The Corporate Sustainability Due Diligence Directive – what is the CSDDD, who will be affected, what is the current stage, and what will happen next?

Companies are at the forefront of the transition into a sustainable economy. This transformation is also a key political priority for the European Union. Moreover, amid the climate crisis, sustainability is often directly linked to environmental issues. However, sustainability extends well beyond climate and environment to society and human well-being. With the Corporate Sustainability Due Diligence Directive (CSDDD), the European Commission has proposed a framework that supports the transition into a sustainable economy and society by considering environmental topics alongside human rights.

With this blog post, we provide an overview of the CSDDD, the reasoning behind it, the benefits that come with it, the current state and how companies can prepare.

What is the Corporate Sustainability Due Diligence Directive?

The transformation into a sustainable economy is an essential priority for the European Union. Examples are the European Green Deal [1] and related regulations like the Corporate Sustainability Reporting Directive [2], the Sustainable Finance Disclosure Regulation [3] or the EU Taxonomy [4]. Companies play an important role in the transition into a sustainable future, where the term “sustainable” not only applies to environmental but also to societal and economic topics. A harmonised EU legal framework on corporate sustainability due diligence for human rights and environmental impacts is expected to advance this transition.

If the Corporate Sustainability Due Diligence Directive gets adopted, it would require companies to identify, prevent, end, or mitigate not only actual but also potential impacts on the environment and human rights. Moreover, conducting due diligence would not be limited to their operations but would extend to the activities of their subsidiaries, including the value chain.

As mentioned in another blog post [5], the foundations of the Corporate Sustainability Due Diligence Directive can be traced back to the UN’s Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises.

What companies will be affected by the Corporate Sustainability Due Diligence Directive?

The proposal would apply to EU companies and non-EU companies that meet the following criteria [6]:

Large EU limited liability companies:

- Group 1: Companies with >500 employees and >€150 million turnover worldwide.

- Group 2: Companies with >250 employees and >€40 million turnover worldwide operating in high-impact sectors*.

Non-EU companies / third-country companies:

- Companies active in the EU with turnover threshold aligned with Group 1 and 2, generated in the EU

SMEs:

- Micro companies and SMEs would not be concerned by the proposed rules. However, they could be affected indirectly in their capacity as contractors to any of the companies mentioned above. The proposal provides supporting measures for SMEs.

*Examples for high-impact sectors: e.g. textiles, agriculture, extraction of minerals. See also [8] “The definition of high-impact sectors has been limited to sectors with a high risk of adverse impacts and for which OECD guidance exists.“

