Climate-related data – the investors’ perspective – Insights from Eurosif

In a recently published study called “Eurosif Report on Climate-related Data – The Investors’ Perspective“, Eurosif, a leading pan-European association promoting sustainable finance, provides insights into the challenges of the availability, reliability and comparability of climate-related data that investors can utilise for investment decisions.

This blog post is part one of a two-part series. Investors are important users of corporate sustainability reports. So in this first part, we look at the challenges from an investor’s viewpoint – we discuss the study’s key findings and focus on data sources, availability, quality and the implications for investors. In part two, we ask how companies can improve their sustainability reporting to better meet the needs of investors and other stakeholders. That will also include an overview of the European regulatory landscape and how regulatory initiatives drive the amount and quality of sustainability and climate-related data that has to be disclosed by companies. Furthermore, we discuss how regulation on external data providers can help to create a level playing field regarding climate-related data used in the investment process.

About Eurosif

Eurosif is a top European association that advocates for Sustainable Finance throughout the EU, the wider European Economic Area (EEA), and the United Kingdom (UK). It consists of national Sustainable Investment Fora (SIFs) based in Europe, and these SIFs have a diverse membership that includes asset managers, institutional investors, index providers, and ESG research & analytics providers. Eurosifs’ activities include contributing to public policy and researching sustainable investments. More information about Eurosif and its mission can be found on their homepage [1].

