Sustainability due diligence, double materiality, ESRS and the CSRD – an overview

With the Corporate Sustainability Reporting Directive (CSRD) comes the European Sustainability Reporting Standard (ESRS) [1]. Both will soon become a reality for those corporations that must report their sustainability performance under these frameworks. In this blog post, we take a first look at how sustainability due diligence informs a company’s materiality assessment. Then we provide an overview of how the results of the double materiality assessment determine the disclosure requirements.

[1] The ESRS is still a draft, and it would be correct to write [draft] ESRS instead of ESRS. Keeping readability in mind, we decided to use the term ESRS in this blog post.

Update: A revised version of the European Sustainability Reporting Standards or ESRS has been released in June 2023. We have compiled this blogpost to share all the information and updates with you.

Read more about the Corporate Sustainability Due Diligence Directive in this blogpost.

Sustainability due diligence and the ESRS

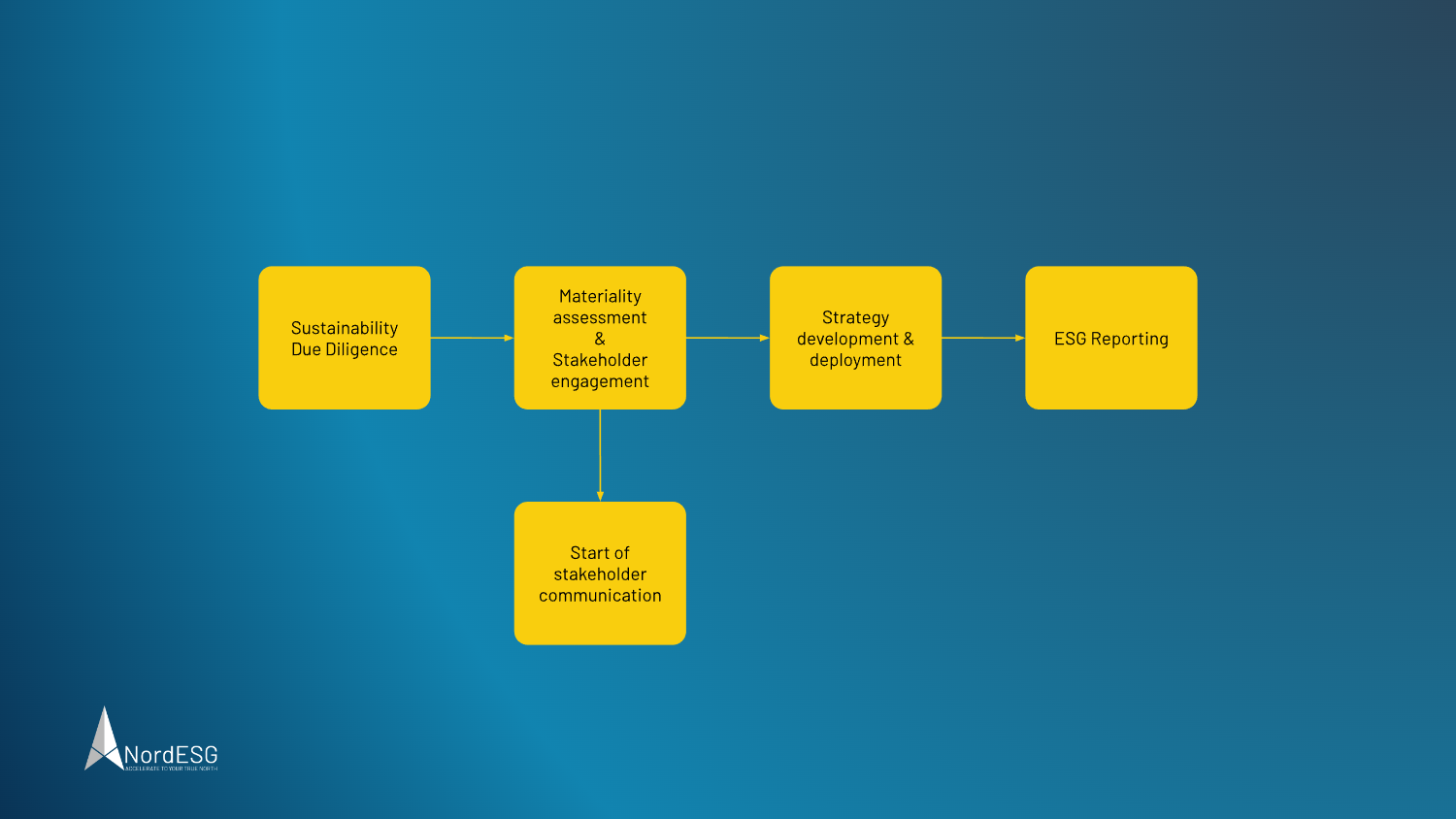

The following figure shows a simplified ESG strategy process with sustainability due diligence as the starting point. Companies will likely revisit their materiality assessments and stakeholder communication based on the requirements of the ESRS.

It can be an opportunity to (further) develop a company’s sustainability strategy and adjust data structures to the disclosure requirements of the ESRS too.

The outcome of the sustainability due diligence process informs the assessment of material impacts, risks and opportunities

ESRS 1 4.0-62 states, “The outcome of the undertaking’s sustainability due diligence process […] informs the undertaking’s assessment of its material impacts, risks and opportunities.“