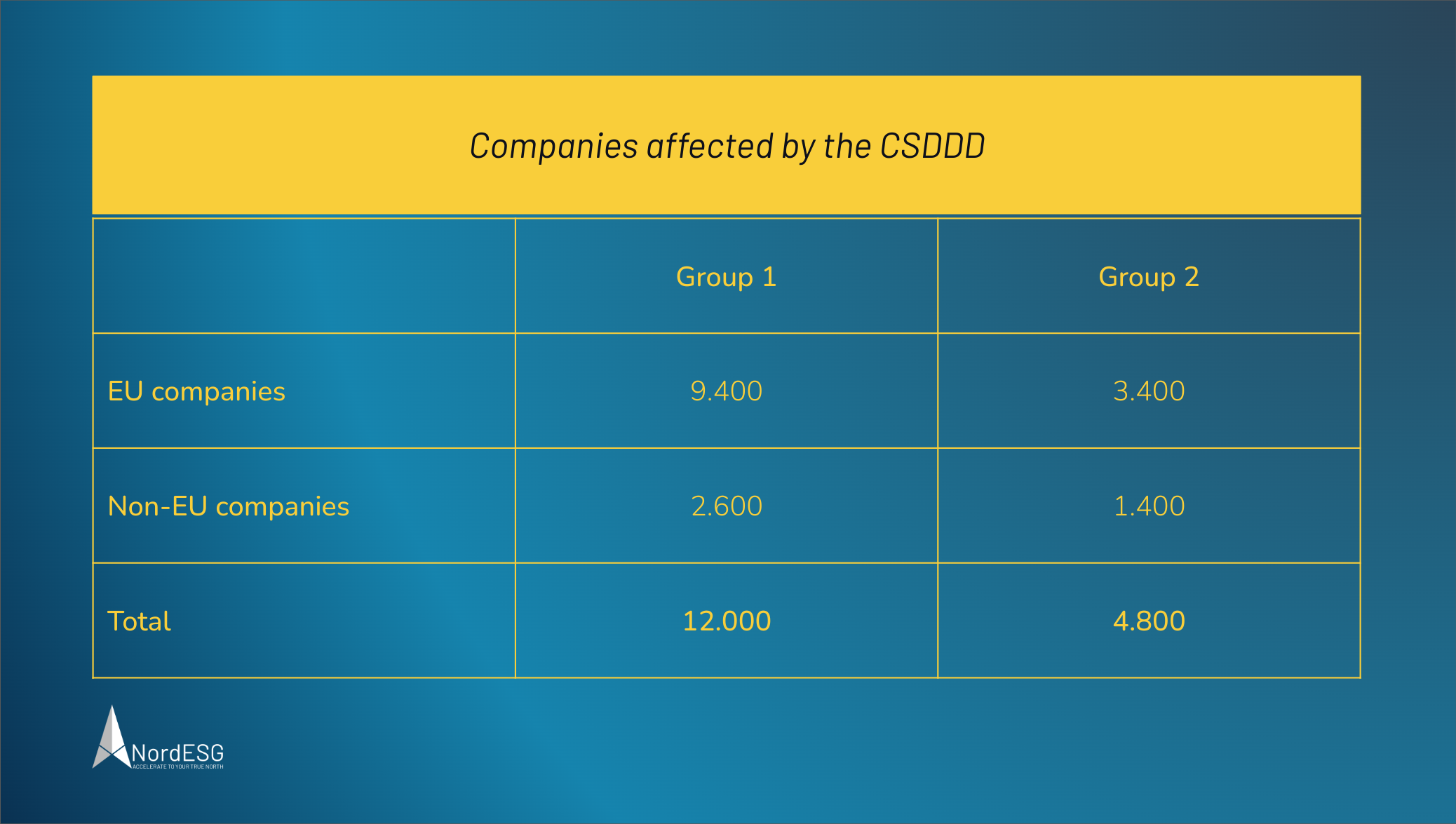

How many companies will be affected by the Corporate Sustainability Due Diligence Directive?

The European Commission provided the following numbers of companies that would fall under the CSDDD.

The obligations of companies and their directors that are within the scope of the directive and how the CSDDD will be enforced

The Corporate Sustainability Due Diligence Directive will establish a corporate due diligence duty to “identify, prevent, bring to an end, mitigate and account for adverse human rights and environmental impacts in the company’s own operations, its subsidiaries and their value chains.” [7].

What will companies within the scope of the Corporate Sustainability Due Diligence Directive be required to do?

Companies that are within the scope of the proposed directive will be required to:

- Integrate due diligence into their policies, and identify actual or potential adverse human rights and environmental impacts.

- Prevent or mitigate potential and bring to an end or minimise actual impacts.

- Establish and maintain a complaints procedure.

- Monitor the effectiveness of the due diligence policy and associated measures and publicly communicate on due diligence.

The proposed directive will require certain large companies to ensure their business strategy is aligned with the Paris Agreement climate goals of limiting global warming to 1.5°C, and directors are incentivised to contribute to climate and sustainability goals [6, 7].

What are directors obliged to do?

The proposed directive will also introduce new duties for directors of European companies within the scope of the Corporate Sustainability Due Diligence Directive:

- Directors are involved in setting up and overseeing the implementation of due diligence processes and integrating due diligence into the corporate strategy.

- When fulfilling their duty to act in the company’s best interest, they will have to consider human rights, climate change and the environmental (long-term) consequences of their decisions too.

In addition: “Companies have to duly take into account the fulfilment of the obligations regarding the corporate climate change plan when setting any variable remuneration linked to the contribution of a director to the company’s business strategy and long-term interests and sustainability.” [7]

Got questions about sustainability?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you.

