The amended European Union Markets in Financial Instruments Directive II (MiFID II) and Insurance Distribution Directive (IDD) come into effect on 2 August 2022. The changes will affect how investment advisers and insurance firms in EU integrate the sustainability preferences of their clients and policyholders, respectively. The amended MiFID II and IDD are critical components of the EU Sustainable Finance plan, but unlike the other regulations like EU Taxonomy, the Sustainable Finance Disclosure Regulation (SFDR), or the Corporate Sustainability Reporting Directive (CSRD), the MiFID II and IDD are not part of the EU Sustainable Finance Agenda in a significant way. This article takes a closer look at what these rules are and how they fit into the overall picture of sustainability related disclosures in the EU.

Background

MiFID II is a legislative framework aimed at strengthening investor protection in the European Union(more here), and the IDD plays a similar role for customers of insurance products(read here). To ensure that investors’ preferences on sustainability and greenwashing concerns are taken into account, the MiFID II and IDD were amended in April 2021(read here and here), and these amendments become effective on 2 August 2022.

MiFID II and IDD, and their interaction with the other elements of the Sustainable Finance Framework.

The essence of the EU Sustainable Finance Framework is to channel private investments toward sustainable projects, and the Framework includes the EU Taxonomy Regulation (read here), Sustainable Finance Disclosure Regulation (SFDR)(read here) and Corporate Sustainability Reporting Directive (CSRD)(read here). These Regulations cover all the key players in the entire value chain of investments like corporates who seek capital, investors who provide money to these firms, and everyone in between. The three regulations – EU Taxonomy, SFDR and CSRD – were created from scratch as part of the European Green Deal, but MiFID II and IDD were already in existence and amended to fit into the Sustainable Finance Framework.

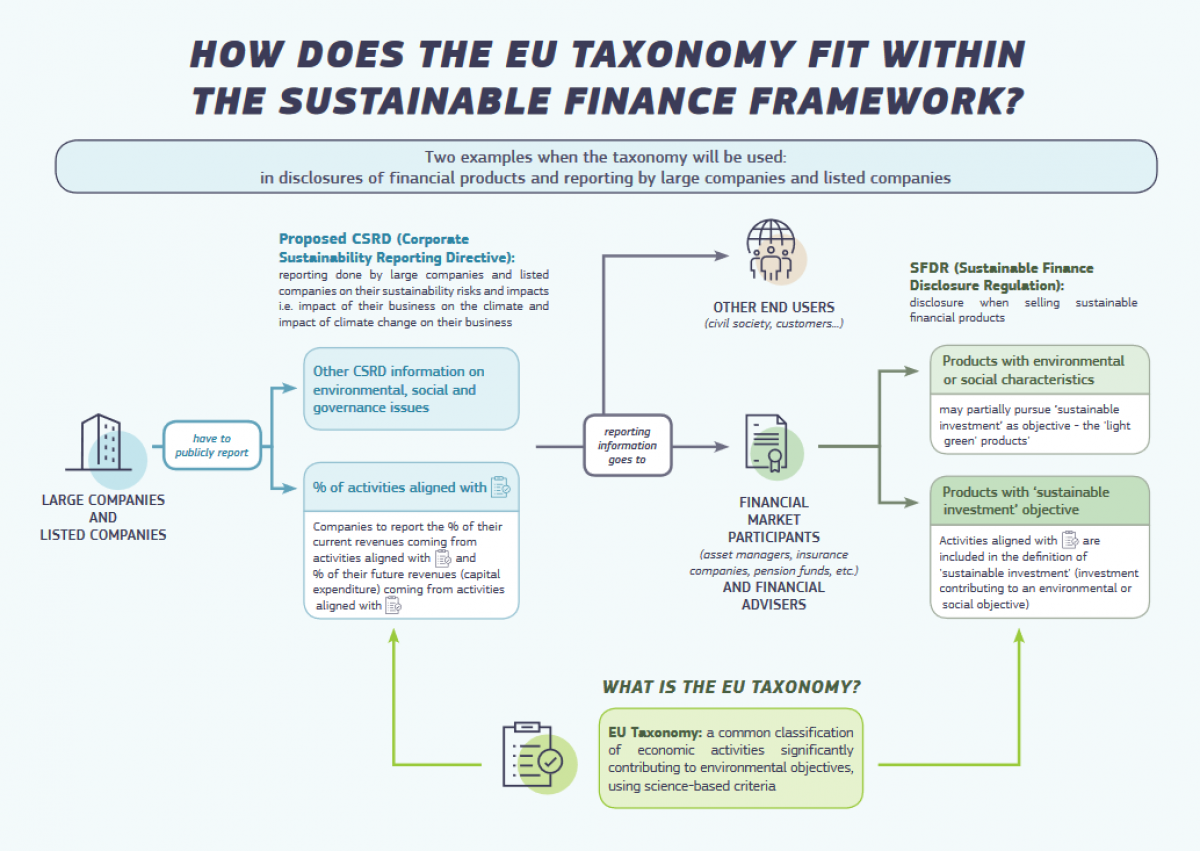

The key to the efficient allocation of capital to sustainable projects is information. The EU Taxonomy defines what activities are environmentally sustainable, while the CSRD mandates reporting of the sustainability performance of corporates. SFDR provides the guidelines for market participants on labelling their financial products based on the EU Taxonomy. The MiFID II and IDD provide guidelines for financial advisers to integrate this information and act according to the sustainability preferences of their clients. Essentially, the data originates from the corporates and transmits through the market participants and advisers to the end investor. The image from European Commission below shows how all these regulations fit together.

Image Source: European Commission

A simplified version of the information and capital flow across the entire value chain and the applicable regulations are given below. The regulations including MiFID II are mapped to the respective players in the value chain. It can be seen that the EU Taxonomy is the common element across the value chain.

Critical components of EU MiFID II and IDD

The EU MiFID II and IDD require advisers to address two components of investing – clients and products. On the former, advisers are required to seek their clients’ preferences on sustainability, based on which they can recommend “suitable” sustainable financial products and insurance-based investment products. On the latter(products), the sustainable products should be in line with the Taxonomy Regulations and SFDR.

The clients can determine their sustainability preferences by choosing one or more criteria below.

- Product with a minimum percentage in sustainable investments aligned to the EU Taxonomy (only environmentally sustainable investments currently).

- Product with a minimum percentage in sustainable investments aligned to the SFDR’s Articles 8 and 9(includes environmental and social assets). Read more on Articles 8 and 9 here.

- Product that considers principal adverse impacts (PAIs). Read more about PAIs here.

The adviser can sell a product to the client only after ensuring that the product matches the sustainability preferences of the client.

Conclusion

With the amended EU MiFID II and IDD implementation, the European Union takes more steps toward operationalizing the European Green Deal. However, the rollout will face challenges because the MiFID II and IDD are linked to the other regulations like Taxonomy, CSRD and SFDR. The information flow will be seamless only when these regulations are fully implemented. The implementation of CSRD has been postponed by at least a year, limiting the data availability of potential investee firms. Lack of clarity on particular taxonomy and SFDR issues also pose a challenge while implementing the MiFID II and IDD regulations. Nonetheless, growth pangs are part of any new initiative, and these regulations are no exception.