How to get started with ESG?

ESG is “here to stay”, is a “complex topic”, and comes with a “steep learning curve”. All this is true from the perspective of a company trying to understand the concept(s) of ESG for the first time. So no wonder one of the top questions we get asked is “how can companies get started with ESG?” and “what will be a good approach to implement ESG?”.

Each business operates in its individual ESG landscape. So, developing a “one-size-fits-all approach” is a challenging task. Instead, we understand implementing ESG as a process-driven effort that needs to be fine-tuned to the particular demands of each business to whom we provide consulting services.

However, there are some waypoints in each sustainability landscape that will be a part of our clients’ ESG journey.

With this blog post, we provide a birds-eye-view of how companies can connect these dots to navigate their ESG landscape.

To get started, we discuss what ESG is all about and why it is relevant to corporations. Then we give an overview of how companies can get started with ESG and provide insights into the steps and building blocks to do so.

What is ESG, and why is it relevant for corporations?

We have extensively blogged about the relevance of ESG for corporations and businesses and what ESG is. So for this blog post, we limit ourselves to providing a short overview of these topics.

What is ESG, and how is it relevant to companies?

ESG is short for “Environment”, “Social”, and “Governance”.

- Environmental criteria focus on the input and output of a company, for instance, energy and water consumption. Waste management and by-products are taken into consideration, too. Directly linked to energy usage are greenhouse gas emissions. Every business affects and is affected by the environment.

- Social criteria are not only tied to labour standards, diversity and inclusion. The focus is on all relationships and interconnections a company has with its stakeholders: communities, institutions and the general public – and social criteria have significant exposure to reputation.

- Finally, there is governance. It is all about the practices, checks and balances, and procedures a company implements to govern itself. It is about how the interests of internal and external stakeholders are balanced, the frameworks that guide decision-making, and how to meet the needs of all stakeholders and comply with the law.

What is the impact of ESG, and how is this concept relevant to corporations?

There is more than one answer to that. Over the last few years, consumer attention to companies’ impact on social, governance and environmental matters has significantly increased. Stakeholders’ opinions on how a company is doing business gain more and more weight and influence.

How can companies get started with ESG?

As already mentioned above, each business operates in its individual ESG landscape and needs to find ways to navigate this landscape by understanding the tasks and responsibilities that stem from the process. One of the most important aspects is the involvement of the c-suite as drivers for the ESG process.