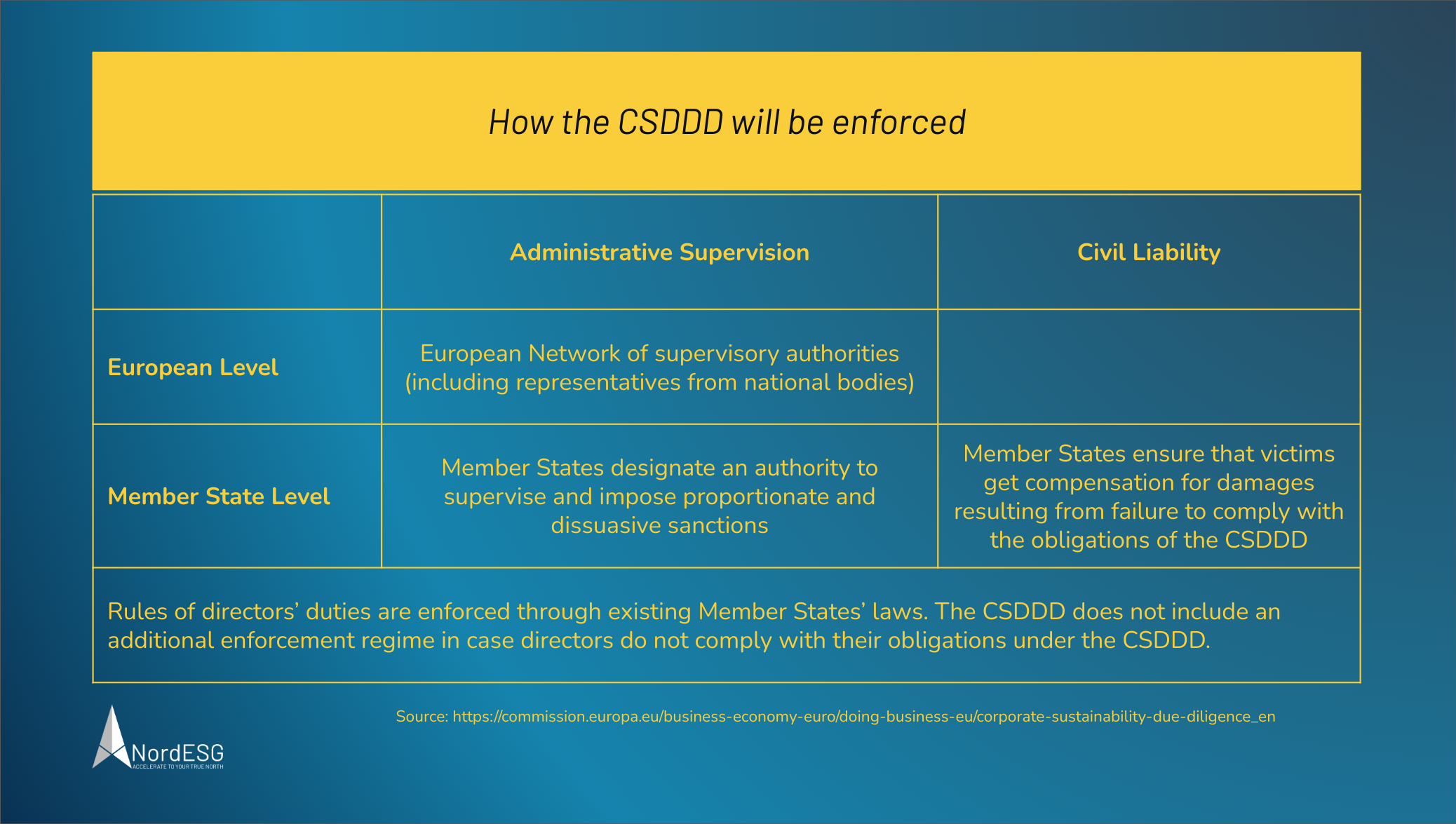

How will the CSDDD be enforced?

