Real Estate, Sustainability, and ESG

Sustainability and ESG (Environment, Social and Governance) have become strategic imperatives, and the real estate industry faces the challenge of responding to them. While some companies seek guidance on implementing ESG and sustainability practises into their business, others have already taken the first steps to navigate their complex ESG landscape. Regardless of the stage of the progress, the common objective is to meet current and future stakeholder expectations. Although there is a significant focus on the “E” in “ESG”, which is understandable given the share of energy consumption and CO₂ emissions, a comprehensive approach that integrates the “S” and “G” is necessary to achieve the aspiration. We have split this blog post into two parts: Firstly, we provide an overview of the challenges that companies in the real estate industry face in the ESG context. Secondly, we offer insights on how to overcome these challenges.

Age of the Anthropocene

We have entered the Anthropocene era [1], where humanity has indisputably become the dominant species on our planet. One indicator, published in 2020 in a study by Elhacham, Ben-Uri, and Grozovski from the Weizmann Institute of Science in Rehovot, Israel, found that “human-made mass” now exceeds the weight of all living biomass [2,3].

While the total weight of all living organisms has remained relatively constant, estimated at around 1.1 trillion tons, the proportion of anthropogenic mass has increased exponentially. In other words, the combined mass of concrete, metal, clothing or simple plastic bottles outweighs the living biomass on our planet. That raises questions related to concepts such as “Global Boundaries” or the idea of “Doughnut Economics” [4].

Real Estate, Sustainability, and ESG

Buildings made of concrete, glass, and metal contribute substantially to the increased artificial mass. In addition, buildings have a long lifespan and complex value chains, making achieving sustainability goals even more difficult.

Got questions about ESG and sustainability?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you.

