Attracting investments by intelligent sustainability reporting – Clues from the Eurosif survey

Eurosif, a leading pan-European association promoting sustainable finance, recently published a detailed report that explains the challenges faced by investors who use the corporate sustainability performance information to take investment decisions. The key takeaways from this report can be summarized into three buckets as follows:

- Quality of data: Study participants stressed the importance of diverse data for informed investment decisions, particularly regarding climate risks and impacts. They endorse the double materiality approach in the ESRS(European Sustainability Reporting Standard), which considers ESG factors affecting the financial performance of a firm and the impacts of a firm’s operations on the people and the environment around it. (Read our articles on double materiality here).

- Quantity of data: Participants expressed the need for comprehensive climate-related information that encompasses not only companies’ own operations but also their value chains. They believe that the current level of ambition for the ESRS should be maintained, including standardized reporting on Scope 3 emissions. (More about scope emissions here, here and here).

- Forward-looking statements aiding investing decisions: Investors seek forward-looking information that includes climate-related targets, risks, opportunities, and transition plans which would enable them to assess better companies’ alignment with global climate goals and their preparedness for the transition to a low-carbon economy.

A comprehensive analysis of these investors’ requirements can be read in Part 1 of this series here. In this part, we analyze how these insights can be intelligently applied by firms getting ready to report their corporate sustainability performance(CSP) in accordance with the EU CSRD regulations.

Why do investors require Corporate Sustainability Performance(CSP) data?

A significant challenge often cited by investors is the insufficient availability of data required to meet EU regulations, including SFDR PAI (Principal Adverse Impact) Indicators or EU Taxonomy alignment. Several participants of the Eurosif study noted that they presently utilize SFDR-related data solely for the purpose of compliance, without regarding it as valuable information for investment decision-making.

As explained in some of our previous blogs, the essence of the EU Sustainable Finance Framework is to channel private investments toward sustainable projects, and the framework includes the EU Taxonomy Regulation (read here) for corporates and investors, Sustainable Finance Disclosure Regulation (SFDR)(read here) for investors and Corporate Sustainability Reporting Directive (CSRD)(read here) for corporates. These Regulations cover all the key players in the entire value chain of investments, like corporates who seek capital, investors who provide money to these firms, and everyone in between.