According to the overview article [6], the Corporate Sustainability Due Diligence Directive will be enforced through administrative supervision and civil liability. For the former, the Commission will set up a European network of supervisory authorities that will include representatives of national bodies. By doing so, a coordinated approach is ensured, and at the same time, this approach will enable sharing of insights, knowledge and experience. To complement this, Member States will designate an authority to supervise and “impose effective, proportionate and dissuasive sanctions, including fines and compliance orders.” [6].

For civil liability, Member States will ensure that “victims get compensation for damages resulting from the failure to comply with the obligations of the new proposals.” [6] and “It is particularly important to enable victims to obtain compensation for damage. Therefore, the proposal will also give those affected by harm the opportunity to hold companies to account. This means that victims will have the possibility to bring a civil liability claim before the competent national courts. Such civil liability concerns companies’ own operations and its subsidiaries and established business relationships with which a company cooperates on a regular and frequent basis, where the harm could have been identified, and prevented or mitigated, with appropriate due diligence measures.” [7].

Since the rules of directors’ duties are enforced through existing Member States’ laws, the Corporate Sustainability Due Diligence Directive does not include an additional enforcement regime for cases where directors do not comply with their obligations under the CSDDD.

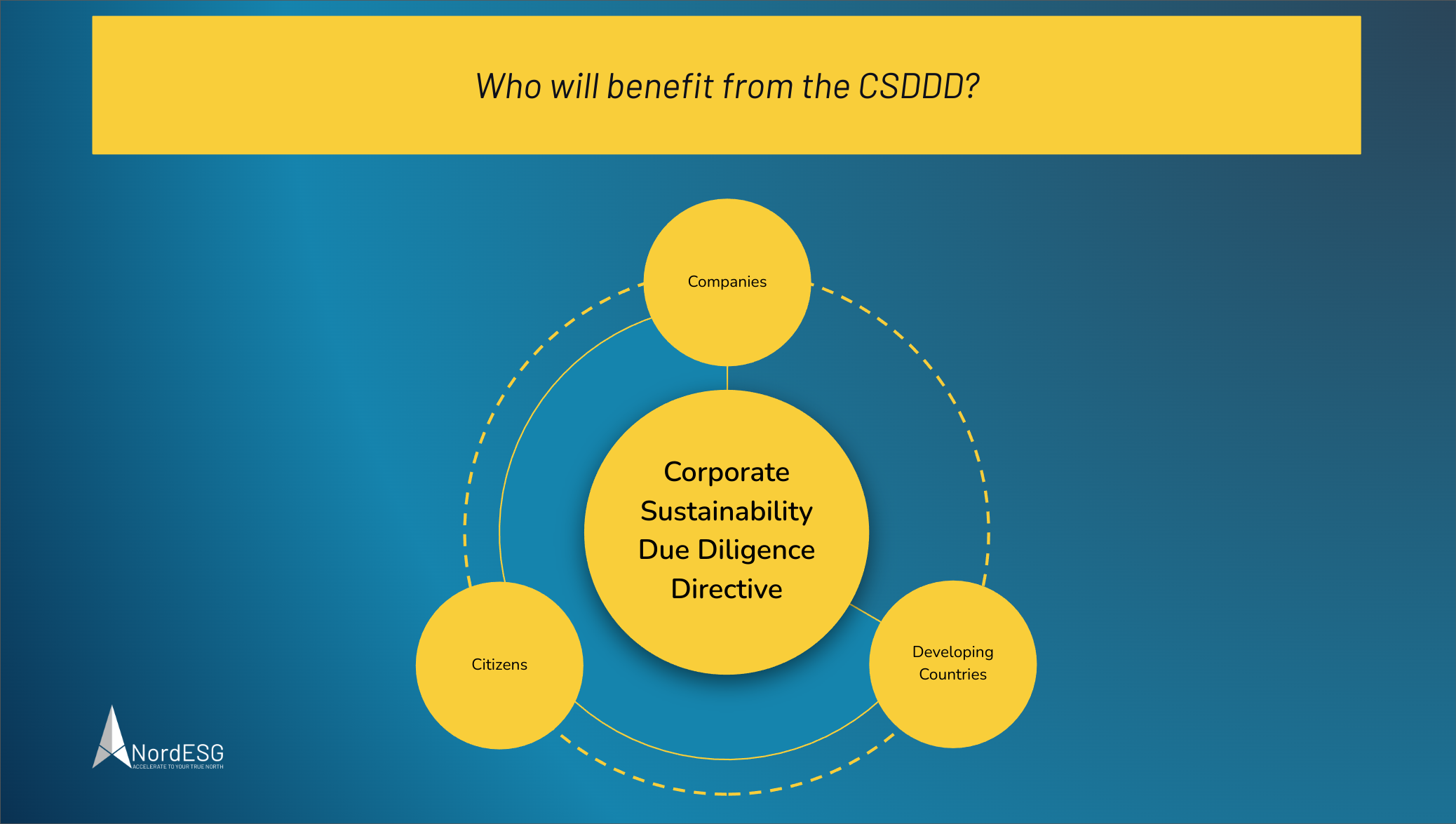

How will companies, citizens and developing countries benefit from the CSDDD?

The European Commission has identified companies, citizens and developing countries [6, 7] to benefit from the Corporate Sustainability Due Diligence Directive.

How companies will benefitThe CSDDD would imply a level playing field with common and transparent corporate sustainability due diligence rules. The following aspects have been mentioned as benefits for corporations operating in the EU market:

|

How citizens will benefitCitizens will benefit from more transparency that enables well-informed decision-making – including better awareness of the impact of products and services:

The above-mentioned article states, “Citizens could also feel more motivated to protect the environment, knowing that they are not alone in their efforts and companies are doing their share as well.“ |

The impact on developing countriesSince the scope of the Corporate Sustainability Due Diligence Directive extends to the value chain, it will also positively impact human rights and environmental protection. Moreover, it will foster the adoption of international standards in developing countries. Therefore, the following benefits are expected for developing countries:

