ISSB issues inaugural global sustainability disclosure standards IFRS S1 and S2

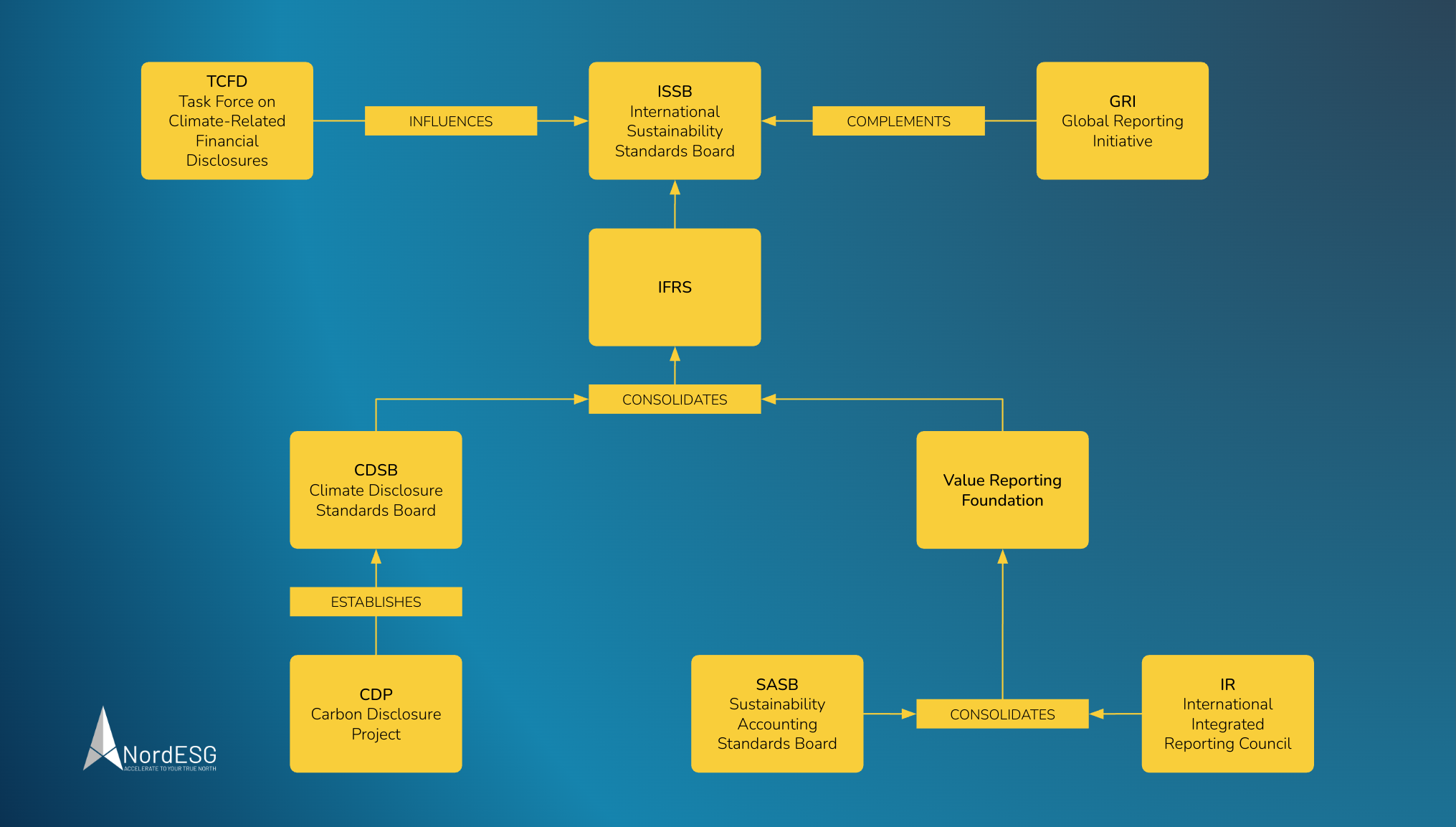

On June 26th 2023, the International Sustainability Standards Board (ISSB) launched the IFRS S1 and S2 sustainability reporting standards. A new reporting framework may seem to be nothing remarkable given the often cited “alphabet soup of ESG frameworks”. However, things are different for the IFRS S1 and IFRS S2 since these standards are an evolutionary result that builds on or consolidates other well-established frameworks into one that can potentially define the global baseline for corporate sustainability reporting. Here is our first overview of the two standards: IFRS S1, “General Requirements for Disclosure of Sustainability-related Financial Information”, and IFRS S2 “Climate-related Disclosures”.

