ESRS, GRI, TCFD & IFRS – Interoperability of reporting frameworks and disclosure requirements

In a previous blog post, we discussed the “alphabet soup” of ESG reporting frameworks. We pointed out that the interoperability of reporting frameworks such as ESRS, GRI, TCFD and IFRS/ISSB is crucial in a globalised world. A lot has happened since then: The introduction of the Corporate Sustainability Reporting Directive (CSRD) came a big step closer and, with it, the European Sustainability Reporting Standard (ESRS). But it is not only Europe: In the United States, news on the IFRS/ISSB reporting standards can be reported too. This blog post provides an initial overview of how interoperable the ESRS is with GRI, TCFD and IFRS/ISSB reporting standards.

Interoperability – How compatible are the reporting frameworks?

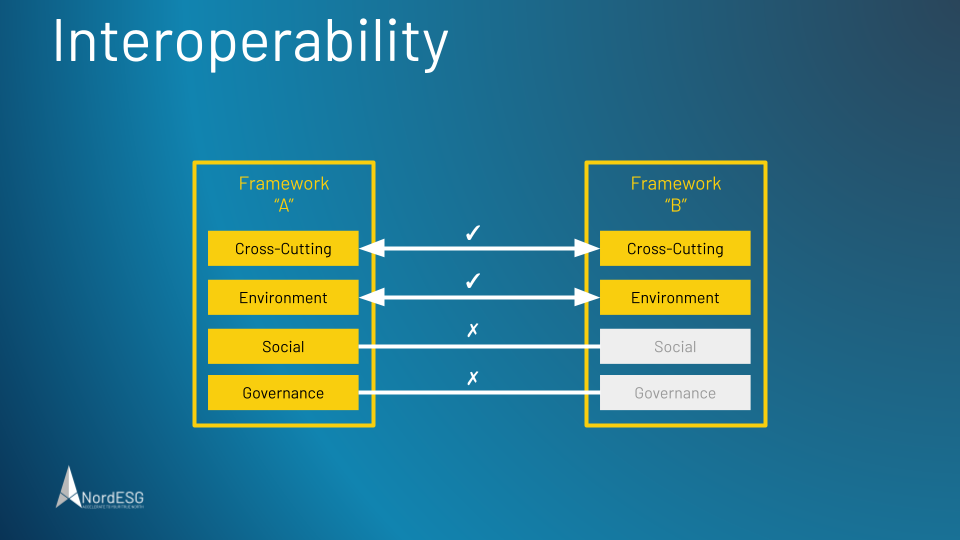

Sustainability performance reporting, or ESG reporting, is about answering questions on “E”, “S”, and “G”, or “Environment”, “Social”, and “Governance”. The crux is that reporting frameworks define different questions or disclosure requirements on the three pillars of the ESG context, emphasise particular topics or do not address others at all.

The good news is that numerous disclosure requirements are of such a fundamental nature that they can be found in almost all reporting frameworks. But, unfortunately, there are also cases where this is not the case.

Let us illustrate this with the example presented in the figure above. While framework “A” maps all ESG topics, framework “B” focuses on the “E” in ESG along with cross-cutting issues. As a result, companies reporting under framework “A” may find it easy to meet the disclosure requirements of framework “B” but not vice versa, as information on “social” and “governance” issues is not represented in the framework “B”. Thus reporting companies cannot meet the disclosure requirements of framework “A” with the information available in the framework “B”.

It is not only about data: Further differences may arise from the fundamental approaches and concepts defined in the reporting frameworks. One example is “materiality”, which can be defined as “financial materiality”, “double materiality”, or “impact materiality”, depending on the reporting framework used. These differences in fundamental concepts can subsequently have huge leverage on the entire reporting process.

Got questions about ESG?

Book a free and nonbinding discovery call to discuss your questions with one of our ESG experts, and learn how we can help you navigate your ESG landscape.

ESRS, TCFD, IFRS and GRI – What about interoperability?