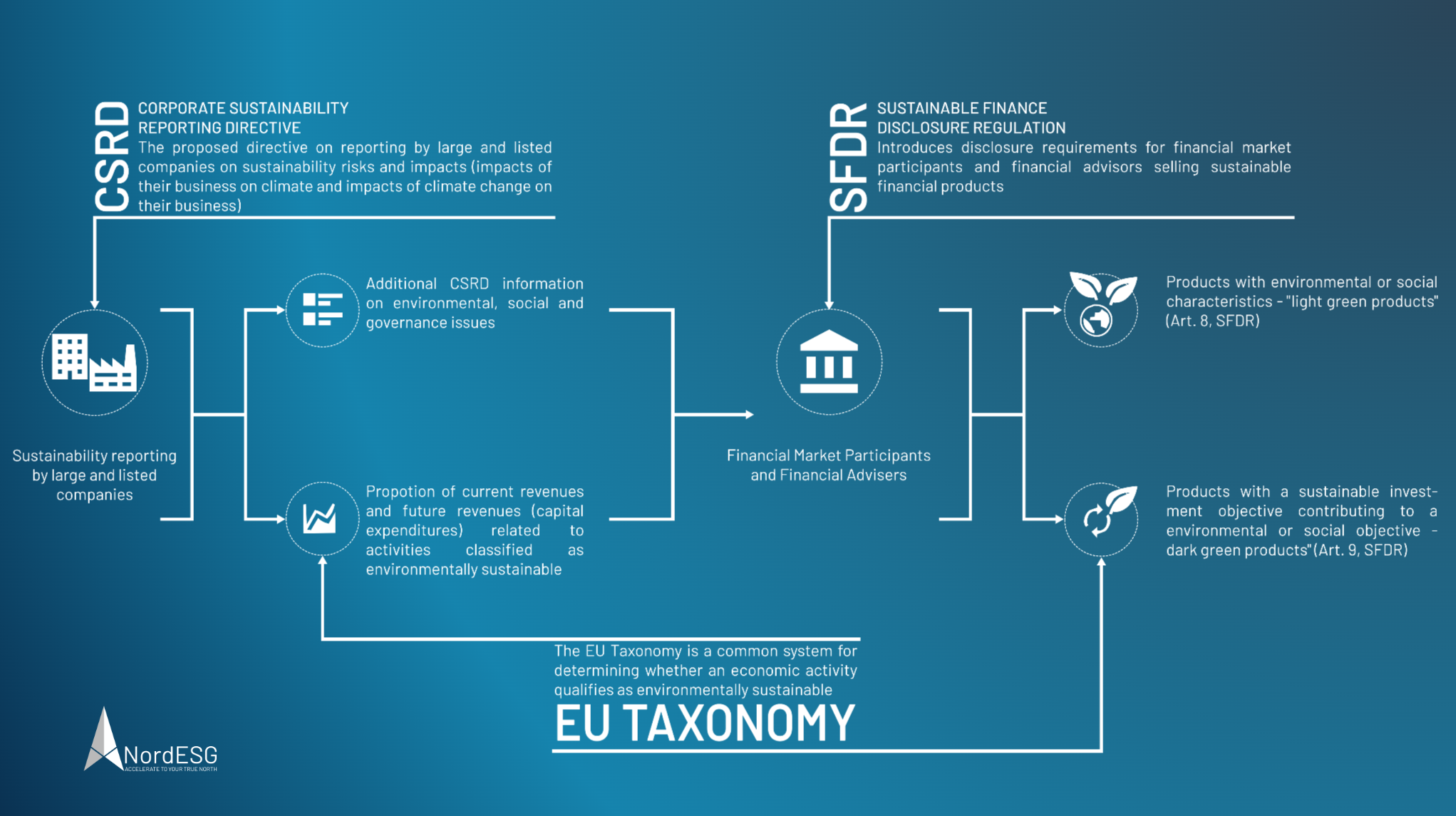

Sustainable Finance amidst a climate crisis – how investments and regulatory initiatives create positive climate-related impacts

Sustainable Finance is about creating positive climate-related impacts and, by doing so, enabling long-term value creation. The two main drivers are stakeholders with an appetite for green financial products, which is still rising. Conversely, regulatory initiatives like the “European Green Deal” [2] aim to redirect capital flows towards greener economic activities. The “European Green Deal” is flanked by other regulatory initiatives on the European level: the “Corporate Sustainability Reporting Directive” (CSRD) [3] and with it, the “European Sustainability Reporting Standard” (ESRS) [4], the “Sustainable Finance Disclosure Regulation” (SFDR) [5], the EU-Taxonomy [6] and to a broader extend the “EU Green Claims Directive” [7] or the “Corporate Sustainability Due Diligence Directive” (CSDDD) [8].

All these initiatives are a clear step up in regulation and the information that has to be disclosed. One example is the CSRD compared to its predecessor, the “Non-Financial Reporting Directive” (NFRD) [9]. In short: today’s regulatory initiatives are data-driven and go way beyond purely qualitative disclosure of sustainability information compared to the NFRD.

All this has implications for Sustainable Finance – whether driven by regulatory initiatives or stakeholder demands, reliable data is vital: “To achieve these objectives, they [investors and owners] need widely available, high quality and decision-useful climate-related information from investee companies. Their corresponding data and information needs have significantly increased in recent years but cannot be fully satisfied yet from a data supply point of view.” [10]

Climate-related data and the investors’ perspective – key takeaways from the Eurosif report

Asset managers and owners are increasingly considering climate-related factors in their decision-making process. The aim is to reduce financial risks and, at the same time, improve climate-related impacts. Eurosifs’ study provides valuable insights into the challenges related to reliable and available climate-related data that is the foundation for this decision-making process.

According to Eurosif, the study had two main objectives: “The study adopts both a risk and an impact perspective: which climate-related information is considered most relevant for decision-making? What are asset managers’ and asset owners’ main challenges, expectations and perceived trends regarding climate-related data and information?” and “This study’s second objective is to derive from the findings concrete recommendations for action for EU policymakers and market practitioners.” [10] Thirty-three respondents from asset management companies, banks, insurance and reinsurance companies, pension funds, foundations and private equity/venture capital firms from the EU, Switzerland, the United Kingdom, Asia, the United States, Canada, Norway and other countries participated in the study.

