EU Paris-aligned Benchmarks (PABs) and Climate Transition Benchmarks (CTBs)

In response to the global challenge of climate change and mobilising capital for the transition to a low-carbon economy, the European Union (EU) legislated two climate benchmarks for indexes for financial assets – Paris-aligned Benchmark (PAB) and Climate Transition Benchmarks (CTB).

Climate benchmarks

A climate benchmark is a type of investment benchmark that integrates specific objectives aimed at reducing greenhouse gas (GHG) emissions and supporting the transition to a low-carbon economy. These objectives are based on scientific evidence from the IPCC and are achieved by selecting and weighing underlying constituents. Climate benchmarks are designed to function as labels that can be used to identify indices that improve the ESG transparency of benchmark methodologies and establish standards for the methodology of low-carbon benchmarks.

While both the EU benchmarks – PAB and CTB – share a focus on decarbonisation, they have different thresholds. The former benchmark(PAB) aligns with the Paris Agreement’s objective of keeping the global average temperature increase to below 2°C above pre-industrial levels.

The legislation was completed in July 2020. Read more here [1] and here [2].

Companies reporting under CSRD can align their climate and decarbonisation strategies to align with these benchmarks and benefit from higher capital inflows from investors who aim to invest in assets that have clear climate and decarbonisation roadmaps in place.

What is the Paris-aligned Benchmark (PAB)?

Paris-aligned Benchmarks (PABs) are a set of criteria that evaluate the alignment of investment portfolios with the objectives of the Paris Agreement on climate change. The Paris Agreement aims to limit global warming to well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5 degrees Celsius.

What is the Climate Transition Benchmark (CTB)?

Climate Transition Benchmarks (CTBs) are a new type of benchmark that evaluates the contribution of investment portfolios to the transition to a low-carbon economy. CTBs are designed to measure the alignment of investment portfolios with the objectives of the EU’s Climate Law, which aims to make the EU climate-neutral by 2050. CTBs are a broader concept than PABs and focus on transitioning to a low-carbon economy rather than just limiting global warming.

What are the differences between PAB and CTB?