EFRAG published the European Sustainability Reporting Standard (ESRS) in November 2022. However, it is currently still a draft. That applies to the IFRS/ISSB standards, too – therefore, changes may occur to these standards later. That being said, we intend to arrive at an initial assessment of the interoperability of the reporting frameworks. As soon as the final versions of the standards are available, we will conduct a more extensive survey.

So what is the current state of interoperability of the reporting frameworks? We will address this question in the chapters below.

ESRS and TCFD

The reporting framework of the Task Force on Climate-Related Financial Disclosures (TCFD) is an established reporting standard. The TCFD framework focuses on the “E” in ESG, while the ESRS covers the full range of sustainability issues (“E”, “S”, and “G”).

EFRAG, tasked with developing the ESRS, has published a document comparing the disclosure requirements of ESRS and TCFD [1]. We refer to this document and limit ourselves to some key findings:

- Governance: TCFD disclosure requirements can be met with ESRS 2 (GOV 1-3) and ESRS E1.

- Strategy: Strategy-related disclosure requirements can be mapped to ESRS 1, ESRS 2 and ESRS E1-4.

- Risk management: Disclosure requirements in the TCFD framework can be mapped to ESRS E1 and ESRS E2.

- Metrics & Targets: Related disclosure requirements can be found in ESRS 2 and ESRS E1.

However, the TCFD framework is “climate only”, so EFRAG is pointing out in [1]:

“When comparing TCFD with ESRS it must be noted that TCFD is on climate only and ESRS are covering also numerous other sustainability matters besides climate. ESRS has Disclosures Requirements applicable across sustainability matters for the reporting areas Governance, Strategy, Impact, risk and opportunity management and Metrics and targets in ESRS 2 General disclosures. […] A comparison of TCFD with ESRS involves therefore Disclosure Requirements from ESRS 2 General disclosures and ESRS E1 Climate change.“

We expect that there is at least a good match for general and climate-related (climate change) disclosures.

ESRS and IFRS/ISSB

Along with the draft ESRS, EFRAG published a document [2] on the interoperability of ESRS and IFRS/ISSB, which we refer to in this section. However, it is important to note that the IFRS/ISSB S1 and S2 are still drafts, and changes that affect interoperability cannot be ruled out at this stage. That is also reflected in EFRAG’s disclaimer: “This document has been prepared by EFRAG Secretariat and has not been agreed with the ISSB. This is an updated version of the reconciliation table prepared when issuing the ESRS Exposure Drafts in April 2022. It does not prejudge the content of any future mapping exercise that the European Commission, EFRAG and the ISSB might undertake on the basis of the final versions of ESRS and of ISSB standards.”

IFRS S1 and ESRS 1 / ESRS 2

With regards to IFRS S1 and ESRS, the EFRAG points out: “The […] objective is to map IFRS S1 Exposure Drafts requirements and ESRS 1/ ESRS 2 […] to illustrate how the content of [draft] ESRS 1, [draft] ESRS 2 has integrated to the maximum extent possible the content of the ED IFRS S1. As such, the disclosures prepared under ESRS are expected to be capable of corresponding to disclosures required by IFRS S1 (for the general disclosure). Since the EDs release in March 2022, the IFRS S2 has been subject to ISSB redeliberations that have not been taken into account in this comparison.“

We have highlighted the following points:

- IFRS/ISSB focuses on “financial materiality” or “single materiality”, while ESRS uses the concept of “double materiality”.

- There is a good match on “Governance”, and both standards aim to enable users of sustainability reports to understand companies’ governance processes to monitor and manage sustainability issues.

- Both standards require reporting on the impacts of risks and opportunities on the business model and value chain and information about how opportunities and risks are concentrated in the value chain.

IFRS S2 and ESRS 1

EFRAG’s disclaimer on the comparison of IFRS S2 and ESRS 1 reads as follows: “The […] objective is to map IFRS S2 Exposure Drafts requirements and [draft] ESRS E1 […] to illustrate how the content of [draft] ESRS E1 has integrated to the maximum extent possible the content of the ED IFRS S2. As such, the disclosures prepared under [draft] ESRS E1 are expected to be capable of corresponding to disclosures required by IFRS S2 (for the general disclosure). Since the EDs release in March 2022, the IFRS S2 has been subject to ISSB redeliberations that have not been taken into account in this comparison.“

Here are our picks from this chapter:

- All reporting requirements related to “Governance” from IFRS S2 can be mapped to ESRS 1 and ESRS 2.