Data sources for the investment process

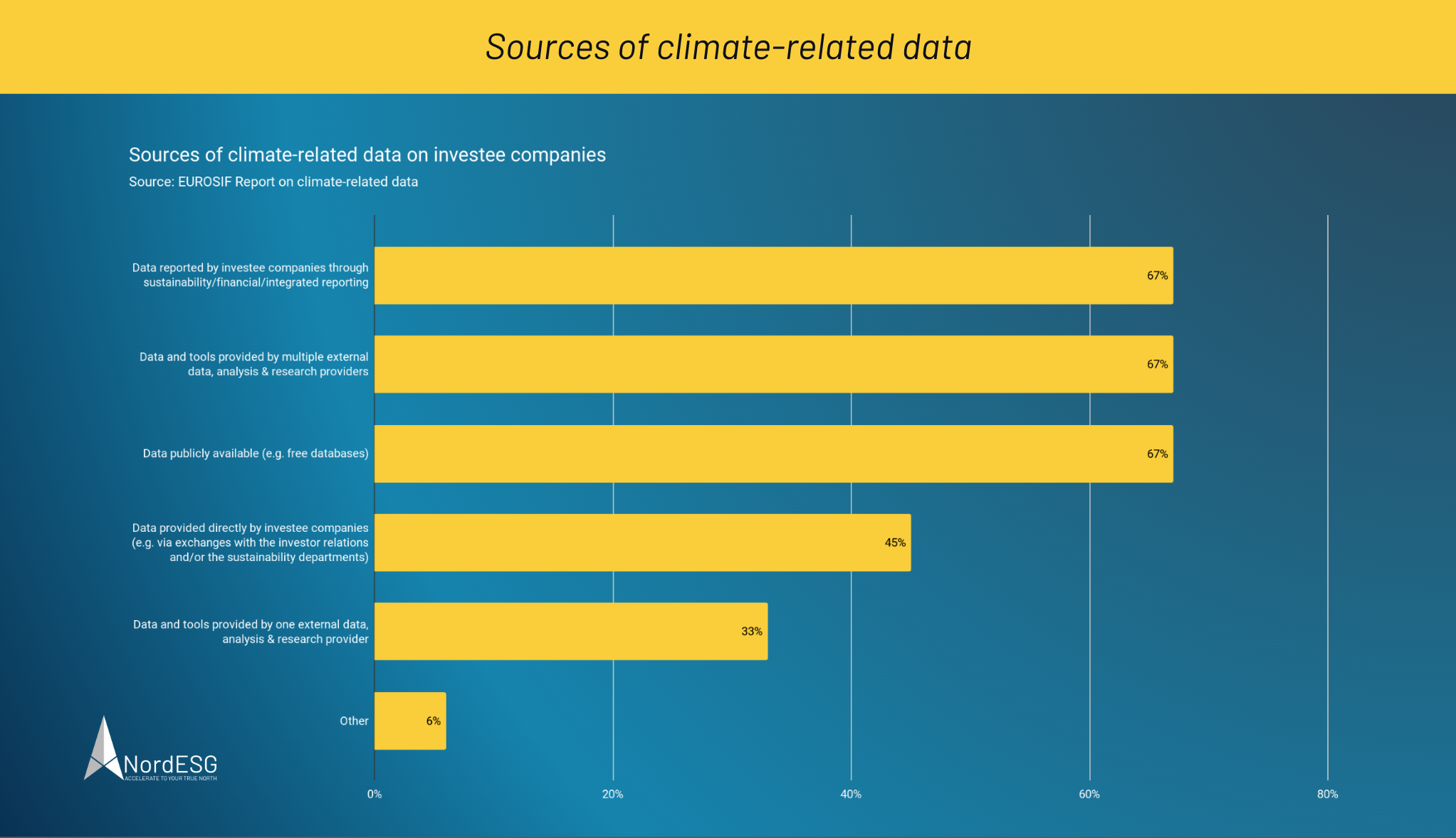

Where does the data used in the investment decision-making process come from? Besides publicly available data, the two most important sources are external data providers and information disclosed in sustainability reports.

