ESG-Disclosure and Corporate Reality

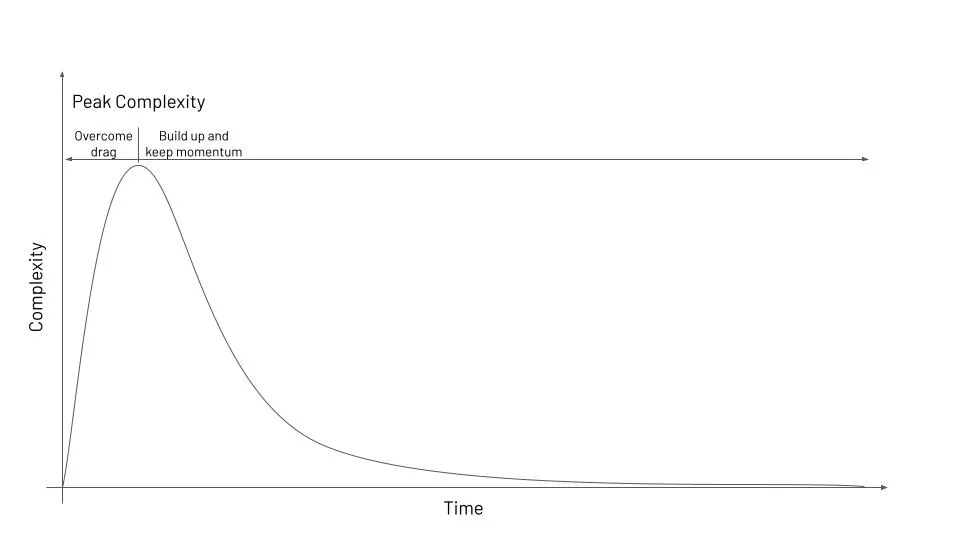

ESG disclosure is becoming mandatory for a growing number of corporations. In this blog post on ESG disclosure and corporate reality, we take a closer look at the challenges (and their causes) for corporations, institutions and industries and how to overcome them. We also share some ideas on how a process could look like that helps corporations to overcome the initial or peak complexity that comes with an ESG process and on success factors to look at when deploying such a process.

The Traction of ESG on Industries, Corporations and Institutions

ESG is here to stay. More than that, ESG is gaining more and more traction, and its impact on industries, corporations and institutions is increasing. Here are some facts: Bloomberg expects the global assets under management (AUM) in the ESG category to cross the US$ 53 trillion mark by 2025 – that represents more than one-third of the projected total US$ 140.5 trillion of AUM by 2025.

Meanwhile, the pressure is building up: Regulators and policymakers expect corporations to become more transparent on ESG related issues. They develop taxonomies designed to make corporate disclosure of non-financial data more transparent and mandatory for a growing number of corporations. Rating and scoring corporations provide ESG ratings based on various data sources and considerations. Financing institutions like banks and private equity firms rely on ESG scores in the decision-making process. Insurance companies announced that they want to have a closer look at ESG related data, too. And so do other stakeholders groups. For those stakeholders, ESG is an instrument of risk management and a way to identify options for sustainable growth.

A Matter of Corporate Survival

In a world where the “old” shareholder model is phasing out to be replaced by the “new” stakeholder model, it all comes down to a simple equation. While a superior ESG proposition will be rewarded, an inferior ESG proposition will come with penalties: Fewer investment options, higher interest rates, less attractive for young talent, less attractive for customers that are factoring in a strong ESG proposition in the buying decision.

In a nutshell: A good ESG proposition is becoming nothing less than a matter of corporate survival.

One could say that the transition from shareholder to stakeholder economy has not only started but is in full swing. As a result of this transition, the corporate landscape is (at least in some parts) becoming an ESG landscape – with new challenges for corporations and large institutions. The top priority is to understand the inner workings of this new ESG landscape. How can corporations comply with regulations? What is the best way to disclose ESG related information? How can corporations make their voice heard? And finally, what is the impact of ESG on corporate valuation?

Focus on Opportunities and Risks

It is easy to understand that with all the perceived complexity and inherent uncertainty, the disclosure of non-financial information feels intimidating for many corporations. It is a complex process that may include substantial cost and involves risks. So at the start, the added value that comes with an ESG process and the opportunity to raise their voice and tell their story is not clear enough for some corporations. Understandably, these companies decide to disclose only mandatory or the most necessary information. That leads to postponing all further steps in the development of a dedicated ESG strategy. By doing so, businesses may trade one risk for another. Focusing on the bare minimum of ESG related activity could imply that they are laggards and miss the opportunity to utilize the insights generated by an ESG process to develop their existing business strategies any further.

How to Overcome Complexity?

It does not have to be that way. A good starting point is to understand the challenges and their causes to overcome the initial drag. Gaining more clarity helps to overcome the peak complexity. From that point onward, corporations can build up and keep their momentum.

