European Sustainability Reporting Standard (ESRS) – First insights from the feedback process July 2023

From June 9 to July 7, the European Commission conducted a public consultation on the draft European Sustainability Reporting Standards. Companies, business associations, NGOs, citizens, trade unions, public authorities, and academic institutions, among others, used the opportunity to comment on the draft for a delegated act that sets out cross-cutting standards and standards for the disclosure of environmental, social and governance information – the European Sustainability Reporting Standards or ESRS. In total, 604 individual responses have been received and published on the European Commission’s website [1]. In this blog post, another update to our blog post on the ESRS in June 2023 [2], we share our first insights on the feedback received by the European Commission.

Note: This post is an update to our original post on the revised European Sustainability Reporting Standards (ESRS) June 2023 that is linked here.

The journey from EFRAG’s draft to the current draft ESRS by the European Commission

In November 2022, EFRAG published its drafts for the European Sustainability Reporting Standard. The drafts have been the result of a development process that involved a wide range of stakeholders. The European Commission consulted the drafts with various stakeholders, including preparers of sustainability reports, which led to multiple revisions.

In June 2023, the European Commission published the draft delegated act for the ESRS [1] and opened the feedback period through public consultation.

The main differences between EFRAG’s draft and the one published by the European Commission are:

- Materiality Assessment: Apart from ESRS E2 “General Disclosures”, all other disclosures will depend on the materiality analysis results.

- More phase-ins are scheduled to allow companies sufficient time to adapt to the reporting obligations.

- Fewer mandatory disclosures and more voluntary disclosures: Compared to EFRAG’s draft, various disclosure requirements have become voluntary disclosures.

- More flexibility: The current draft provides more flexibility in different places to reduce the reporting burden.

Who provided feedback on the draft ESRS?