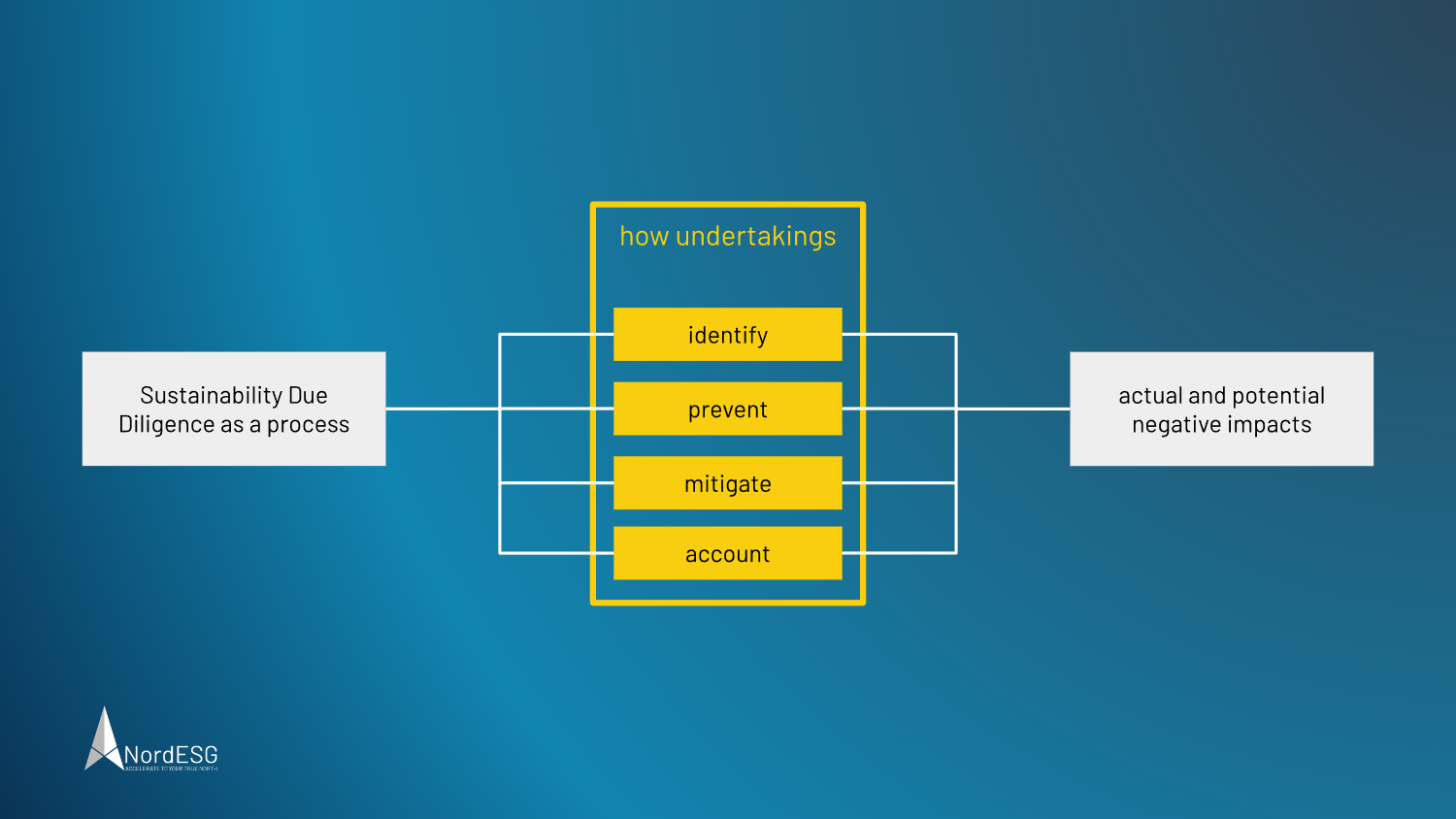

Sustainability due diligence is a process that helps undertakings

- identify

- prevent

- mitigate

- account

actual and potential negative impacts on the environment and their business stakeholders. The term “negative impacts” is clarified in ESRS 1 4.0-63 as “negative impacts caused or contributed by the undertaking and negative impacts which are directly linked to the undertaking’s own operations, its products or services through its business relationships.“.