According to the findings of the study, “Data reported by investee companies through sustainability, financial or integrated reporting”, “Data and tools provided by multiple external data, analysis & research providers”, and “Data publicly available” are the top three sources for climate-related data all ranking with 67%.

External data providers play an essential role in the decision-making process. All respondents use at least one data provider for climate-related data and information, and two-thirds even use data provided by multiple vendors simultaneously. In this context, it is mentioned that “These findings emphasise the prominent role external data and research providers play in the climate-related, and more broadly, the sustainable investment, ecosystems.” [10].

The study concludes that the reliance on external data providers will persist, even if companies disclose more high-quality climate-related data. Speaking of sustainability disclosures of companies, the experts interviewed for the study state that sourcing data from external data providers is not the only option since standardised reporting frameworks will increase the quantity and quality of sustainability information to be disclosed by companies.

Availability and quality of climate-related data – Challenges for investors and owners

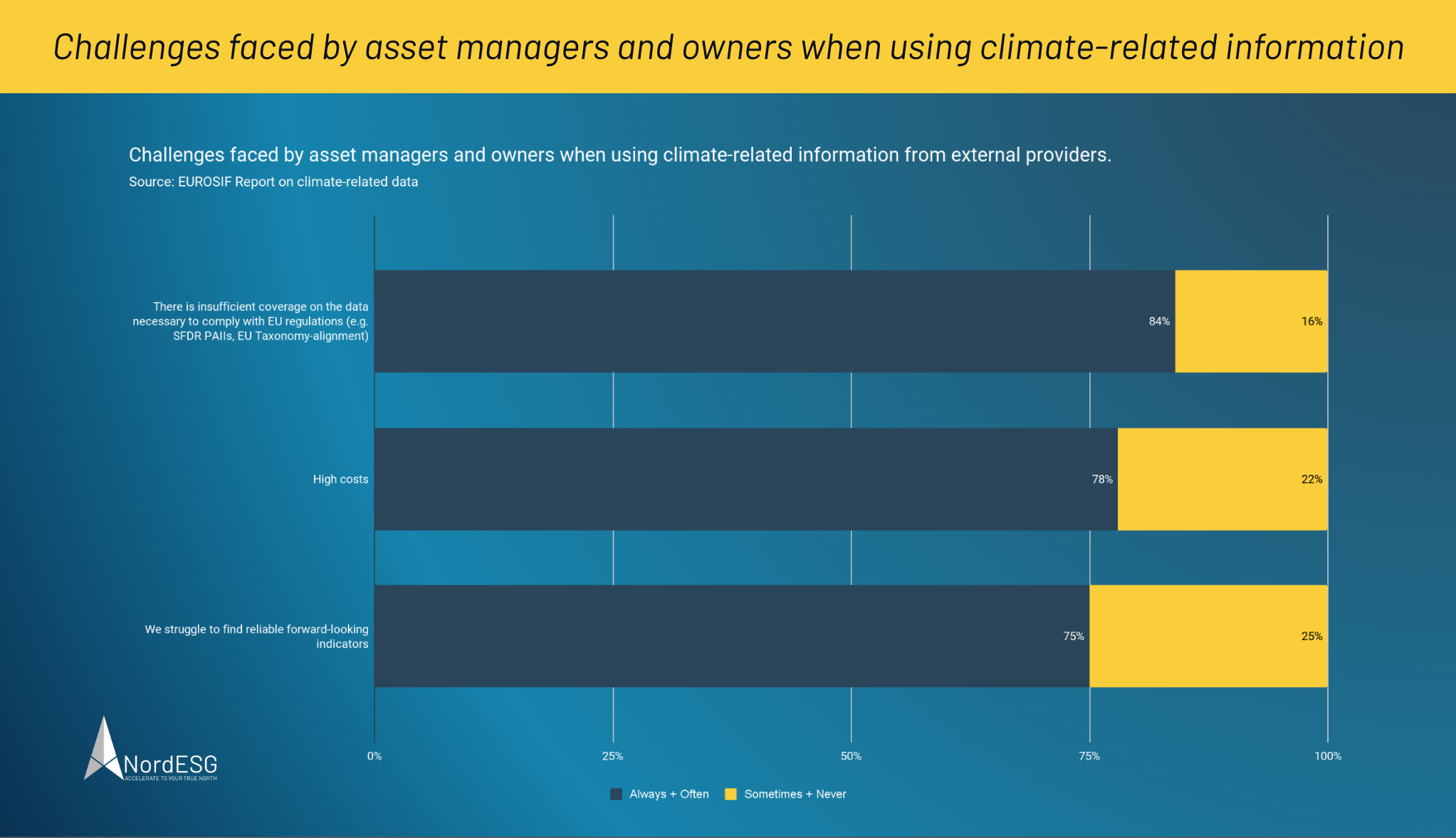

Another key finding of the study is related to the challenges investors and owners face when using climate-related data from external providers. Besides high costs for such data, insufficient data coverage to comply with EU regulations and reliable forward-looking indicators are the top three issues reported. Finally, please note that we aggravated the results by combining the answers in just two categories, while the study provided four possible options to answer in the following charts.