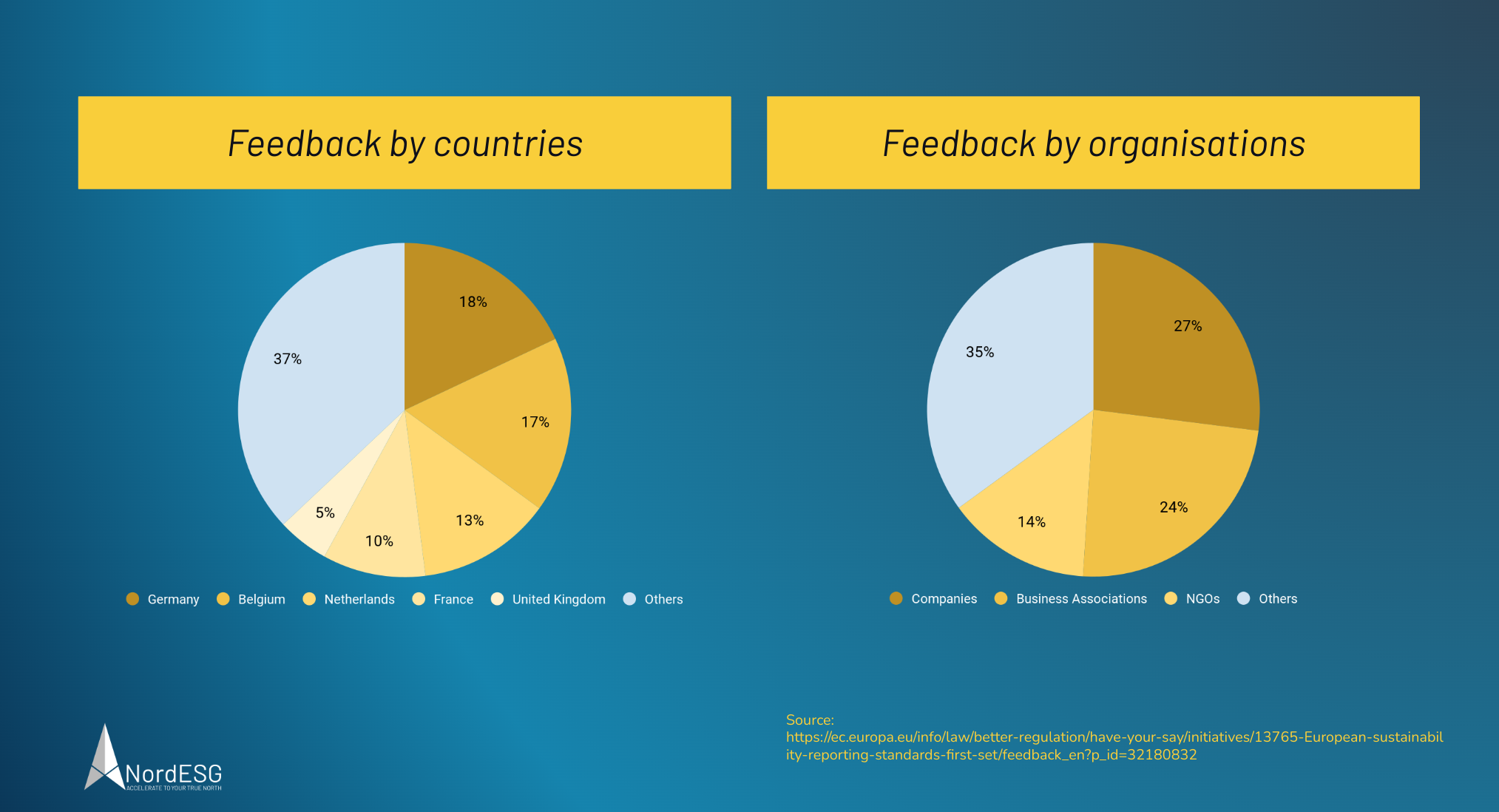

Statistical data published by the European Commission indicate that most feedback came from

- Germany (18%)

- Belgium (17%)

- the Netherlands (13%)

- France (10%)

- the United Kingdom (5%).

However, feedback also came from Switzerland, Singapore, Japan, India, El Salvador, and others. We take this as a clear indication of the importance of European legislation in a global context.

Almost two-thirds of the feedback came from

- companies (27%)

- business associations (24%)

- non-governmental organisations (14%)

More details are available at the webpage of the European Commission [3].

Got questions about sustainability?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you.

An overview of the feedback

As expected, the feedback on the draft delegated act for the European Sustainability Reporting Standard is diverse. In our perception, different thematic lines are emerging, which we will present here and shouldn’t be understood by no means as a scientific approach.

Double materiality as a core concept of the ESRS

“Double Materiality” is a core concept of the ESRS and has become even more critical in the current draft. Apart from the (reduced set of) mandatory disclosures defined in ESRS E2 “General Disclosures”, reporting on sustainability performance will depend on the outcome of the double materiality assessment, making the materiality assessment the linchpin for disclosures – in line with the credo “report on what is material”.

- Proponents of this approach see an advantage in the reduced scope of “mandatory disclosures” compared to EFRAG’s draft and point out that a stronger focus on reporting on topics deemed material to a company will lower the reporting burden.

- However, this assessment is not unanimously shared. Quite a few commentators favour returning to the more extensive set of mandatory disclosures proposed by EFRAG in the November 2022 release of the draft ESRS to maintain comparability between companies on fundamental sustainability topics like climate and human resources.

- Another argument shared opposing the now-released ESRS draft is that the dependence on the materiality assessment can be used to create loopholes or avoid reporting on unwelcome issues because by classifying them to be not material. In this context, commenters also raised the question of why a company should not at least briefly explain why a particular issue is not considered material.

Requirements of Investors and other stakeholders

The feedback reflects diverse stakeholder demands. Investors and other financial market participants must meet their disclosure requirements. Given that, it is no surprise that various feedback addresses disclosure requirements along CSRD / ESRS and SFDR need to be aligned, particularly for PAIs. Some comments state that disclosing data points with PAI relevance should become mandatory to provide investors with robust and comparable information. That can also improve the flow of information along CSRD and SFDR, minimise data gaps and help financial market participants meet their disclosure requirements (SFDR, Benchmark Regulation, Pillar 3, …). Doing so would contribute to avoiding “indirect disclosure requirements” by FMPs leading to companies collecting and disclosing the required data.

In our series on sustainability information from an investors’ perspective, we have highlighted the importance of reliable information in this context [4].

Interoperability of ESRS and ISSB / IFRS

With the IFRS S1 and S2, the ISSB has developed a reporting standard that aims to become the “global baseline” for sustainability reporting. A simplified understanding would be that the ESRS applies to EU companies, while the ISSB/IFRS standards apply to the rest of the world. However, this view falls short:

- Non-EU companies can also fall under the CSRD reporting requirements if they meet the relevant conditions to do so.

- Likewise, EU companies can become subject to reporting requirements outside the EU and may have to report under ISSB/IFRS.

Hence, ISSB/IFRS and ESRS interoperability is a priority mentioned in the comments to avoid additional reporting burdens for the companies concerned. However, as various commentaries point out, this would first require overcoming fundamental hurdles such as multiple definitions (keyword “financial materiality”) and making further adjustments to both standards to foster interoperability.

Another question raised in this context is whether the “lowest” or the “highest” common denominator should be sought in search of interoperability. In other words: Should the standards be further simplified until the lowest common denominator is reached, or should, if necessary, additions be made to the scope of each framework so that interoperability and granularity are favoured?