Sustainability due diligence

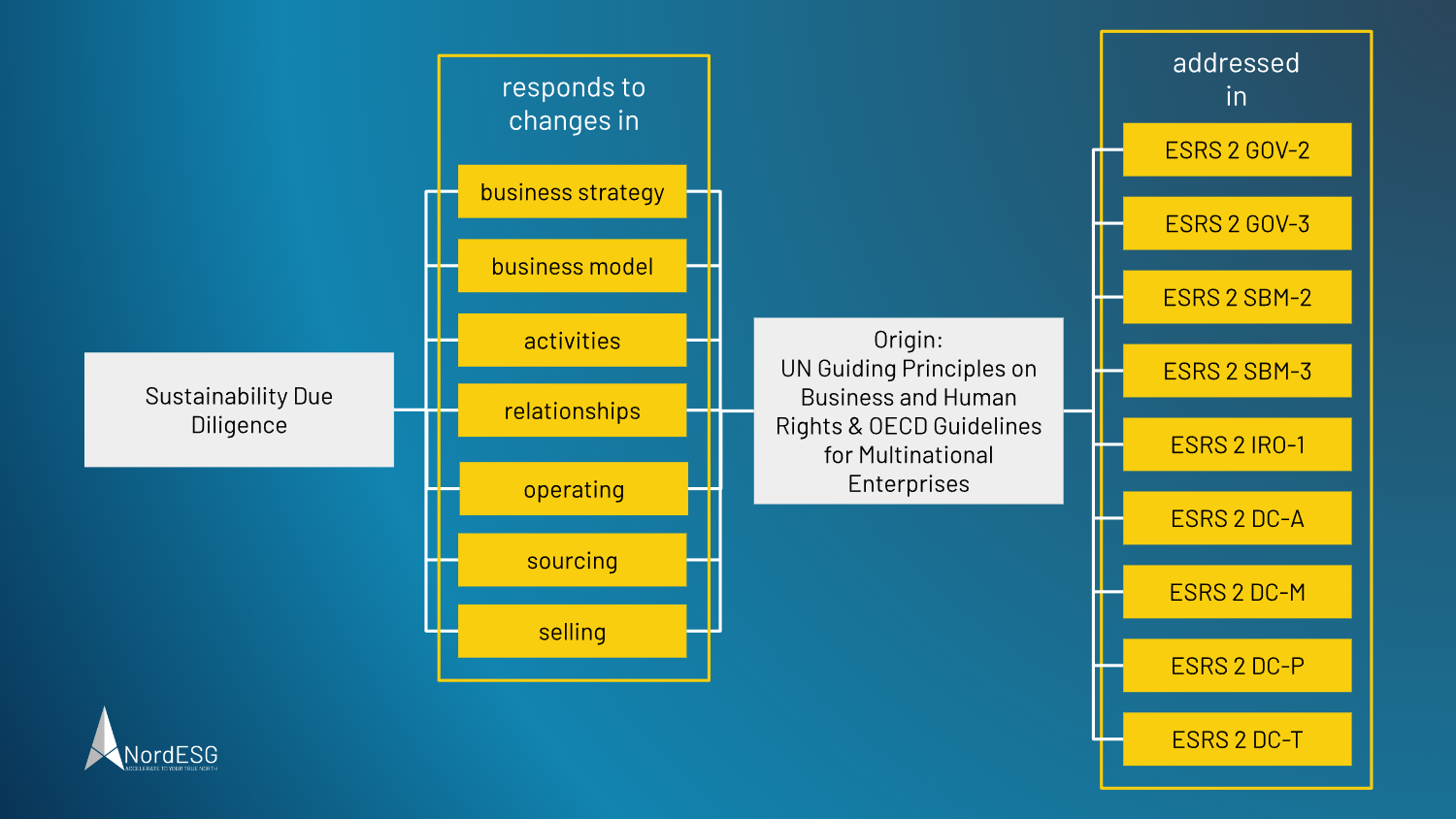

Sustainability due diligence follows a holistic approach and responds to changes in business strategy, business model, activities, relationships, operating, sourcing and selling of products.

Sustainability due diligence is defined in the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises. Both describe several steps for a sustainability due diligence process. Most companies will only be able to simultaneously address some impacts they have identified. Therefore it is possible to prioritise actions based on their severity and the likelihood of the impacts identified.

That links the results of the sustainability due diligence to the assessment of material impacts (the company’s double materiality assessment), where sustainability risks and opportunities, which are often a byproduct of those impacts, are identified. It is essential in this context to note that “ESRS do not impose any conduct requirements in relation to sustainability due diligence; nor do they extend or modify the role of governance bodies.” (ESRS 1 4.0-62).

ESRS and the concept of double materiality

Before discussing the concept of double materiality, we have to take a short detour to establish basic terms and take a closer look at the application requirements mentioned in ESRS 1.