- ESRS also includes a “statement on sustainability due diligence” (ESRS 2, DR GOV 4).

- The reporting requirements for “climate related disclosures” can be found in ESRS E1. In addition, ESRS E1 covers additional reporting requirements like 1.5°C alignments, carbon emissions, taxonomy-related information, and other reporting requirements).

- The document also mentions the concept of sustainability due diligence in ESRS and how physical and transition risks are identified.

- There will still have to be coordination on the sector-specific standards, which are not yet available (as drafts or final versions).

GRI and ESRS

The GRI standard is one of the most widely used frameworks for sustainability reporting. Like EFRAG, the GRI has also looked into the question of interoperability and has made an initial classification in a recently published document [3]. We refer to this document in our further remarks.

Like the ESRS, the GRI standard is divided into four sections and covers all sustainability issues in the context of ESG. In the documents accompanying the publication of the draft ESRS, EFRAG has pointed out that the development of the ESRS aimed to be as consistent as possible with the disclosure requirements of the GRI Standard. That is good news, especially for those companies that already report their sustainability performance using the GRI reporting framework. There are minor differences, but they can be bridged. One example is the concept of materiality (GRI: “Impact Materiality”, “ESRS: Double Materiality”).

The GRI paper explains: “To provide the full picture, a company should report both how it impacts the world it operates in (using GRI Standards) and how sustainability topics affect the organisation (using IFRS Sustainability Disclosure Standards). Taken together and in the context of the CSRD, this is referred to as double materiality.“

Another note from the above document refers to the processes and procedures already established for sustainability reporting by companies using the GRI framework. According to GRI’s paper, reporting companies can integrate the requirements arising from the ESRS into already established reporting processes for GRI-aligned reporting. Regarding this, GRI points to a yet-to-be-published handout that describes the mapping of disclosure requirements and the procedures. This handout will be available as soon as the European Commission adopts the final version of ESRS. EFRAG, for its part, has announced a similar document. Again, we will report on this in our blog as soon as these documents are available.

Therefore, it is expected that there will be good compatibility between the ESRS and the GRI. However, companies reporting according to the ESRS at the European level will benefit if, for example, they simultaneously continue their sustainability reporting according to the GRI standard at the international level.

Conclusion

Companies using the ESRS for their sustainability performance reporting may have the advantage that almost all disclosure requirements in other standards can be met. But conversely, this is only sometimes the case, especially when it is a reporting standard that focuses on one of the three pillars of ESG.

Good interoperability is emerging between the GRI Standard and the ESRS, which is a particular advantage for companies already reporting according to the GRI Standard. However, how interoperability will finally develop between IFRS/ISSB and ESRS remains to be seen, as this will depend on the final versions of both standards. In any case, we will report on further developments.

Sources

[1] Appendix IV – TCFD Recommendations and ESRS reconciliation table

[2] Appendix V – IFRS Sustainability Standards and ESRS reconciliation table

[3] GRI and the European Sustainability Reporting Standard (ESRS)

About NordESG

NordESG is an advisory firm helping corporates develop, articulate and execute their ESG and sustainability strategies. Our work includes sustainability performance reporting support under various ESG frameworks, strategy development or conducting materiality assessments. By doing so, we help businesses meet their disclosure compliance requirements like CSRD but also help them proactively communicate their strategy to other stakeholders like investors, customers and local communities in which they operate. Our work is focused mainly on Europe and North America.

Discovery Call

Book a free discovery call below

Get in touch via email

Disclaimer

This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent the views expressed or reflected in other NordESG communications or strategies.

This material is intended to be for information purposes only. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Information herein is believed to be reliable, but NordESG does not warrant its completeness or accuracy.

Some information quoted was obtained from external sources NordESG consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and data and information contained in this communication may change in the future. The views and opinions expressed in this communication may change.