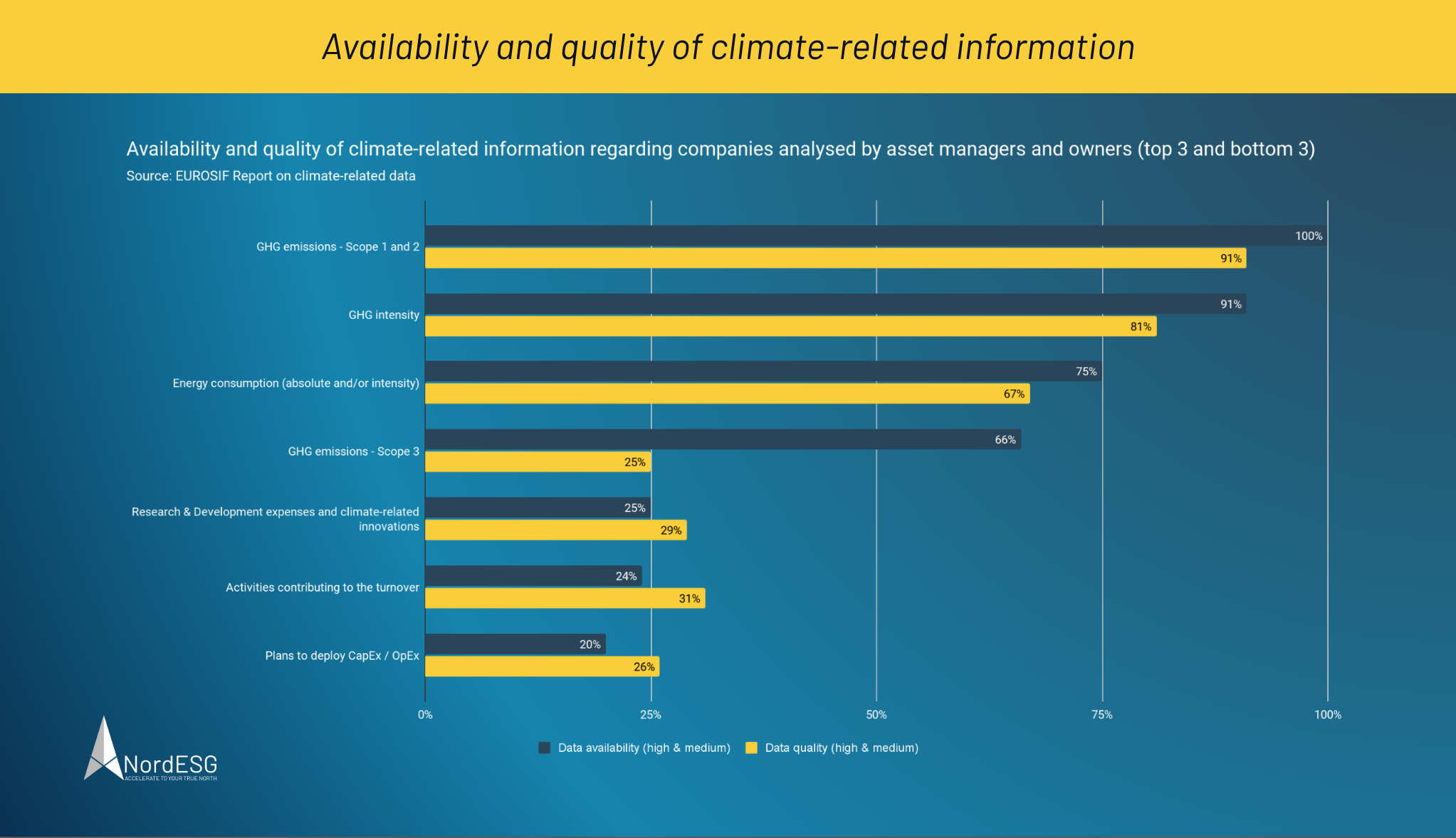

Another key finding of the report is that availability of climate-related data does not always correlate with high data quality. To illustrate this, we combined some data points from the study in the chart below (top three results and bottom three results).

While data on scope 1 and 2 emissions is widely available, and the data quality is high or at least medium, data availability and quality for scope 3 emissions show a very different picture: While scope 3 emission data are available, the share of high-quality data is meagre.

Another finding is that data availability and quality on GHG intensity and energy consumption are also in the top ranks.

On the flip side, the bottom three results are:

- Data availability and quality on R&D expenses and climate-related innovations.

- Activities contributing to turnover.

- Data on plans to deploy CapEx/OpEx.

Note that the data presented here is just an extract, while the Eurosifs study covers 19 categories in total.

Got questions about sustainability?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you.

From backwards-looking data to forward-looking indicators

Backwards-looking data, e.g. from sustainability reports, is one thing to consider in investment decisions. However, forward-looking data is important too. The study states, “Forward-looking information allows asset managers and owners to assess the climate-related potential of a company and its adaptation efforts to mitigate physical and transitional risks.” [10]. But forward-looking indicators come with their own set of challenges ranging from insufficient availability of underlying data (93% of proprietary forward-looking indicators), insufficient availability or reliable, standardised indicators (80%) or assumptions and outcomes that are not reliable and their scientific soundness is