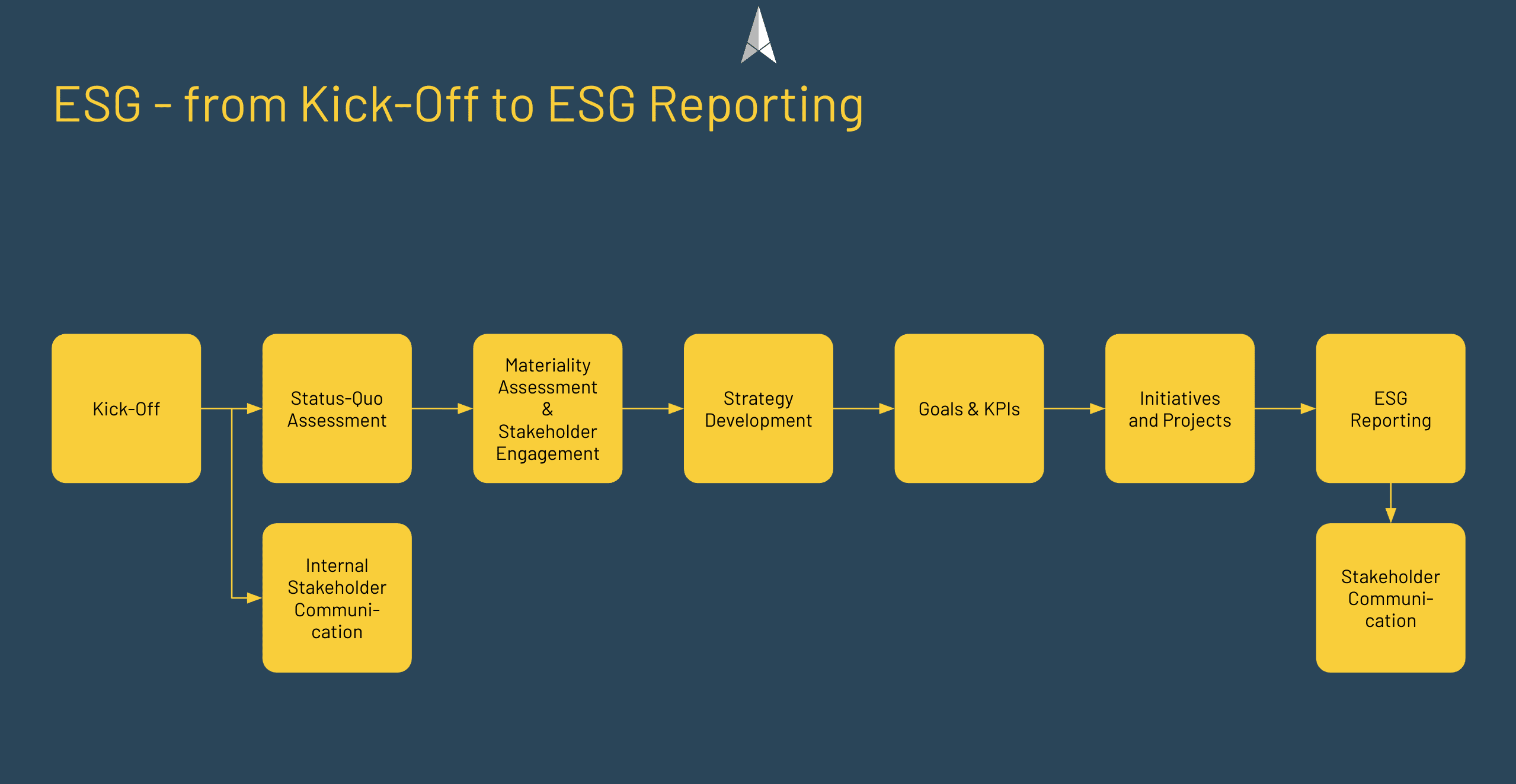

We have already blogged about how companies can get started with ESG (read more here) and shape their entry into sustainability. Refer to the figure below for an overview of a typical process to implement ESG.

ESG and sustainability management – typical tasks

Some ESG or sustainability management tasks will directly stem from the process shown in the figure above, while other duties can be derived from job descriptions for ESG or sustainability managers. We have compiled a cross-section of these in the following sections.

In addition, the culture of sustainability can be shaped by the Chief Executive Officer (CEO) acting as a corporate role model for employees.

The CEO sets the corporate standard by creating a culture of corporate sustainability, whilst the in-house counsel ensures the business model’s legality and legitimacy, acting as part of the moral compass.

Besides strategic issues and managing projects and initiatives, ESG and sustainability managers must also be able to score in terms of communication and knowledge transfer. For example, when responding to stakeholder inquiries, internal sustainability communication or knowledge transfer.

Strategy: Develop or further develop the ESG or sustainability strategy

Typical tasks in this context are:

- The development and/or continuous further development of an ESG or sustainability strategy.

- The establishment and/or further development of the company’s sustainability management.

- The support of the c-suite management and other departments on sustainability issues and/or issues relating to the sustainability strategy.

Data: Collecting data and setting goals and KPIs

ESG is a data-driven approach. Here is an overview of tasks in this context:

- Collecting data on sustainability topics, analysing them, and implementing systems to collect ESG key data systematically.