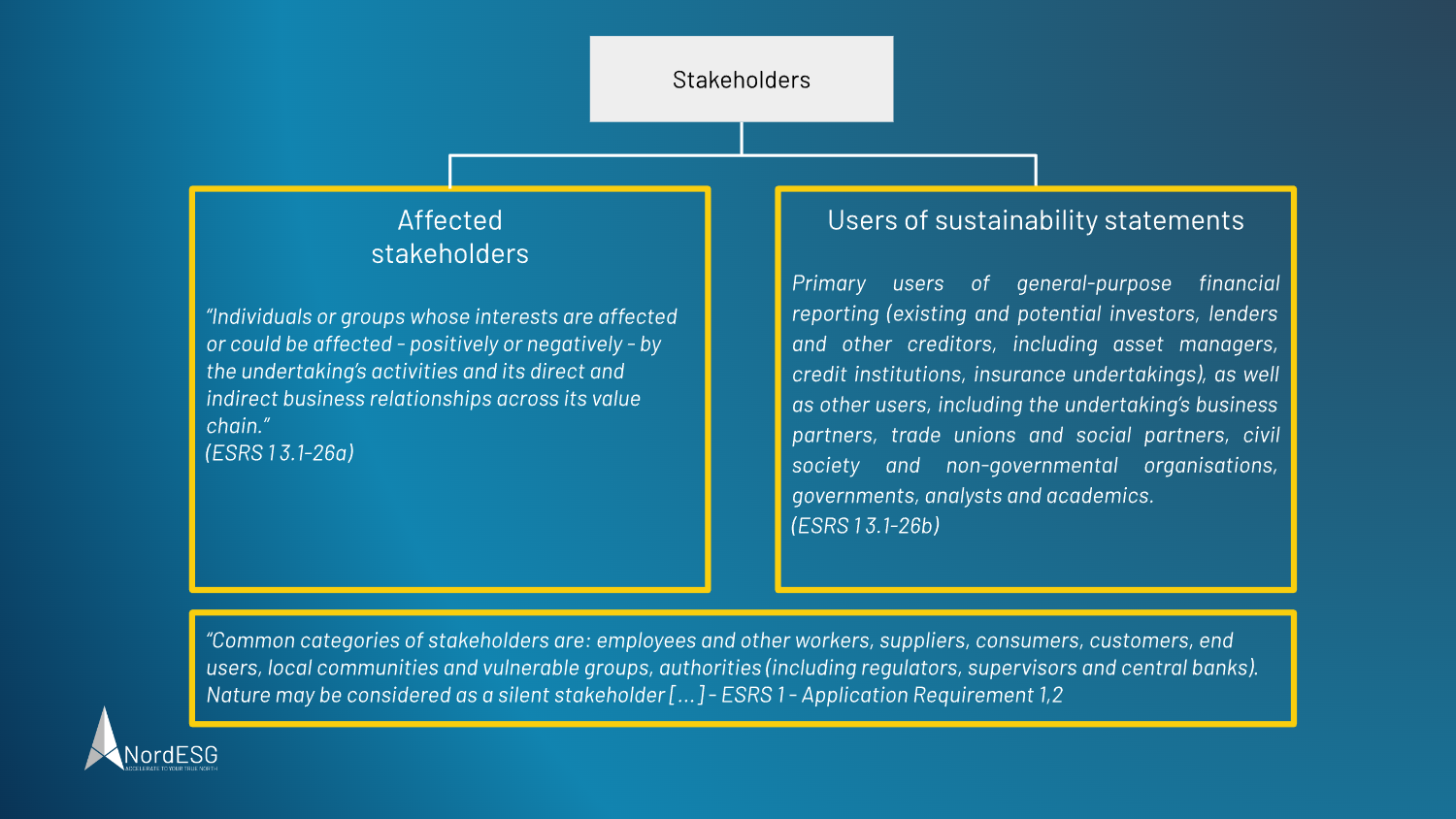

Stakeholders

The ESRS defines two main stakeholder groups: “Affected stakeholders” and “Users of sustainability statements”. Affected stakeholders are, by definition of the ESRS, those individuals or groups that are or may be affected in a positive or negative way by the activities of an undertaking.

It is important to note that this includes activities across a company’s value chain too. The latter group, “Users of sustainability statements”, includes investors, lenders, trade unions, and NGOs, among others (see figure above for details). Moreover, some stakeholders or stakeholder groups may be represented in both categories.

Why stakeholder dialogue matters

Engaging with stakeholders is more than just informing them about the results of a materiality assessment. It is rather about establishing an ongoing dialogue. That enables companies to get insights into the views and priorities of their stakeholders – considering stakeholders to be experts in their particular domain. But, more than that, it is about getting valuable feedback and learning how stakeholders perceive risks and opportunities identified in the materiality assessment.

ESRS 2 states: “The views and interests of stakeholders that are expressed as part of the undertaking’s engagement with stakeholders through its sustainability due diligence process(es) may be relevant to one or more aspects of its strategy or business model. As such, they may affect the undertaking’s decisions regarding the future direction of the strategy or business model(s).” – ESRS 2 Disclosure Requirement SBM-2 – Interests and views of stakeholders.

Clarifications on the concept of double materiality under ESRS

Materiality is not an end in itself, and conducting a double materiality assessment can become a complex task for companies. In any case, it should not be misunderstood as just a mandatory training exercise. Instead, it is a tool that helps companies to identify those sustainability matters that are material to them and gain a better understanding of the risks and opportunities associated.

The ESRS takes this one step further by stating that a materiality assessment is necessary for the company to identify those material impacts, risks and opportunities it has to report on. Sustainability matters that qualify as material for the reporting company may either stem from impact materiality, financial materiality or both. That is where the two perspectives of double materiality originate since it covers both views simultaneously and considers the existing interdependencies between them.