The Waypoints along the Corporate ESG Journey

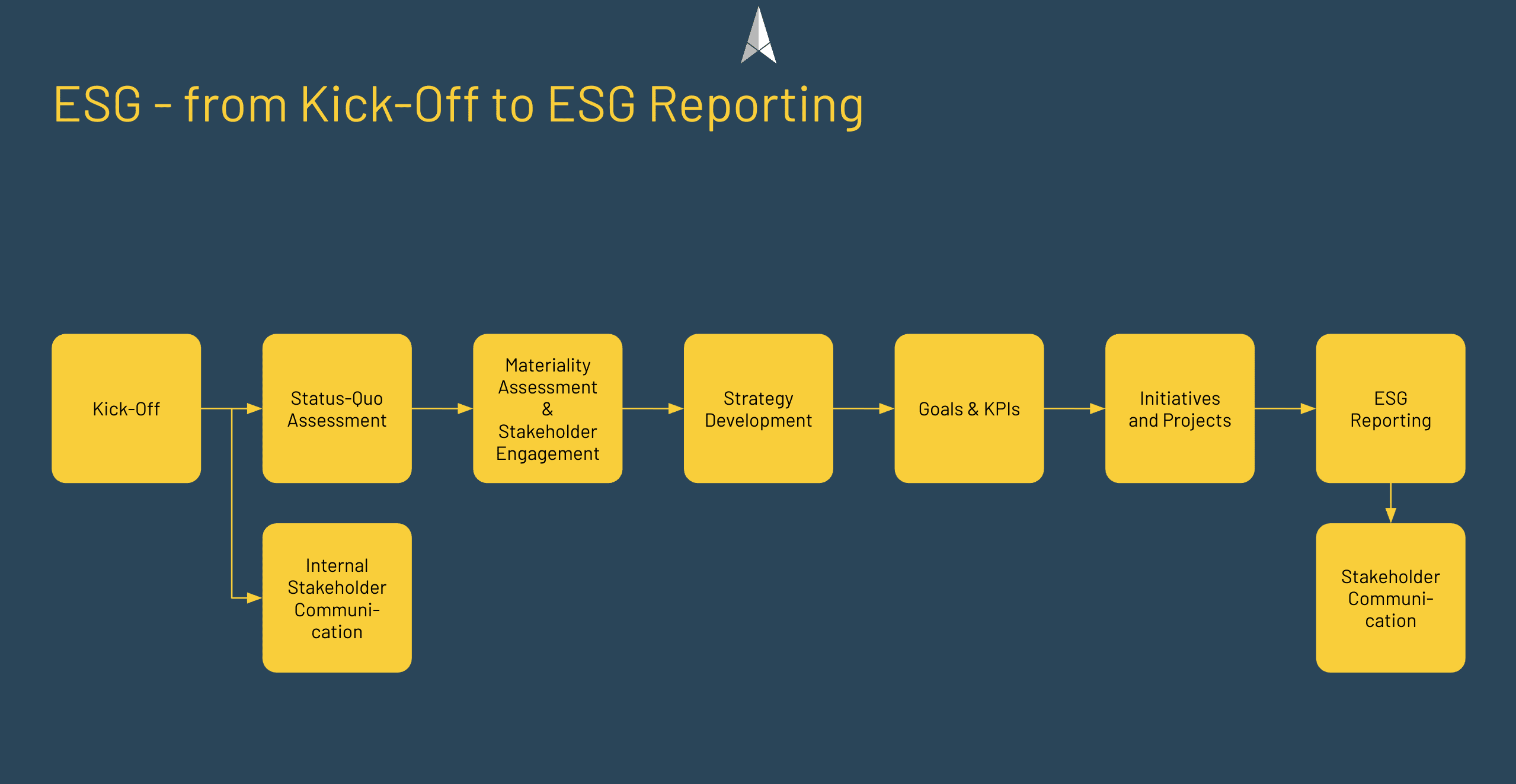

The following figure shows a generic ESG process. This process can be tweaked to fit a company’s needs starting its corporate ESG journey. In the following paragraphs, we outline the individual work packages.

Before you even start…

It is critical to have the c-suite on board. The top management plays an essential role along the entire ESG journey and should understand its role in supporting the ESG management team along the way. This is also the time for thought leadership communication to ensure that everybody within the company understands the priority of the forthcoming ESG process.

Kick-Off Meeting

The kick-off meeting is the formal starting point for the corporate ESG journey and, simultaneously, the onboarding of all relevant departments.

Knowledge about ESG may be heterogeneous. Therefore, the kick-off meeting is an excellent opportunity to inform everyone about what ESG is, its impact on the company, and its relevance in the future.

The kick-off meeting is also a valuable opportunity to engage with all relevant departments and ensure their support for the upcoming process.

Ideas and Action Items

- The “why” is understood by everyone – including why ESG is relevant to the company from different viewpoints.

- Industry-specific information related to stakeholder expectations, (upcoming) trends and regulations are presented and discussed.

- The outline of the ESG process, starting with the kick-off meeting to the non-financial reporting and the tasks related to each step, is given, and responsibilities are defined.

- The kick-off meeting is also a good time and place to nominate an ESG oversight board.

Communication with Internal Stakeholders

The kick-off meeting is also a good starting point to engage with internal stakeholders and inform them about the ESG process and how they can participate. That can include ways how internal stakeholders can submit ideas and viewpoints too.

Ideas and Action Items

- Inform about the ESG process and how internal stakeholders can participate and contribute.

- Offer options to capture ideas and viewpoints (e.g., feedback forms) so no good idea gets lost.

- Invite departments to contribute to the ESG process and support department heads with their communication efforts along the ESG process.

Performing a Status-Quo Assessment

The results of the status-quo assessment will later become the foundation for the ESG strategy, strategy-related goals and KPIs. It is one of the most challenging tasks since, for the first time, ESG-related data has to be captured systematically. This work package also includes the decision about the reporting framework (more about ESG reporting frameworks here).

The ESG-related data captured during this process step will later become the baseline. So any future improvements will be measured against the results of the status-quo assessment.

Ideas and Action Items

- The prime objective is to collect high-quality and highly reliable data that can be used as a foundation for future planning and setting goals for the ESG strategy. Later the same data is used for sustainability reporting.

