ISSB update February 2023 – On the way to becoming a guiding star for sustainability reporting?

Members of the International Sustainability Standards Board (ISSB), the IFRS Foundation’s sustainability standard body, have approved the first two exposure drafts of the corporate sustainability disclosure standards: “S1 – General Requirements” for disclosure of sustainability-related financial information and the “S2 – Climate-related disclosures”. In this blog post, we look at the ISSB objectives and the key concepts of the disclosure standards and discuss when the standards will become effective.

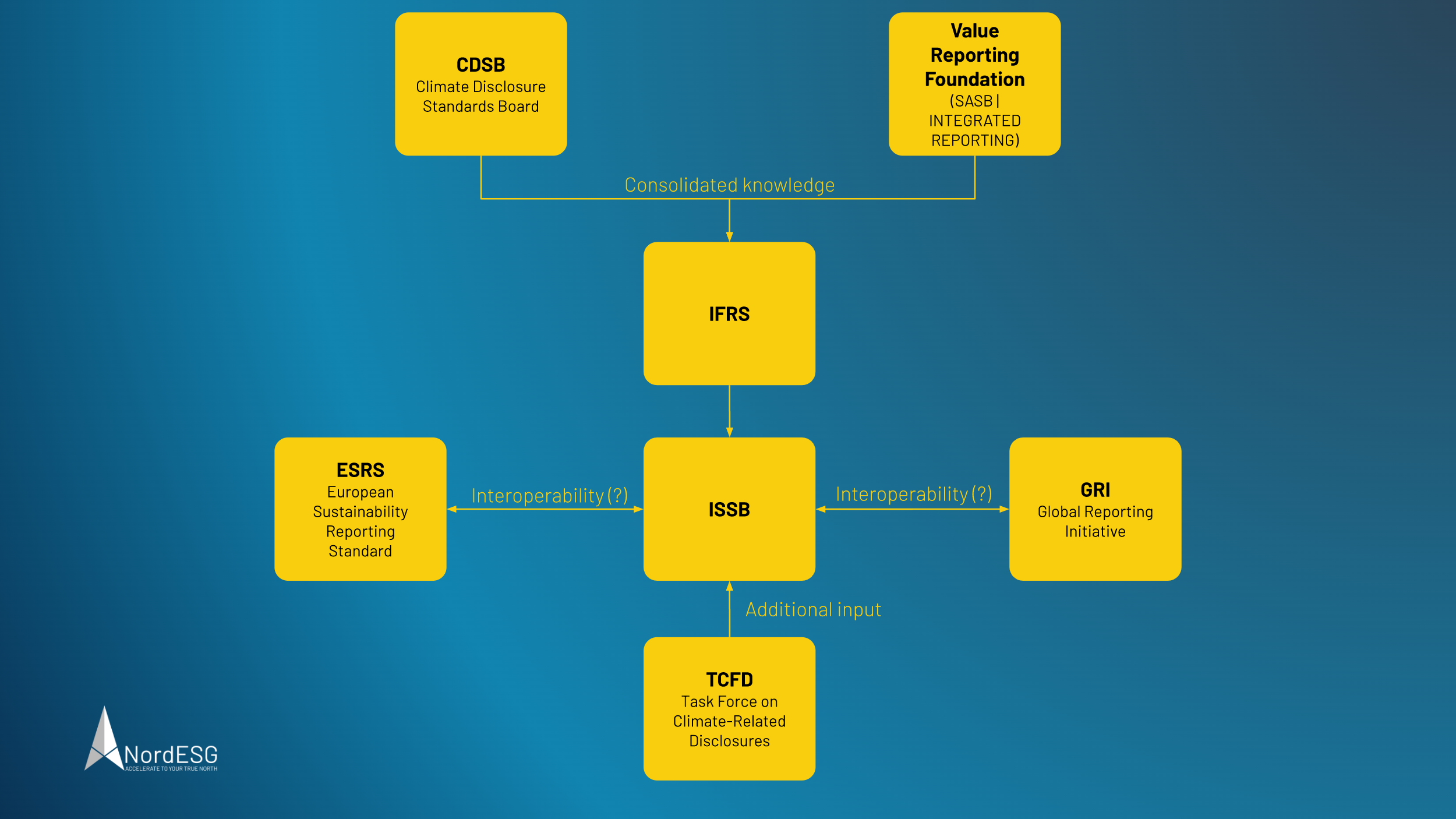

IFRS and ISSB

Before we look at the recent developments of the reporting frameworks, we provide an overview of the ISSB and its key objectives. The IFRS Foundation launched the ISSB in 2021 to develop standards for the global baseline of sustainability disclosures that enable companies to provide comprehensive sustainability information in a globalized world and simultaneously meet the information needs of investors and international capital markets.