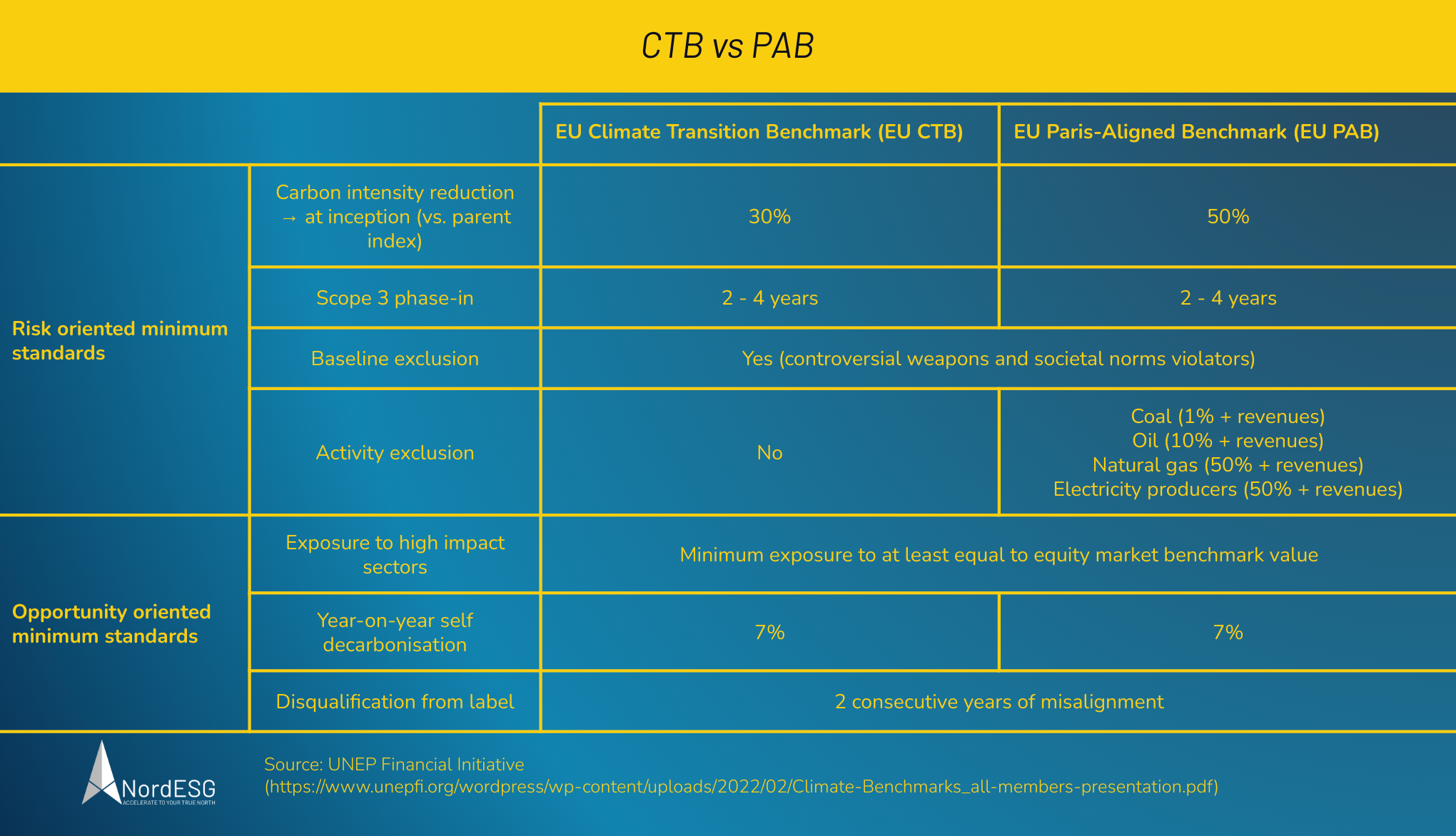

The main difference between PABs and CTBs is their focus. PABs evaluate the alignment of investment portfolios with the objectives of the Paris Agreement, while CTBs assess their contribution to the transition to a low-carbon economy. The table below compares the two benchmarks on key parameters.

Source : UNEP Financial Initiative[3]

In comparison to EU Climate Transition Benchmarks (CTBs), EU Paris-aligned Benchmarks (PABs) permit greater decarbonisation of investments relative to the underlying investable universe (50% versus 30%). Moreover, they impose further exclusions on activities related to fossil fuels and electricity producers that have high greenhouse gas (GHG) emissions.

Got questions about ESG or carbon emissions?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you.

Conclusion

The EU Paris-aligned Benchmarks (PABs) and Climate Transition Benchmarks (CTBs) are progressive regulations designed to direct capital toward assets that facilitate the achievement of the EU’s climate and decarbonisation objectives. By preventing improper labeling of funds and greenwashing, these benchmarks promote greater transparency and accountability in the financial industry, thus enhancing the sustainability of investments. As the world continues to grapple with the climate crisis, these benchmarks represent a crucial step forward in creating a more sustainable future.

Sources and further information

[1] REGULATION (EU) 2019/2089 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 27 November 2019 amending Regulation (EU) 2016/1011 as regards EU Climate Transition Benchmarks, EU Paris-aligned Benchmarks and sustainability-related disclosures for benchmarks

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:32019R2089

[2] COMMISSION DELEGATED REGULATION (EU) 2020/1818 of 17 July 2020 supplementing Regulation (EU) 2016/1011 of the European Parliament and of the Council as regards minimum standards for EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32020R1818&rid=1

[3] UNEP Financial Initiative https://www.unepfi.org/wordpress/wp-content/uploads/2022/02/Climate-Benchmarks_all-members-presentation.pdf

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.