- Capturing high-quality and reliable data enables first insights and comparisons for setting priorities and strategy development and deployment.

- One of the most critical aspects is identifying missing data or data gaps against the ESG reporting framework and deploying processes to capture missing data.

Greenhouse Gas Emissions and the Status-Quo Assessment

Reporting on greenhouse gas emissions is a common thread in sustainability reporting and, simultaneously, has a high priority for stakeholders. A good starting point for reporting on GHG emissions is the GHG protocol.

The GHG protocol distinguishes GHG emissions into three categories:

- Scope 1 emissions are GHG emissions from sources directly owned or controlled by the reporting company. The simplest example is a company’s heating system and the emissions attributable to its operation.

- Scope 2 emissions, on the other hand, are indirect emissions, such as those generated by the production of purchased electrical or thermal energy.

- Scope 3 emissions represent another class of indirect greenhouse gas emissions not included in Scope 2. They are divided into “upstream” and “downstream”, depending on whether they occurred along the value chain.

Read more about GHG emissions here and here.

Materiality Assessment and Stakeholder Engagement

There is some confusion about what a materiality assessment is and what it should cover (more on that here and here). We recommend performing a “double materiality assessment” (you can find more information on the process here). The result of the materiality assessment is what is material to the company from the inside-out and outside-in perspectives. And the results should be discussed with key stakeholders to capture their input and viewpoints. This initial stakeholder engagement is also an opportunity to learn more about your shareholders’ priorities, values and perspectives.

Ideas and Action Items

- The materiality assessment helps you to identify what is material for your company – from both the inside-out and the outside-in perspectives.

- It is an opportunity to check how material topics are reflected in the overall business strategy.

- Engage with internal and external stakeholders to get insight into their values, priorities and opinions on materiality. While engaging with stakeholders, build an inventory of all relevant (key) stakeholders or stakeholder groups and their preferences.

- Use the stakeholder inventory for future stakeholder engagements and stakeholder communication.

Strategy, Goals and KPIs

The status-quo assessment, the materiality assessment results and stakeholder engagement inputs are the foundation for the strategy development process. In addition, future trends and challenges are taken into account. Finally, the results are consolidated into an ESG strategy. Developing the strategy also implies prioritising those topics that have the most significant impact on the corporation or will lead to fast results.

While the strategy gives overall guidance, the goals and KPIs derived from the ESG strategy will form a framework that makes success measurable.

About ESG Goals

Goals and KPIs should be directly related to the ESG strategy. The strategy gives the overall direction, while ESG goals or KPIs define the exact path, time and resources needed along the way. Therefore it is essential to set specific (SMART) goals and objectives to enable efficient goal tracking.

Goals can also contribute to prioritising topics where taking action is required most or those goals that bring the most added value to the company.

Ideas and Action Items

- The objective is to arrive at an ESG strategy that covers all ESG-relevant topics in the “Environment”, “Social”, and “Governance” domains.

- The ESG strategy, in conjunction with operationalisable goals, enables efficient tracking of progress and results.

ESG-Initiatives and Projects

Projects and initiatives are essential components that help companies to achieve their ESG goals and KPIs. While the ESG strategy defines the overall direction, ESG goals and KPIs act like a funnel that helps to focus on desired outcomes. Finally, ESG initiatives and projects bring the traction needed to achieve these desired outcomes.

Ideas and Action Items

- Prioritise those areas where ESG-related projects and initiatives can contribute the most.

- Integrating internal and external stakeholders in projects and initiatives can bring new ideas and viewpoints.

ESG-Reporting and Stakeholder Communication

All efforts finally cumulate in the ESG reporting. The ESG report covers risks and opportunities in a balanced and transparent way. Things to consider are the requirements that come with reporting frameworks (read more about reporting frameworks here) and the demands of stakeholders or stakeholder groups that will use the ESG report later.

Ideas and Action Items

- Avoid greenwashing.

- Keep the demands of stakeholders that will use the ESG report in mind. Creating excerpts with critical facts and figures for specific stakeholders can be an approach.

- Report transparent about the current status, goals and achievements.

Conclusion

ESG is a complex task, and getting started with ESG may initially feel intimidating. We hope we have provided some navigation aid with this blog post so you can begin navigating your sustainability landscape and get started with ESG a bit easier. So get started and keep the momentum. ESG is not a sprint; it is a marathon.

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.