Impact and financial materiality

The ESRS defines impact materiality and financial materiality, as shown in the table below.

|

Impact perspective and financial perspective |

|

| “A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- and long-term time horizons. Impacts include those caused or contributed to by the undertaking and those which are directly linked to the undertaking’s own operations, products, or services through its business relationships. Business relationships include the undertaking’s upstream and downstream value chain and are not limited to direct contractual relationships.” – ESRS 1 3.4-46 | “A sustainability matter is material from a financial perspective if it triggers or may trigger material financial effects on the undertaking. This is the case when it generates or may generate risks or opportunities that have a material influence (or are likely to have a material influence) on the undertaking’s cash flows, development, performance, position, cost of capital or access to finance in the short-, medium- and long-term time horizons. Risks and opportunities may derive from past events or future events and may have effects in relation to: (a) assets and liabilities already recognised in financial reporting or that may be recognised as a result of future events; or (b) factors of value creation that do not meet the financial accounting definition of assets and liabilities and/or the related recognition criteria but contribute to the generation of cash flows and more generally to the development of the undertaking.” ESRS 1 – 3.5-52,53 |

Got questions about the ESRS?

Book a free and nonbinding discovery call to discuss your questions with one of our carbon accounting experts, and learn how we can help you with Scope 3 Emissions.

Assessing the impact and determining material matters to be reported and their severity