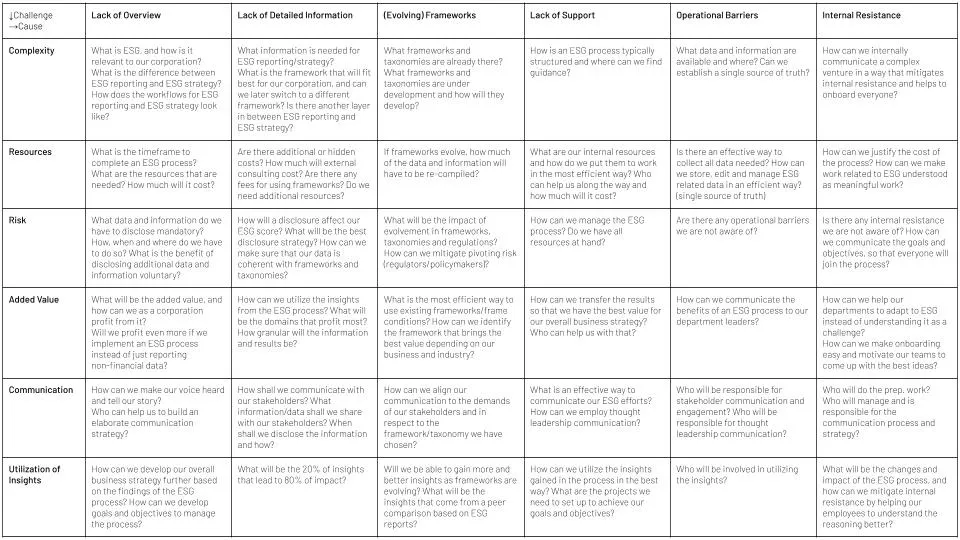

We have compiled a table with possible questions related to complexity, resources, risk, added value, communication and utilization of insights. According to our research, there are two categories, lack of overview and lack of detailed information, that might contribute most to the perceived uncertainty and cause most of the initial drag.

There are answers to these questions that help to build and keep the momentum up.

ESG Disclosure and Corporate Reality – Get Answers to the Most Relevant Questions

Being aware of the questions involved is the first step. Finding answers is next. Each corporation has a different background, background and culture. So there is no such thing “as one size fits most” approach. However, there is an approach that enables corporations to get a better understanding of their ESG landscape.

Define Your Priorities and Approach to ESG

Each corporation has different priorities when it comes to non-financial reporting and ESG. These priorities will reflect in the approach to ESG.

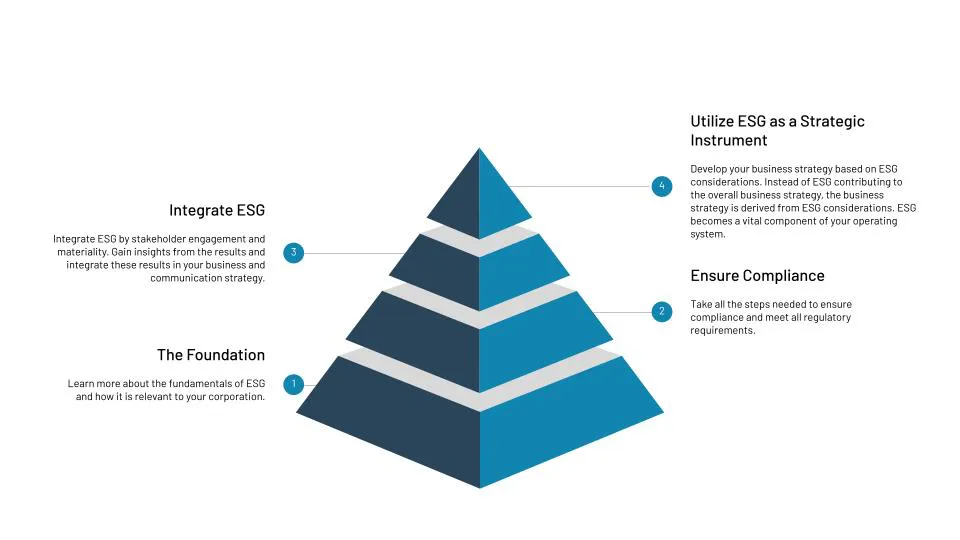

A four-layer approach enables corporations to develop a strong ESG proposition while focusing on their priorities. Layer one is all about the foundations. Like an ESG 101, this stage gives answers to all the basic questions related to non-financial reporting and ESG. Layer two is all about compliance and meeting regulatory requirements. Corporations seeking information on what is mandatory for them to disclose will find the answers in this layer. Stepping up one notch is Layer three. This layer is all about the integration of ESG and gaining insights from doing so. Examples of tasks in this layer are stakeholder engagement and materiality. Finally, there is layer four. This layer combines all other layers and adds strategic planning based on ESG considerations. This layer is especially interesting for those companies that want to ESG into their strategic planning and corporate culture.

Conclusion ESG Disclosure and Corporate Reality

ESG-Disclosure and Corporate Reality: Getting involved in ESG and implementing sustainability is a marathon, not a sprint. There is a steep learning curve, but there is also an approach that enables corporations to climb the ladder step by step. Becoming clear on the workflow based on priorities will help overcome the initial drag and helps to build up momentum to keep the process going.

Here are some ideas to consider:

- Set a robust foundation: Ensure that there is a common understanding of ESG and the goals related to the ESG process.

- Define a workflow based on priorities: Workflows will look very different if the goal is to ensure compliance compared to implementing ESG as a strategic instrument.

- Get people involved: Build a strong ESG team with representatives from all relevant departments/functions to capture all ideas and views.

- Narrow down on risk and opportunities: Involve stakeholders (internal/external) to understand their views on future risks and opportunities and take that information into the overall process.

- Know your data: You can only manage what you can measure, especially when it comes to ESG. Communicate what data/information is needed and when. It is not only about data collection but also about data monitoring related to goals and objectives.

Further Reading

Here is a list to other blog posts that might be interesting:

- Corporate Sustainability Reporting Directive (CSRD)

- European Sustainability Reporting Standard (ESRS)

- Our ESG Glossary

About NordESG

NordESG is an independent consulting firm that advises on sustainability and ESG. We support companies in navigating their sustainability landscape and develop strategies and concepts individually tailored to their requirements. This also includes managing the transition to CSRD. We look forward to hearing from you via email. You can also make an appointment with us directly for a free introductory meeting.