- Setting ESG and sustainability goals, prioritising particular sustainability topics and defining KPIs. This task also includes their subsequent monitoring to ensure target achievement and to be able to evaluate strategic initiatives.

Implementation: Supply chains, develop and manage projects and initiatives

The implementation may include the following requirements:

- Identify potential for optimisation and improvements – that may also include existing supply chains aiming to improve the ESG performance of suppliers.

- Planning, implementation and evaluation of ESG or sustainability projects and initiatives.

Reporting & Communication: non-financial reporting, sustainability reporting, ESG and sustainability communication

ESG and sustainability communication directed at various stakeholder groups can include the following tasks:

- Implementation of (formal) sustainability disclosure or non-financial reporting under the requirements of reporting frameworks (GRI, CSRD / ESRS).

- Support and monitoring of internal and external review processes/audits.

- Preparation of sustainability communication tailored to the requirements of individual stakeholder groups.

- Function as a contact point for internal and external stakeholder inquiries.

- Preparation and publication of CO₂/greenhouse gas emissions. Information on product carbon footprint (PCF) and energy consumption.

- Thought leadership communication related to ESG and sustainability.

Monitoring of ESG trends, peers, ratings, regulatory developments

Other tasks include, for example, the monitoring of (regulatory) trends and peer assessments:

- Monitoring of ESG or sustainability trends and upcoming (regulatory) developments.

- Peer assessments and monitoring of ESG ratings (e.g. CSP, MSCI, Sustainalytics). That may also include communication with external auditors.

- Planning and implementation of workshops, awareness-raising and qualification measures.

So no doubt, the task that an ESG or sustainability management has to perform are diverse and require extensive know-how and communication skills. In addition, high workloads can occur – e.g. when the “reporting season” is approaching, and information has to be prepared and validated for sustainability reporting.

How companies can respond to the organisational challenge of ESG and sustainability

Companies can pick from various approaches to implement ESG and sustainability and provide the resources needed to do so.

The Options: From “In-house ESG Management” to “Outsourcing ESG Management”

After clarifying the “what”, we focus on the “how” and show how companies can implement ESG or sustainability management into their organisational structure.

In-house ESG Management

Establishing an “In-house ESG Management” will be the go-to solution for most companies to implement ESG and sustainability into their organisation – either as an independent or integrated into an already existing department. For example, in-house legal departments can demonstrate, support and facilitate accountable leadership within the company and safeguard compliance with laws and uniform global ethics.

Planning to do so must consider the associated tasks and how long it takes until necessary (personnel) resources are available.

In-house ESG Management combined with external consulting

This approach is similar to “In-house ESG Management” but adds external resources and know-how to the mix. External resources or consulting can help to shorten the timeframe until the internal sustainability management becomes operational (e.g. know-how transfer, supporting tasks like double materiality assessments, or aiding in establishing internal processes for data collection). However, the chores assigned to external consultants will depend on the initial situation:

- Companies currently establishing an ESG or sustainability management: External support and know-how can offer the advantage of implementing the processes and structures needed while at the same time supporting crucial tasks like sustainability assessments, stakeholder engagement or developing a sustainability strategy.

- Companies already having established an ESG or sustainability management: Already established ESG or sustainability departments can benefit from external support too. Examples are adjustments needed to regulatory conditions shifts (CSRD, EU Taxonomy) or implementing new processes and methods (double materiality, carbon accounting).

Interim ESG Management

An “Interim ESG Management” can be an interesting option for those companies that aim to become (or remain) capable of acting on ESG and sustainability quickly.

An “Interim ESG Management” can bridge the period until the company’s own ESG management is fully capable of action and, in addition to thematic work, can also lay a good foundation for the future work of an in-house ESG management.

Another advantage can be seen in the know-how transfer from “interim” to “internal” ESG management, so the time needed to (further) qualify in-house personnel can be reduced.

Depending on the company’s sustainability journey, the “Interim ESG Management” tasks can range from laying foundations like developing an ESG strategy to advising management and c-suite.

Another benefit of an interim ESG management solution is flexible working models (hybrid work, fixed periods of on-site presence, remote work).

Outsourcing ESG Management – ESG as a service

“Outsourcing ESG management” takes the concept of “ESG as a service” one step further. In this case, the entire sustainability management is outsourced and managed by an external service provider.

As a result, companies can flexibly decide on the service levels they need: From complete outsourcing of all tasks to just a sub-set of specific tasks that require unique expertise (e.g. CO₂ emissions reporting or aligning to EU Taxonomy) not available within the organisation.

As with “Interim ESG Management”, flexible agreements can be made regarding the on-site presence, resources provided, the scope of services rendered, and competence profiles needed. So outsourcing ESG management tasks can be understood as ESG as a service.

What is the “best” solution?

There is no general answer to this question. The best solution will depend on the company’s priorities and demands:

- What is the long-term perspective envisaged? Are there plans to install an in-house ESG management, and is outsourcing even an option?

- What costs are associated with the respective solutions, and what solution offers the best value to the company?

- What timelines must be met, and how fast should the implementation start?

- How fast should adequate processes for preventing, mitigating, and accounting for human rights and environmental impacts in corporations’ operations and supply chains be implemented?

NordESG – Beyond ESG consulting

To avoid a decision-making dilemma at the end of this article, we offer a free, no-obligation discovery call in which we will be happy to discuss the individual courses of action with you.

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.