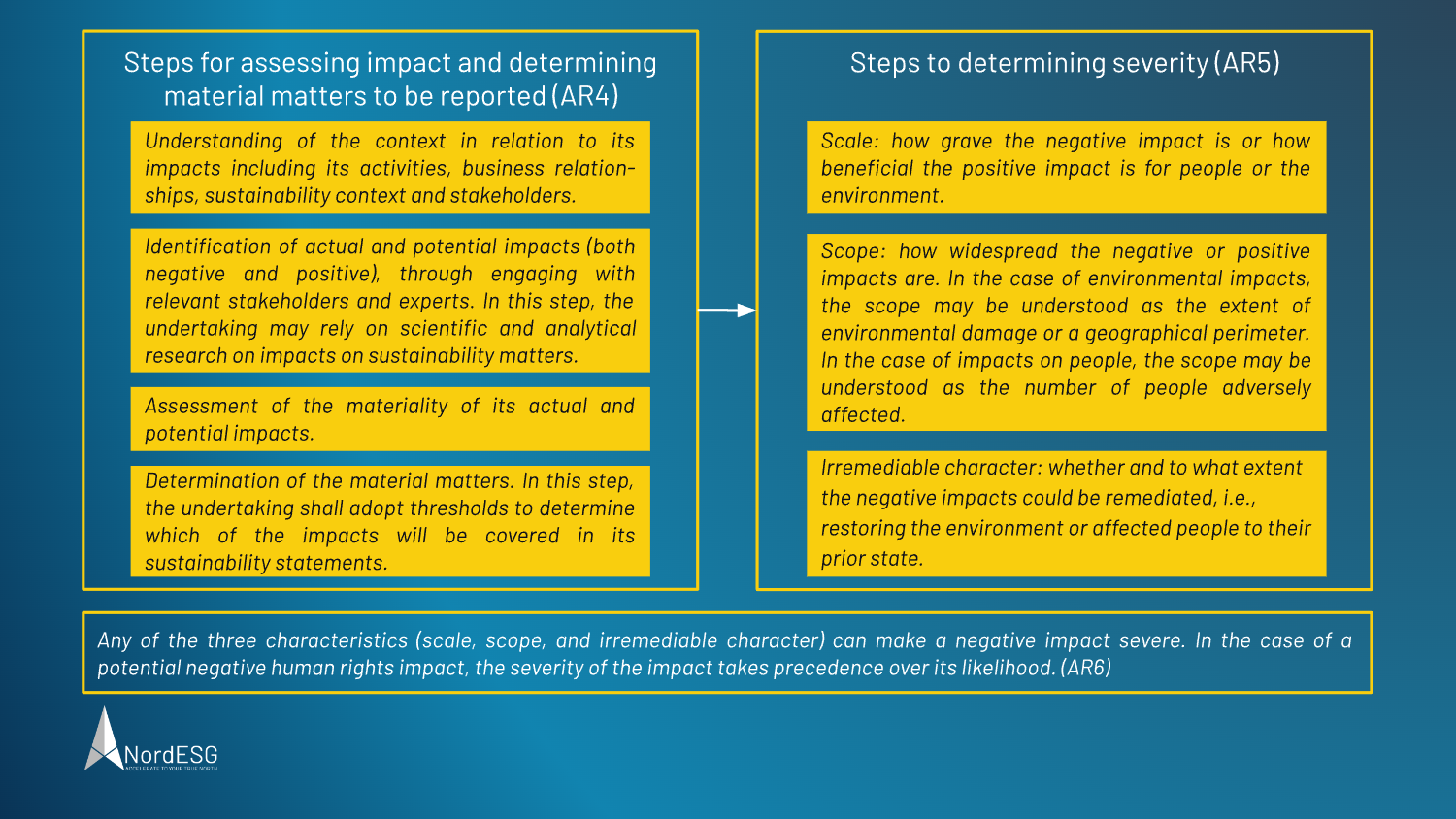

The application requirements (AR) 4 to 6 detail the steps for assessing the impact and how a reporting company determines material matters to be reported. They also provide information on determining the severity, while AR6 clarifies the role of human rights impact. See the chart below for details.

The results of the double materiality assessment determine disclosure requirements.

Suppose a company concludes that a sustainability matter has reached the threshold and thus has to be considered material. In that case, it has to report on it according to the disclosure requirements related to the specific sustainability matter. The classification of what is material is not arbitrary. The application requirements state that the reporting company has to explain how it applies the criteria for impact and financial materiality and how it uses appropriate thresholds to decide what is material to them and what to report on.

ESRS 1 states: “When the undertaking concludes that a sustainability matter is material as a result of its materiality assessment, it shall:

(a) report according to the Disclosure Requirements (including Application Requirements) related to that specific sustainability matter in the relevant ESRS, and (b) develop and report additional appropriate entity-specific disclosures (see section 1.4 Entity-specific disclosures of this Standard) when the material sustainability matter is not covered by an ESRS or is covered with insufficient granularity.“

So if it is not material, there is no need to report it, right?

Yes, but there are some disclosure requirements that companies have to report on, whether they are considered to be material or not. These include:

- ESRS 2, i.e., all its disclosure requirements (including their data points).