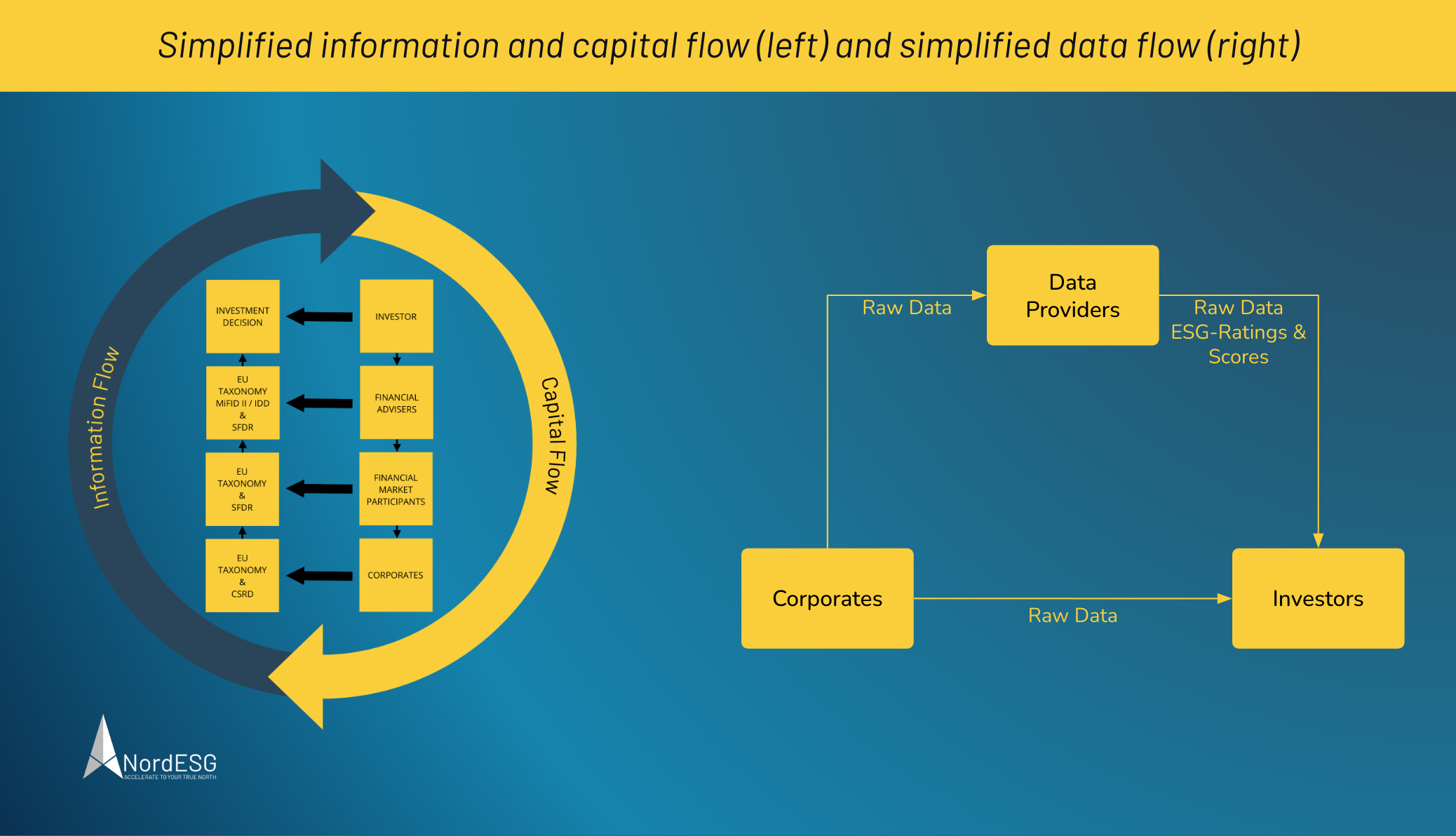

The key to the efficient allocation of capital to sustainable projects is “information”. The EU Taxonomy defines what activities are environmentally sustainable, while the CSRD mandates reporting of the sustainability performance of corporates. The SFDR provides guidelines for market participants on labeling their financial products based on the EU Taxonomy. The MiFID II and IDD provide guidelines for financial advisers to integrate this information and act according to the sustainability preferences of their clients. Essentially, the data originates from the corporates and transmits through the market participants and advisers to the end investor.

A simplified version of the information and capital flow across the entire value chain and the applicable regulations and a simplified version of the data flow are given below.

What type of data can help investors take better investment decisions?

The primary objective of investors is to invest in assets that give them the highest returns, which stem from higher valuations or, at the very least, the prevention of value erosion of the investee companies. In order to align sustainability performance reporting with this objective, it is essential to focus on two key factors: exploiting opportunities and reducing downside risk.

By actively identifying and capitalizing on opportunities, businesses can increase their valuation. This involves recognizing and seizing prospects related to sustainable practices, technologies, and markets. Additionally, mitigating downside risk is crucial to protecting and growing a firm’s value. Climate risks, regulatory changes, and shifts in market preferences can all pose threats to a company’s financial performance. Hence it is important for companies to be transparent about these opportunities and challenges and report them in their sustainability reports.

Got questions about sustainability?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you.

Upsides or opportunities

The upside potential for businesses lies in the revenue generated from new opportunities linked to decarbonization and the net-zero transition. According to the TCFD(read here), these opportunities encompass various areas, such as

- resource efficiency,

- energy sources,

- products and services,

- markets, and

- resilience.

Companies can optimize their resource usage by adopting sustainable practices and technologies, reducing waste and enhancing operational efficiency. Furthermore, the shift towards renewable energy sources provides avenues for innovation and growth. Developing and offering environmentally friendly products and services also enables businesses to cater to the increasing demand for sustainable solutions. Expanding into new markets that prioritize sustainability opens doors for greater market share and increased profitability. Moreover, building resilience against climate-related risks helps companies withstand potential disruptions and strengthens their long-term viability in a changing world.

Downsides or risks

On the other hand, it is crucial for businesses to acknowledge the downside potential associated with climate risks, as highlighted by the Task Force on Climate-related Financial Disclosures (TCFD). These risks encompass both physical risk and transition risk.

- Physical risks are the direct consequences of climate change, including extreme weather events, rising sea levels, and changing temperature patterns. These events can lead to infrastructure damage, supply chain disruptions, increased insurance costs, and operational challenges.

- Transition risks, on the other hand, arise from the process of transitioning to a low-carbon economy. This includes policy changes, regulatory frameworks, market shifts, and technological advancements that could render certain assets or industries obsolete or financially unviable. Companies heavily reliant on fossil fuels, for instance, may face significant financial losses as the world transitions to cleaner energy sources.

Past performance and forward-looking statements

The key takeaway from the Eurosif survey was that investors’ requirements include

- Past Performance

- Quantity or breadth of data

- Quality of data

- Forward looking statements

The quantity of data is to a large extent taken care of by the European Sustainability Reporting Standards(ESRS) as part of CSRD. The standards also provide guidelines regarding the quality of data. The quality or the usefulness of the data for investors will depend on how much of the sustainability performance is quantified once ESRS comes into effect.

A large number of sustainability reports of EU companies that we reviewed are not very decision useful. They fall into the 3 broad categories:

- Has a lot of generic sustainability information pertaining to their industry or country, but not a lot of specific information about the company’s sustainability performance. In order to compensate for the lack of useful information, they contain long verbose sentences and glossy pictures of solar panels or wind turbines with green meadows. They also typically contain images of people of different ethnicities to convey a sense of diversity.

- The second types of reports have a lot of qualitative information which can be useful for an investor to understand the broad directions that the company is moving towards, but this information is typically not backed by any absolute or relative numbers like year-on-year changes in specific energy consumption, or reduction in emissions.

- The third kind of reports are the most ideal ones, and contain a lot of useful qualitative and quantitative information on the sustainability performance of the reporting firm. These firms also typically report on their strategic goals, and the roadmaps to achieve those goals. In essence, these kinds of forward-looking statements can help investors in understanding the value drivers for a firm from the perspective of climate change and decarbonization. These reports typically have a strong foundation in the form of stakeholder engagement and double materiality assessment. Read more about double materiality here.

Conclusion

In conclusion, attracting investments through intelligent sustainability reporting is an important factor for companies seeking to enhance their value and secure long-term success. To effectively attract investors, sustainability reporters must provide both quality and quantity of disclosures, including forward-looking statements that demonstrate their commitment to sustainable practices. By strategically aligning their reporting efforts with investor needs, companies can not only meet the growing demand for transparency but also improve their overall company value.

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.