In March 2022, the ISSB released the first exposure drafts of the sustainability reporting standards. More updates and developments have followed since then – including consultations on the exposure drafts on topics like biodiversity, human capital, and how sustainability reporting can be linked to financial reporting.

We believe the IFRS S1 and S2 standards are a welcome contribution to the global demand for uniform, reliable, and comparable sustainability information. The ISSB is well-positioned to achieve this by combining CDSB, Value Reporting Foundation, SASB, and the work of the International Integrated Reporting Council in what the ISSB is today.

Core concepts of IFRS S1 and IFRS S2 disclosure standards

The IFRS describes the core concepts in IFRS S1 to ask for the disclosure of material information about sustainability-related risks and opportunities and setting out general reporting requirements while also pointing to other standards and frameworks in the absence of a specific IFRS standard.

The term “Sustainability” is described as “the ability for a company to sustainably maintain resources and relationships and manage its dependencies and impacts within its whole business ecosystem over the short, medium and long term.” and “a condition for a company to access the resources and relationships needed (such as financial, human and natural), ensuring their preservation, development and regeneration to achieve its goals.” At the same time, the concept of materiality is described as “Information is material if omitting, misstating or obscuring it could reasonably be expected to influence investor decisions.” (see [1] for reference).

IFRS S2 is about climate-related disclosures. The core concepts are described as disclosing material information about climate-related risks and opportunities. IFRS S2 incorporates TCFD recommendations and industry-based disclosure requirements (financed emissions). Required is the disclosure of data on physical and transition risks and climate-related opportunities.

Related to materiality, the presentation on the IFRS S2 points out “Determine the effects of climate-related risks and opportunities on the company’s performance and prospects“, “Understand the company’s response to, and strategy for, managing its climate-related risks and opportunities“, and “Evaluate the ability of the company to adapt its planning, business model and operations to climate-related risks and opportunities.” (see [2] for reference).

Got questions about reporting frameworks?

Book a free and nonbinding discovery call to discuss your questions with one of our sustainability experts, and learn how we can help you with Scope 3 Emissions.

The challenge of setting a global baseline while maximizing interoperability with other sustainability reporting standards

The ISSB is setting a global baseline for sustainability reporting. At the same time, long-established and comprehensive frameworks like GRI exist, and the European Sustainability Reporting Standard (ESRS) is on its way to becoming the mandatory reporting framework for those European companies that fall under the Corporate Sustainability Reporting Directive (CSRD) and those companies outside the EU that do substantial business within the union.

As we pointed out in this blog post, the interoperability of reporting frameworks in a globalized world is a must to meet the demands of investors on one side while reducing compliance costs for companies on the other.

What are the timelines, and where can companies get guidance on the implementation process?

The ISSB reporting standards are expected to be released in mid-2023 and to become effective by January 2024 – so time is of the essence.

The presentations we referred to earlier provide a first idea of how companies can adapt to the IFRS S1 and IFRS S2. In addition, the ISSB has announced reliefs and guidance on implementing the standards. That includes a partnership framework for capacity building, so companies can scale up their approach to use the standards.

Preview on part 2 of this series

We will cover the similarities and differences between the ISSB and ESRS in part 2 of this series. We are focussing on understanding the terms “sustainability” and “materiality” in ESRS, GRI and IFRS. We will link to part 2 here after the published blog post.

Sources and further reading

Webinars and presentations by ISSB / IFRS can be found here: https://www.ifrs.org/news-and-events/news/2023/01/issb-corporate-reporting-webinar-series/

[3] Our blog post about the interoperability of reporting frameworks

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.