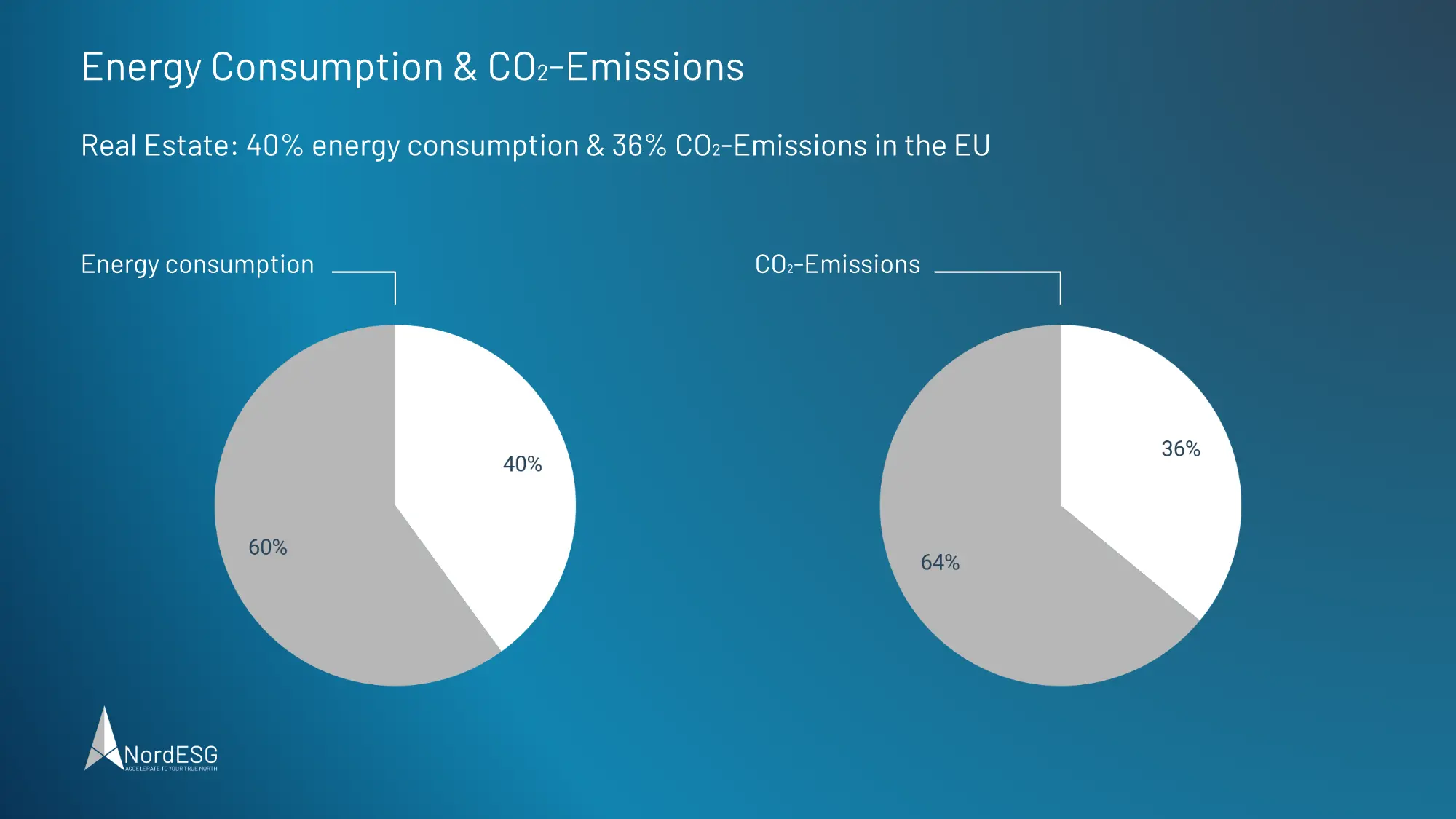

The real estate sector accounts for 40% of energy consumption and 35% of CO₂ emissions in the European Union, indicating the tremendous pressure and potential to contribute to preventing climate change. No wonder an ever-increasing awareness of sustainability and ESG by legislators, investors, civil society, and other stakeholders leads to corresponding requirements and close monitoring of developments in the real estate sector. At the same time, climate change and its associated impacts are also a critical consideration for the industry itself.

Climate Change and Climate Impacts

The Paris Climate Agreement of 2015 aims to limit global warming to below 1.5 °C to avert significant climate risks. Reducing CO₂ emissions by 80-95% by 2050 is essential, with real estate responsible for a considerable share of the emissions to be avoided.

Climate change is already affecting the real estate industry, with increasing numbers and intensities of weather events worldwide. For example, floods and storms are risks for real estate portfolios that are taken into account by investors. A study by Evora Global [5] reports that almost half of the real estate investors surveyed report climate-related impacts. However, the canon of sustainability and ESG extends beyond the “E” in ESG or environmental issues.

The “S” and “G” in “ESG”

The “S” and “G” in “ESG” are equally important for a holistic view and to meet the expectations of investors, clients and other stakeholders. Including these factors not only help to “ESG-proof” a company but is relevant to other factors like reputation or the ability to attract young talent [6].

Insights – Getting Started with ESG, Energy, CO₂, Social and Governance

Getting started with ESG and overcoming initial hurdles can be challenging due to the complexity of ESG in itself [7]. So in this section, we have compiled some insights to help start the process.

Getting Started with ESG

In several previous blog posts, we discussed how companies can get started with ESG and build their sustainability strategy [8]. A vital element is to conduct a materiality assessment [9] to identify what is material for a business and prioritise crucial strategic sustainability aspects. Applying the concept of “double materiality” [10] entails considering both the outside-in and the inside-out perspectives, “financial materiality” and “impact materiality” simultaneously. This multi-stakeholder approach is particularly significant for companies moving towards mandatory sustainability reporting under the Corporate Sustainability Reporting Directive (CSRD) since the concept of “double materiality” is a core component of the European Sustainability Reporting Standard (ESRS), which will serve as the framework for future sustainability reporting under the CSRD. However, there are various other materiality concepts, which we have discussed in a separate blog post [11].

Reducing greenhouse gas emissions and adapting to climate change

Given the significant share of CO₂ emissions that stem from the building sector and considering its reduction potential, it is clear that action is required to unlock this potential. The current renovation rate is only one per cent, and time is running out in light of the EU’s climate targets. In addition to a more “traditional” approach, such as improving energy efficiency through thermal insulation, switching to lower carbon footprint energy sources, integrating renewable energy, or optimising operations, other aspects, like providing e-mobility charging infrastructure and considering other mobility topics, will become increasingly crucial in near-term future.