Furthermore, the article mentioned above states, “The Commission looks forward to working further with EU trading partners to ensure mutually reinforcing initiatives, including the development of voluntary sustainability standards, support of multi-stakeholder alliances and industry coalitions, as well as accompanying support provided through EU development policy and other international cooperation instruments.“ |

What is the current state, and what will happen next with the Corporate Sustainability Due Diligence Directive?

The European Commission proposed the CSDDD in February 2022 [8], and in December of the same year, the European Council finalised its position on the proposed directive [9]. The European Parliament is expected to vote on the Corporate Sustainability Due Diligence Directive later in 2023. Based on that schedule, Member States could adopt the CSDDD in 2025. The phase-in period would start in 2026.

However, changes to the directive’s scope will likely be during the legislative negotiations, as indicated by the European Council position paper [9] that contains remarks on coverage, definitions, civil liability, directors’ duties and other topics. In any case, companies that fall within the scope of the CSDDD should closely monitor future developments.

Sources and further reading

[1] European Commission – A European Green Deal – Striving to be the first climate-neutral continent:

[2] CSRD – NordESG – CSRD Update November 2022

[3] SFDR – NordESG – EU Sustainable Finance Disclosure Regulation

[4] EU Taxonomy – NordESG – What is the EU Taxonomy Regulation

[5] Sustainability Due Diligence and Double Materiality – NordESG

[6] European Commission – Corporate Sustainability Due Diligence – Fostering sustainability in corporate governance and management systems:

[7] European Commission – Questions and Answers: Proposal for a Directive on corporate sustainability due diligence:

[8] European Commission – Proposal for a Directive of the European Parliament and of the council on Corporate Sustainability Due Diligence and amending Directive (EU) 2019/1937:

[9] Council of the European Commission – Proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on Corporate Sustainability Due Diligence and amending Directive (EU) 2019/1937, 30. November 2022:

Additional reading

European Commission – Factsheet – Just and sustainable economy: Companies to respect human rights and environment in global value chains:

European Commission – Press release – Just and sustainable economy: Commission lays down rules for companies to respect human rights and environment in global value chains:

European Commission – Proposal for a Directive on corporate sustainability due diligence and annex:

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.