- The data points prescribed in topical ESRS that are listed in ESRS 2 Appendix C List of data points in cross-cutting and topical standards that are required by EU law which stem from other EU legislation.

- ESRS E1, i.e., all its disclosure requirements (including their data points).

- For undertakings with 250 or more employees, the disclosure requirements ESRS S1-1 to S1-9 (including their data points) in ESRS S1 “Own Workforce”.

What are the key takeaways?

Our key takeaways from this closer look at the ESRS’s take on sustainability due diligence and double materiality indicate:

- Companies should be aware of the complexity of the ESRS, how elaborated this reporting framework is and how the ESRS interacts with other concepts.

- As a result, some companies will need to implement new processes first to be able to report fully under ESRS.

- Reporting companies should also be aware that conducting a double materiality assessment that meets the requirements of ESRS requires time and resources to prepare and evaluate the results.

- Engaging with stakeholders and actively involving them in the materiality assessment process is crucial to gain the desired insights.

- The ESRS Application Requirements are a must-read for companies reporting under ESRS/CSRD.

This blog post covered the “tip of the iceberg” of just one core concept of the ESRS. Companies that fall under the regulations of the CSRD are therefore well advised to thoroughly examine the requirements that come with the CSRD and the ESRS as early as possible. To learn more on how we can help you navigate your sustainability landscape, book a free discovery call with our ESG experts below or send us an e-mail.

Sources and Links

[1] ESRS – Frist set of draft ESRS – https://www.efrag.org/lab6

Our blogpost about the Corporate Sustainability Due Diligence Directive can be found here.

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.