Further optimisations and adaptations to climate change go even further. For example, to combat the “urban heat island effect,” targeted greening measures [12] can be implemented to help reduce temperatures in the urban environment. That includes greening roofs and facades and planting trees, and creating shading. Another approach is to put reflective surfaces as a cover on pavements or other commonly asphalted surfaces to reflect heat and create a more pleasant microclimate during the summer [13]. With climate change leading to heavy rainfalls, surface water management is also becoming essential to consider. Decentralised rainwater management approaches such as “sponge city” or “sponge town” are pursued to relieve the sewage system and prevent flooding [14, 15]. These adaptations can also have a positive effect on reducing climate-related risks for real estate investments. Until now, we have mentioned the CO₂ footprint of buildings quite often. That raises the question about what is included in it from a GHG accounting perspective. What about operational carbon emissions, and how are they distinct from upstream and downstream emissions? What do “embodied carbon” and “circular economy” mean? We will take a closer look in the next chapter.

Embodied Carbon and Circular Economy

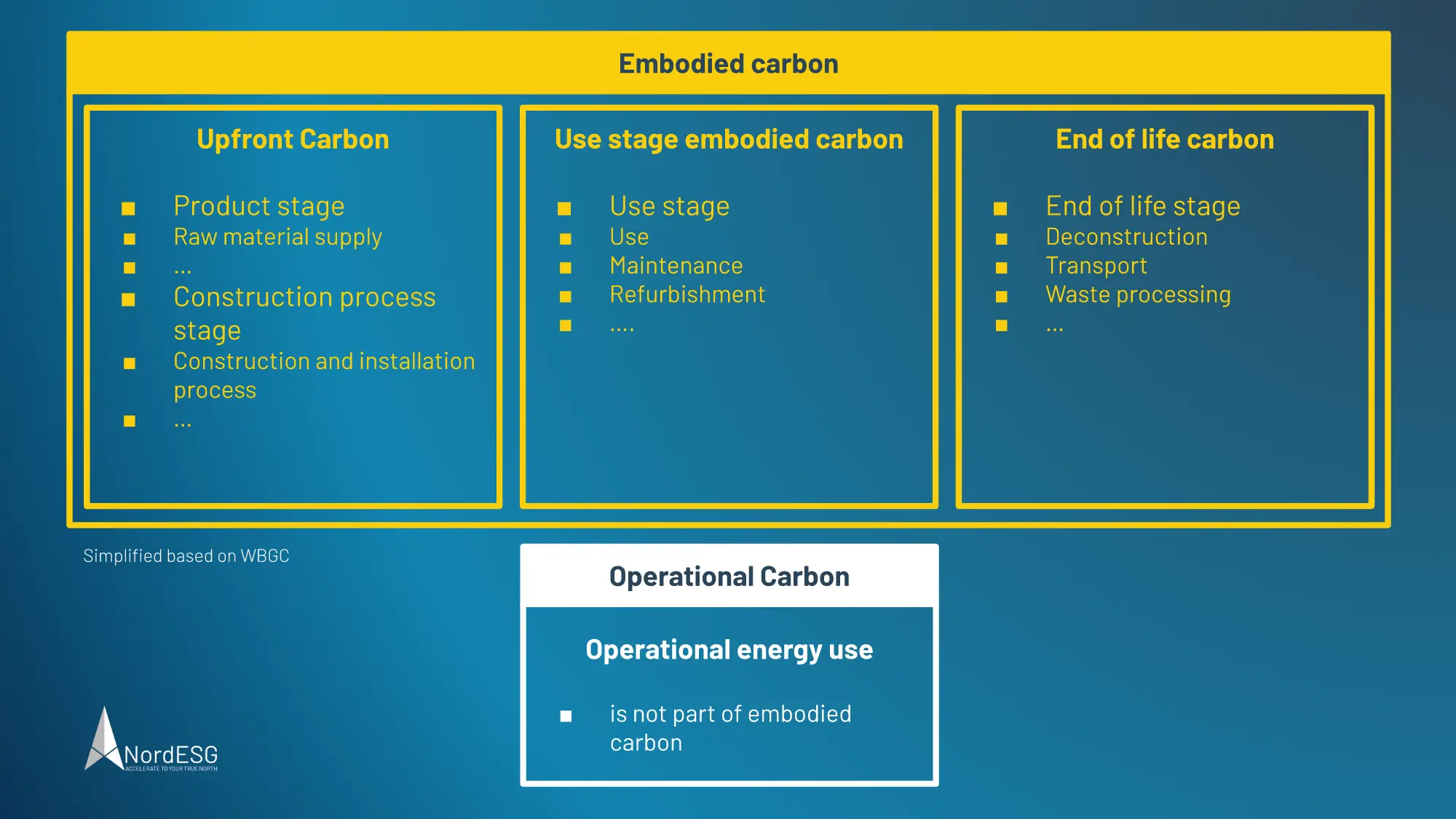

Embodied carbon, sometimes called embedded emissions, refers to greenhouse gas emissions that occur during the entire life cycle of a building [16]. That includes emissions from up- and downstream processes such as the production of building material, emissions that occur during the construction phase, and those that arise during deconstruction. However, emissions from operational energy use are not part of the embodied carbon category.

Buildings are responsible for 39% of annual global greenhouse gas emissions, with 28% caused by the building’s operation (operational energy use) and 11% attributable to embodied carbon. Energy efficiency during operation and the decarbonisation of the energy supply will drive the share of embodied carbon on the total emissions even further. It is important to note that extensive renovation measures also contribute to embodied carbon. Recycling building materials like concrete, steel, copper, and aluminium can help to transition into a circular economy [17].

Digitisation and IoT

Digitisation and the “Internet of Things” (IoT) offer new opportunities for companies in the real estate sector. For example, data collection in existing buildings can help capture consumption data in real time, identify trends early on, and compare the performance of different properties. Automated billing is one aspect of that, while at the same time, the consumption data can be the foundation for GHG accounting.

Considering consumption data makes it easier to determine energy-saving potential and prioritise measures – and it can also help to monitor progress and effects of applied energy efficiency measures.