disputable (73%). The challenges cited when using external providers’ forward-looking indicators are similar but have different rankings. Here assumptions and outcomes are unreliable, and their scientific soundness is disputable, ranking at 86%. Other remarks are related to the insufficient comparability between methodologies of different data providers and the opaqueness that makes these methodologies hard to understand. The report states, “The main concern for asset managers and owners relying on forward-looking indicators from external data providers […] is the perceived lack of scientific reliability of the underlying assumptions and outcomes of said indicators.” [10].

And from forward-looking indicators to net-zero targets

The challenges for investors continue after forward-looking indicators. Net-zero carbon emission targets are also critical for investment decisions. Again we have compiled a chart with the key findings combining the perceived data availability and quality for the top and bottom three categories and added scope 3 emissions to the list. It is easy to understand that scope 1 and 2 emissions and baseline year emissions rank high since these two indicators are closely intertwined. That also applies to whether the target is absolute or relative. As highlighted before, regarding scope 3 emissions, the perceived availability of data is relatively high (45%), while the perceived quality of data is less high (18%). Looking at the bottom end of the list, topics like the reliance on carbon offsets, removals and avoidance or the coherence of net-zero targets with sectoral pathways as well as changes in targets and methodologies are mentioned – with metrics on perceived data availability and quality at the lower end. Note that the data represented here is just an extract, while the Eurosifs study covers 19 categories in total.

