“What is the difference between the CSRD and the ESRS?”

One of the questions we get asked most is “What is the difference between the CSRD and the ESRS?” So let’s dive into the topic and discuss the differences between the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standard (ESRS) in this blog post.

Update: A revised version of the European Sustainability Reporting Standards or ESRS has been released in June 2023. We have compiled this blogpost to share all the information and updates with you.

The Corporate Sustainability Reporting Directive and the European Sustainability Reporting Standard in Context

The CSRD and the ESRS can be better understood if embedded in a broader context – the European Green Deal. With climate change and environmental degradation at our doorsteps, the European Green Deal is a policy that will transform the European Union into “a modern, resource-efficient and competitive economy, ensuring no net emissions of greenhouse gases by 2050, economic growth decoupled from resource use, [and] no person and no place left behind.” [1]

To achieve this, capital flows must be aligned towards greener and more sustainable economic activities.

The European Trinity: Taxonomy, Sustainable Finance and Corporate Sustainability

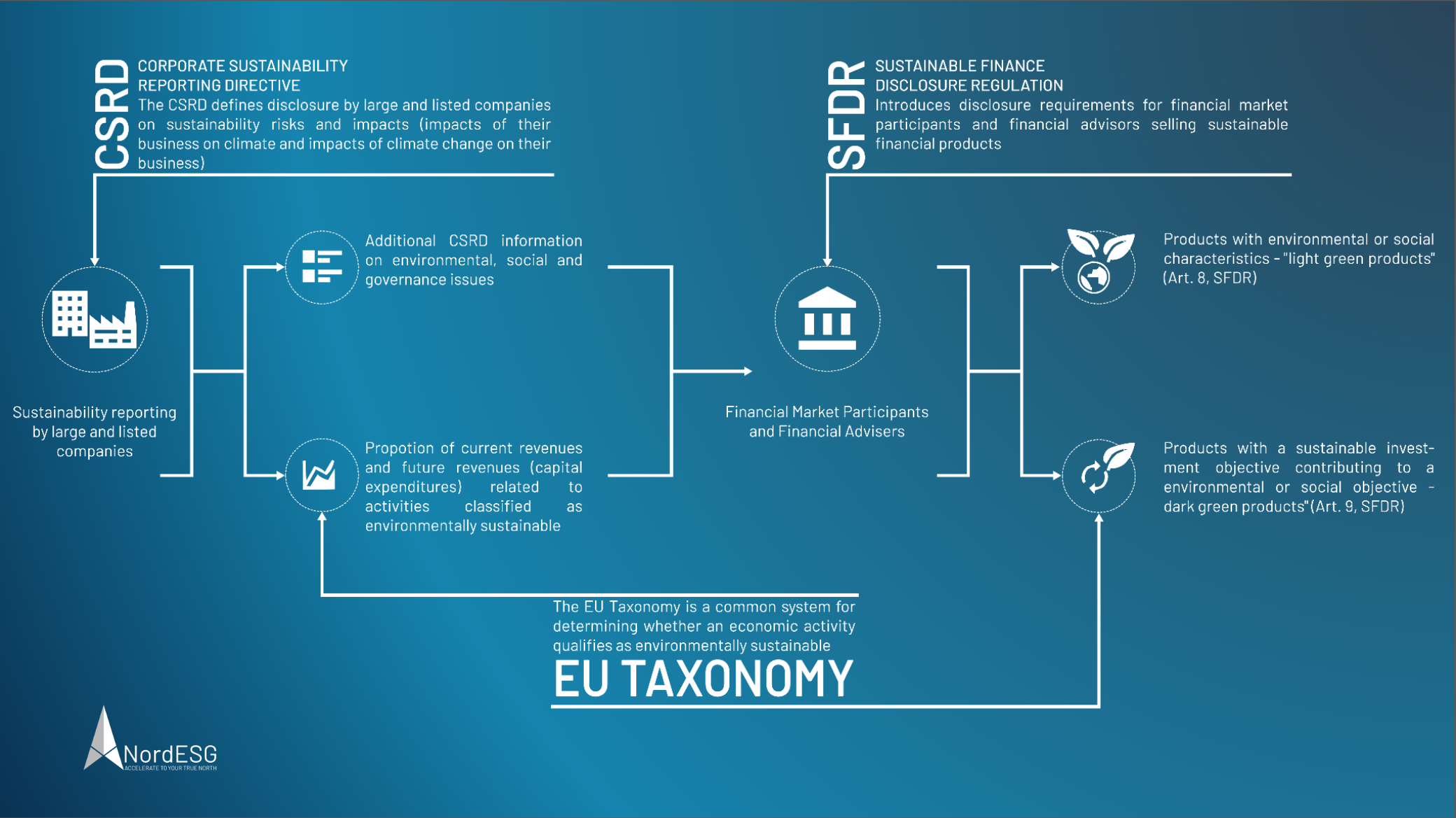

To ensure that the goals of the European Green Deal can be achieved, the EU Taxonomy [2], the Sustainable Finance Disclosure Regulation (SFDR) [3], and the Corporate Sustainability Reporting Directive (CSRD) [4], or how we call it, “The European Trinity”, have been introduced.

As shown in the graphic above, each regulation contributes in a distinctive way to align capital flows towards greener economic activities.

- The EU Taxonomy: The EU Taxonomy is a common system for determining whether an economic activity qualifies as environmentally sustainable.

- The Sustainable Finance Disclosure Regulation: The SFDR introduces disclosure requirements for financial market participants and financial advisors selling sustainable finance products.

- The Corporate Sustainability Reporting Directive: The CSRD defines disclosure by large and listed companies on their sustainability risks and impacts.

In a nutshell: Corporations disclose their sustainability performance under the CSRD and the EU Taxonomy. Financial market participants and advisers use this information to fulfil their disclosure needs and derive how “green” a financial product is (light or dark green products). Moreover, sustainability topics are very relevant to stakeholders, as the still-growing appetite for ESG-aligned investments indicates. So the interaction of the CSRD, SFDR and Taxonomy contributes to aligning capital allocation to sustainable activities.