A short history of the IFRS S1 and IFRS S2

As mentioned above, the two standards released by the ISSB are the evolutionary result and are built on the foundations laid by other reporting frameworks. The most prominent example is the framework developed by the Taskforce on Climate-related Financial Disclosures (TCFD). Besides the TCFD, the now-released standards also have a heritage that stems from other voluntary reporting standards that have evolved over several years. As ISSB Chair Emmanuel Faber mentioned in an interview, “Rather than adding new ingredients to the alphabet soup of extant sustainability disclosure standards, the ISSB standards build on the work of (among others) the Climate Disclosure Standards Board (CDSB), the Task Force on Climate-related Financial Disclosures (TCFD), the Value Reporting Foundation’s Integrated Reporting Framework and industry-based guidance from the Sustainability Accounting Standards Board (SASB)”. Read the detailed interview [1] for additional insights.

A quick overview of the IFRS S1 and IFRS S2

Paragraph 1 of the IFRS S1 states that “The objective of IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information is to require an entity to disclose information about its sustainability-related risks and opportunities that is useful to primary users of general purpose financial reports in making decisions relating to providing resources to the entity.”

The core content of the IFRS S1 is detailed in paragraph 25 in four categories:

- Governance: In this section, the reporting undertaking must provide information about its governance processes and its established controls and procedures to monitor and manage its sustainability-related risks and opportunities.

- Strategy: Under the strategy section, the reporting entity has to provide information on its approach to managing sustainability-related risks and opportunities.

- Risk management: To complement the governance and strategy part, the reporting undertaking must provide information on its processes to identify, assess, prioritise and monitor sustainability-related risks and opportunities.

- Metrics and targets: Simply put, this section is about making it “measurable” by providing data about the sustainability performance of the reporting entity and its progress on sustainability-related risks and opportunities.

Appendices A to E provides further guidance for preparers of sustainability reports by laying out defined terms, giving application guidance, providing sources of advice, informing about the qualitative characteristics of useful sustainability-related information and the effective date and transition into reporting against this standard.

Complementing the IFRS S1, the IFRS S2 (paragraph 1) states that “The objective of IFRS S2 Climate-related Disclosures is to require an entity to disclose information about its climate-related risks and opportunities that is useful to primary users of general purpose financial reports in making decisions relating to providing resources to the entity.” and “This Standard requires an entity to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term. For the purposes of this standard, these risks and opportunities are collectively referred to as ‘climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects’.”

The IFRS S2 sets out specific climate-related disclosure requirements (e.g. Scope 1, 2 and 3 GHG emissions) and complements the IFRS S1. A first look at the disclosure requirements reveals the heritage that stems from the Task Force on Climate-related Financial Disclosures (TCFD).

Decision useful information on a global scale

In our two-part series on the Eurosifs “Report on Climate-related Data – The Investors Perspective” [2, 3], we discussed the growing demand for decision-useful information on climate-related data that helps investors to achieve their sustainable investment objectives.

The now-released standards have the potential to substantially contribute to providing such decision-ready and decision-useful information to investors and other relevant stakeholders.

Considering the global footprint and importance of IFRS standards worldwide, the IFRS S1 and S2 can become the global baseline for sustainability reporting and international accounting requirements. IFRS accounting standards are adopted in more than 140 jurisdictions, adding leverage to the IFRS S1 and S2 as the global baseline. In any case, releasing the IFRS sustainability standards may further consolidate the “alphabet soup” of ESG frameworks.

Since the European Sustainability Reporting Standard (ESRS) has yet to be finalised [4], we cannot conclude the interoperability of both frameworks. Still, we will cover this aspect once the final version of the ESRS is available.

What’s next?

After the release of IFRS S1 and S2, the ISSB plans to collaborate with jurisdictions and companies to facilitate their adoption. Key initiatives include establishing a Transition Implementation Group to assist companies in applying the Standards and introducing capacity-building programs to ensure successful implementation.

Furthermore, the ISSB will maintain its partnership with jurisdictions that aim to enforce additional disclosures beyond the global baseline. Additionally, the ISSB will collaborate with GRI to enhance reporting efficiency and effectiveness when utilising the ISSB Standards in conjunction with other reporting frameworks.

Conclusion

In conclusion, the launch of IFRS S1 and S2 by the ISSB [5] represents a significant step towards a unified global sustainability reporting framework. These standards consolidate established frameworks and offer decision-useful information for investors and stakeholders. With the widespread adoption of IFRS accounting standards, IFRS S1 and S2 can become the global baseline for sustainability reporting. The ISSB plans to support adoption through collaboration, establishing a Transition Implementation Group, and capacity-building initiatives. Partnerships with jurisdictions and the GRI will enhance reporting efficiency. Overall, these standards contribute to consolidating the ESG reporting landscape and promoting standardised corporate sustainability reporting.

Sources and further reading

[1] Greenbiz

[2] Eurosif Part 1

[3] Eurosif Part 2

[4] ESRS update

[5] IFRS

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.