Phase-ins, simplifications and concerns about regressions compared to EFRAG’s November 2022 draft ESRS

Phase-ins, i.e. transition periods until some sustainability disclosures are due for the first time, are being positively received because they provide additional time to implement the necessary processes and to meet the new reporting requirements. The same applies to the proposed simplifications and the fact that various disclosure requirements have become voluntary instead of mandatory.

Here is a quick summary of the main differences between EFRAG’s November 2022 draft and the current draft delegated act:

- Phase-in periods: Additional phase-in/transition periods are envisaged to make it easier to start reporting. These cover one or more years, depending on the size of the company and the respective issues. Examples include disclosures on “Scope 3 emissions” or “Own workforce”.

- Voluntary disclosures: Compared to EFRAG’s draft, various disclosures have become voluntary in the draft now submitted. Examples are “Biodiversity Transition Plans” or why a company classifies a sustainability issue as not material.

- More flexibility: There should be more flexibility for various disclosures, such as stakeholder engagement.

While companies generally welcome these simplifications and phase-ins, other stakeholders, including investors and NGOs, are more critical. They rely on this information, fearing phase-ins may cause additional delays until data becomes available.

Another argument is that some topics are of fundamental importance, e.g. greenhouse gas emissions and climate change. Hence, these topics should be classified as material so that reporting becomes mandatory since it would not be expedient to make disclosure dependent on the outcome of the materiality assessment.

Concerns that the now-published draft represents a step backwards in ambition compared to EFRAG’s November 2022 proposal are reflected in many comments. Simplifications, the reduced scope of mandatory disclosures, making more information voluntary to report on – all this could lead to a situation, where compliance is satisfied, but the real leverage arising from reporting and sustainability strategy may be lost. For example early identification of sustainability-related risks and opportunities. As a result, the contribution to the transition into a future economy outlined by the EU Green Deal would not be sufficiently supported.

Need for clarification and implementation guidance on the European Sustainability Reporting Standards.

Despite all the simplifications and phase-ins, the ESRS is still an elaborated and complex framework to align with. That is particularly true for companies that must disclose their sustainability performance for the first time. Accordingly, many comments demand implementation guidance. That is especially true for the concept of double materiality so that this assessment can be implemented confidently and structured. The topics mentioned in this context range from identifying proper threshold values above which a sustainability issue is considered material to stakeholder engagement. Such implementation guidance is vital to arrive at comparable results across all companies, which would benefit users of sustainability reports. Handouts, case studies and other educational material is considered helpful for preparers of sustainability reports so that they can align more quickly with the requirements of the ESRS.

Conclusion

As mentioned above, this blog post does not intend to be a statistical or scientific approach to the feedback received by the European Commission on the draft ESRS. However, some topics emerge from the broad spectrum of feedback published on the Commission’s webpage. Meeting the demands of all stakeholders, considering the vast range of industries, and the various sizes of companies that fall under the CSRD, is a challenging task. The equation becomes even more complex if the information demands of FMPs are considered.

This will require compromises that, as expected, will not be met with enthusiasm by all stakeholders involved. We do not judge whether the European Commission’s or EFRAG’s proposal is better or worse. Instead, we would like to focus the attention on the goals associated with the ESRS:

- Support the interaction of regulations like CSRD, SFDR and EU Taxonomy by ensuring the provision of crucial information while avoiding “indirect disclosure requirements”.

- Provide stakeholders with robust information on sustainability performance to empower them to draw comparisons and make well-informed decisions.

- Pave the way towards a sustainable economy as the EU Green Deal outlines by directing financial flows toward sustainable investments.

- Help to understand that sustainability performance reporting is the outcome of a sustainability process and not an end in itself. So reducing the efforts to a mere compliance exercise would be a missing chance to leverage opportunities sustainability context.

- Ensuring interoperability with other reporting frameworks since there will be multiple overlaps in a globalised world where Non-EU-companies may have to report under CSRS, and at the same time, EU-companies may face the challenge of disclosing their sustainability performance under the ISSB/IFRS framework. Interoperability may also be relevant to those companies that report to other frameworks like GRI.

At this point, it remains to be seen how the final version of the European Sustainability Reporting Standard will look like and how large, medium and small enterprises will be able to align with the disclosure requirements, many of which will report for the first time on their sustainability performance.

We will keep our readers posted on further developments of the European Sustainability Reporting Standards.

Sources and further reading

[1] European Commission – European sustainability reporting standards – first set

[2] NordESG – European Sustainability Reporting Standard Update June 2023

[3] European Commission – Overview of feedback received for the ESRS

[4] NordESG – Eurosif: Investors perspective

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.