Implementing IoT devices can pave the way to building automation, including load balancing and optimising the operation of heating, cooling, and other appliances – even based on forecasting data. The next step may be a “digital twin” that takes the optimisation to the next level by delivering even more differentiated insights on optimisations [18].

Social and Governance

Besides technology, digitisation and carbon emissions, social concerns, and governance issues are other critical ESG factors for the real estate industry. As buildings are primarily located where people reside, engaging with local communities is imperative, including effectively communicating planned construction projects and understanding stakeholders’ perspectives and concerns. The development of public space is also an essential factor. Buildings must meet extensive requirements, focusing on providing protection and security. Affordable housing is no longer confined to urban areas, and the surrounding environment of buildings can have a significant social impact on the community, from meeting possibilities to local supply. As demographic changes occur, care and medical services are becoming increasingly crucial alongside accessibility. Social concerns extend beyond interactions with tenants and buyers of real estate to include issues such as occupational safety and employee rights, which are governed by appropriate standards and are of utmost importance in international construction projects. Governance issues encompass regulatory compliance, diversity, responsible marketing, and other trends, such as linking remuneration to attaining sustainability objectives and dealing with governance issues transparently.

Conclusion

In conclusion, the real estate industry faces many sustainability challenges. Each company must navigate its unique ESG landscape to identify opportunities, mitigate risks, and develop tailor-made strategies that provide genuine added value. This article offers a first overview of the many facets of sustainability, ESG, and the real estate industry and underscores the importance of tailored advice.

Sources

[1] Anthropocene

[2] Global human-made mass exceeds all living biomass. https://doi.org/10.1038/s41586-020-3010-5

[3] We are doubling the mass of the human-made, “anthropogenic” part of the world every twenty years and the curve is not flattening Weizmann Institute of Science

[4] Kate Raworth – Doughnut Economics

[5] Evora Global

[6] NordESG – Impact of ESG

[7] NordESG – Getting started with ESG

[8] NordESG – ESG Strategy for 2023

[9] NordESG – Materiality Assessment

[10] NordESG – Double Materiality

[11] NordESG – Materiality Madness

[12] EPA Urban Heat Island Effect 1

[13] EPA Urban Heat Island Effect 2

[14] Sponge City 1

[15] Sponge City 2

[16] World Green Building Council – Embodied Carbon

[17] Circular Economy

[18] TCS Digital Twin

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.