Can regulatory initiatives help to bridge the gap?

Can regulatory initiatives help to bridge the gap and pave the way to highly available and simultaneously high-quality data to assist the investment process? According to the study, “91% of respondents agreed that some sort of regulatory intervention would be required or at least helpful to address some of the main challenges identified throughout this report.” [10].

The Corporate Sustainability Reporting Directive (CSRD), Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy comprise a robust framework. Future regulatory initiatives like the Corporate Due Diligence Directive and the Green Claims Directive will even improve the situation further. However, according to the study, differing implementation timelines have caused friction and misalignments. The study states that the respondents expect that the regulatory efforts will lead to increasing data availability and reliability over time. With companies reporting in detail about their sustainability performance, those data will become more relevant and useful for investors and owners. However, it seems that sustainability information disclosed by corporations will not be the predominant source future investment decisions will be based on, since the “interviewed experts also acknowledge that the added value of using information from several external data providers builds upon the variety and diversity of their modelling.” [10]. Finally there is the topic of interoperability and harmonisation globally since most of their firms operate in more than one jurisdiction. Read our blog posts on the interoperability of reporting frameworks [11] and about the “CSRD and the Brussels-Effect” [12] for further information.

Conclusion

What are our main takeaways from Eurosifs’ study? One aspect is the availability and quality of data needed in investment processes. Data sourced from a broad bandwidth of data suppliers combined with “raw data” provided in the sustainability reports of corporations is essential for well-informed investment decisions. We see a good alignment for some data and the quality of those data (e.g. Scope 1 and 2 emissions). However, there are other categories where data availability is at a high or medium level, but the score for data quality does not match the one for data availability. That is particularly true for Scope 3 emissions, where two-thirds of respondents state a high or at least medium data availability but at the same time rank the data quality (high and medium) to just 25%. So Scope 3 emissions can be understood as a prime example of a critical link to value chain-related information and forward-looking information. Another crucial information is that neither good data coverage nor high data quality is available for some other categories.

The role of external data providers will remain strong for several reasons. Still, we expect that with regulatory-driven disclosure requirements, “raw data”, as Eurosif calls it, will become more available and relevant for investment purposes. Another aspect that must be considered is additional information from corporate sustainability performance disclosures in the form of materiality assessments. With the CSRD comes the European reporting framework ESRS with the concept of double materiality at its core – providing insights into financial and impact materiality simultaneously and providing additional, hopefully, valuable and decision-useful insights for investment purposes.

Besides the quantity and quality of climate-related data, forward-looking information is another factor to consider. As pointed out above, there is room for improvement regarding the scientific reliability of the underlying assumptions and outcomes. Seen from an investors perspective, reliable and accurate forward-looking indicators for climate-related risks, opportunities, targets and transition plans would allow a more in-depth assessment of how aligned an investee company regards its alignment to global climate goals and the ability to transition into a low-carbon economy required by regulatory initiatives like the European Green Deal.

We will add a link to part 2 of this blog post, “Attracting investments by intelligent sustainability reporting“, here as soon as it is published.

Sources and further reading

[1] Eurosif Homepage

[2] European Green Deal

[3] NordESG – Corporate Sustainability Reporting Directive

[4] NordESG – European Sustainability Reporting Standard

[5] NordESG – Sustainable Finance Disclosure Regulation

- https://nordesg.de/en/eu-sustainable-finance-dislosures-regulation/

- https://nordesg.de/en/clarifications-on-sfdr-by-the-european-commission/

[6] NordESG – EU-Taxonomy

[7] NordESG – EU Green Claims Directive

[8] NordESG – Corporate Sustainability Due Diligence Directive

[9] NordESG – Non-Financial Reporting Directive

[10] Eurosif Report on Climate-related Data The Investors’ Perspective (May 2023)

[11] NordESG – Interoperability of reporting frameworks

[12] NordESG – The Corporate Sustainability Reporting Directive and the “Brussels Effect”

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.