Got questions about sustainability?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you.

The CSRD and the ESRS – Two sides of the same coin

So what is the difference between the CSRD and the ESRS [5]? There is less of a “difference”, but rather a “union” of both since the CSRD and the ESRS are closely intertwined.

| CSRD | ESRS |

| The CSRD is a regulatory initiative that defines corporate sustainability reporting requirements for large and listed corporations in the European Union (and for some Non-EU companies [6]) – it is about the “why” and defines the “who” and “when“. | The ESRS is the reporting framework corporations must use to disclose their sustainability performance under the CSRD.

As a reporting framework, the ESRS guides the “how” and “what“. |

From “Why” to “How”

Why: There are good reasons for the CSRD – for example, overcoming the shortcomings of its predecessor, the Non-Financial Reporting Directive (NFRD).

Who: The CSRD will apply to around 50.000 companies from the European Union and about 10.000 non-EU companies.

When: The CSRD is being phased in. So only some companies that fall under the CSRD will have to report immediately.

How: This is where the ESRS as a reporting framework comes into play. The ESRS guides how companies report under the CSRD and the disclosure format.

What: The ESRS will also define the scope of information that has to be disclosed – in general and specific to E, S, and G. There will be even sector specific standards at a later stage.

In conclusion, the CSRD and the ESRS are two sides of the same coin. While one represents the regulatory initiative, the other provides a framework for the sustainability reporting of corporations. Therefore, we have compiled a selection of blog posts and links in the following section and invite you to learn more about the CSRD and the ESRS.

Sources and further reading

[1] European Commission – A European Green Deal

[2] NordESG – What is the EU Taxonomy?

[3] What is the Sustainable Finance Disclosure Regulation?

[4] What is the Corporate Sustainability Reporting Directive?

[5] The The European Sustainability Reporting Standard

[6] The CSRD and non-EU companies – The Brussels Effect

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.